Fortrea Holdings Inc (FTRE, Financial) experienced a temporary suspension in trading as a result of a volatility-related pause. This disruption is associated with the stock's recent price fluctuations, necessitating a hold to allow market participants to evaluate current conditions. Such interventions are common in markets to ensure orderly trading and to prevent excessive volatility.

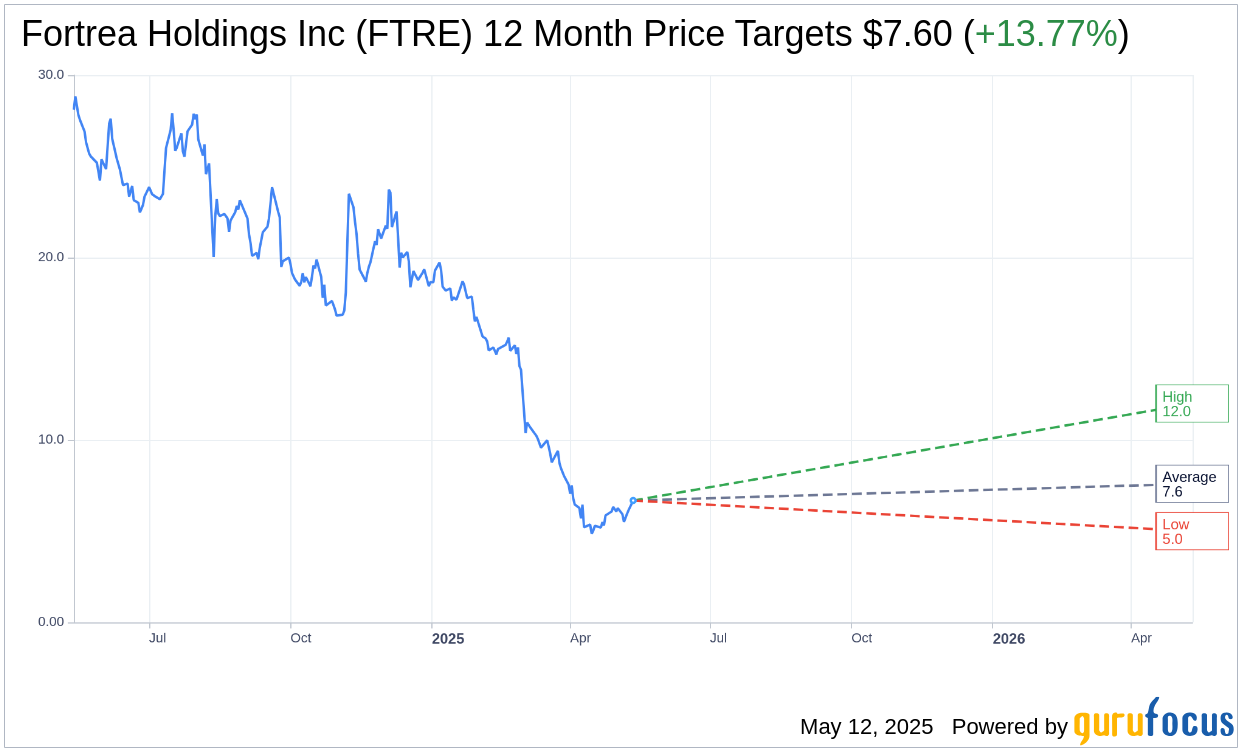

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Fortrea Holdings Inc (FTRE, Financial) is $7.60 with a high estimate of $12.00 and a low estimate of $5.00. The average target implies an upside of 13.77% from the current price of $6.68. More detailed estimate data can be found on the Fortrea Holdings Inc (FTRE) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Fortrea Holdings Inc's (FTRE, Financial) average brokerage recommendation is currently 3.2, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

FTRE Key Business Developments

Release Date: March 03, 2025

- Revenue: $697 million for Q4 2024, a decline of 1.8% year over year.

- Full Year Revenue 2024: $2,696.4 million, a decrease of 5.1% compared to 2023.

- Adjusted EBITDA: $56 million for Q4 2024; $202.5 million for full year 2024.

- Adjusted EBITDA Margin: 7.5% for full year 2024, down from 8.6% in 2023.

- Net Loss: $73.9 million for Q4 2024; $271.5 million for full year 2024.

- Adjusted Net Income: $16.6 million for Q4 2024; $30.1 million for full year 2024.

- Book-to-Bill Ratio: 1.35 times for Q4 2024; 1.16 times for the trailing 12 months.

- Backlog: $7.7 billion, a growth of 4.2% over the past 12 months.

- Cash Flow from Operating Activities: $262.8 million for the 12 months ended December 31, 2024.

- Free Cash Flow: $237.3 million for 2024.

- Days Sales Outstanding: 40 days as of December 31, 2024.

- 2025 Revenue Guidance: $2.45 billion to $2.55 billion.

- 2025 Adjusted EBITDA Guidance: $170 million to $200 million.

- SG&A Increase: 16.9% year over year for Q4 2024.

- Net Interest Expense: $21.9 million for Q4 2024, a decrease of $12.6 million year over year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Fortrea Holdings Inc (FTRE, Financial) achieved a strong book-to-bill ratio of 1.35 in the fourth quarter, indicating robust demand and successful sales efforts.

- The company's backlog has grown to $7.7 billion, reflecting a solid pipeline of future work.

- Fortrea's phase one clinical pharmacology services business experienced its most successful quarter ever, driven by significant repeat awards and investments in clinic capacity.

- The company successfully exited most of its Transition Service Agreement with its former parent, reducing associated costs and improving operational independence.

- Fortrea has implemented a comprehensive customer relationship feedback program, resulting in significantly improved net promoter scores, indicating enhanced customer satisfaction.

Negative Points

- Fortrea's revenue and adjusted EBITDA projections for 2025 are below prior expectations due to the impact of pre-spin projects with lower revenue and profitability.

- The company's fourth-quarter revenues declined by 1.8% year-over-year, primarily due to lower late-stage clinical service fee revenue.

- SG&A expenses increased by 16.9% year-over-year, driven by professional fees and one-time costs related to exiting TSA services.

- The adjusted EBITDA margin for full year 2024 decreased to 7.5% from 8.6% in 2023, impacted by lower late-stage clinical service fee revenues and higher SG&A costs.

- Fortrea's net loss for full year 2024 was $271.5 million, a significant increase from the net loss of $31.7 million in 2023, highlighting financial challenges.