Bayer (BAYRY, Financial) is initiating a strategic reorganization of its Crop Science division in Germany, focusing on production and research in crop protection. This decision is part of Bayer's effort to maintain global competitiveness amid aggressive market moves by Asian manufacturers who have flooded the market with low-cost generic products, sometimes priced below European manufacturing costs. The division is also facing increased regulatory and export challenges.

To address these issues, Bayer plans to concentrate on innovative technologies and products that deliver unique value beyond generics. Consequently, operations at its Frankfurt site will cease by the end of 2028, with some activities being sold or moved elsewhere. Streamlining efforts will also be made at the Dormagen site to ensure future viability, while research and development will be centralized in Monheim am Rhein.

This reorganization will affect around 200 roles related to active ingredient production and formulation out of nearly 1,200 positions. Bayer remains committed to maintaining its presence in Germany, but acknowledges the need to adapt to current industry challenges to uphold this commitment.

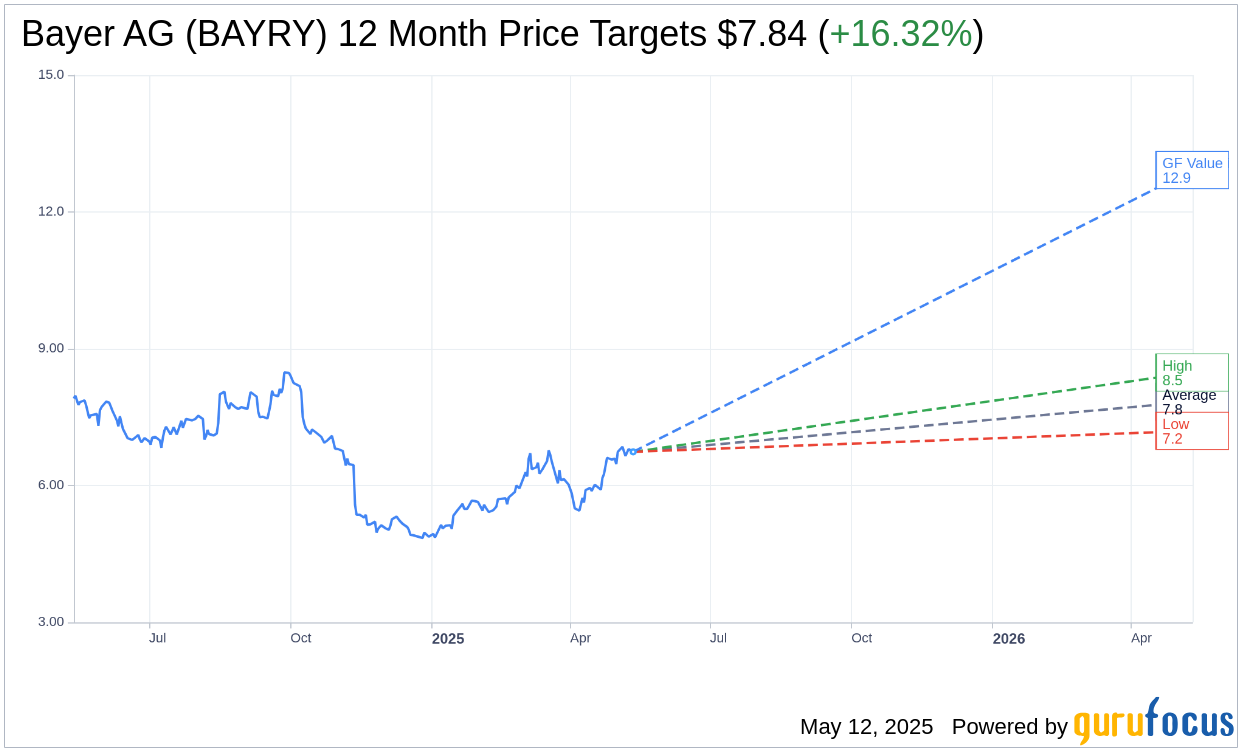

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Bayer AG (BAYRY, Financial) is $7.84 with a high estimate of $8.48 and a low estimate of $7.20. The average target implies an upside of 16.32% from the current price of $6.74. More detailed estimate data can be found on the Bayer AG (BAYRY) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Bayer AG's (BAYRY, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Bayer AG (BAYRY, Financial) in one year is $12.92, suggesting a upside of 91.69% from the current price of $6.74. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Bayer AG (BAYRY) Summary page.

BAYRY Key Business Developments

Release Date: March 05, 2025

- Net Sales Growth: 1% increase on a currency and portfolio-adjusted basis for 2024.

- EBITDA Before Special Items: EUR 10.1 billion, 14% below the prior year.

- Net Debt: Reduced to EUR 32.6 billion by the end of 2024.

- Free Cash Flow: EUR 3.1 billion, ahead of guidance.

- Core Earnings Per Share: EUR 5.05, below the prior year.

- Reported Earnings Per Share: Minus EUR 2.60, impacted by impairment losses.

- Pharmaceuticals Sales Growth: 3.3% increase on a currency and portfolio-adjusted basis.

- Pharmaceuticals EBITDA Margin: 26% for 2024.

- Consumer Health Sales Growth: 1.9% year over year.

- Consumer Health EBITDA Margin: 23.3%, in line with last year.

- Crop Science Sales Decline: 2% decrease, with an EBITDA margin of 19.4%.

- 2025 Net Sales Outlook: EUR 45 billion to EUR 47 billion.

- 2025 EBITDA Before Special Items Outlook: EUR 9.5 billion to EUR 10 billion.

- 2025 Free Cash Flow Outlook: EUR 1.5 billion to EUR 2.5 billion.

- 2025 Core Earnings Per Share Outlook: EUR 4.50 to EUR 5.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Bayer AG (BAYRY, Financial) achieved a slight growth in net sales by 1% in 2024, driven by strong performance in pharmaceuticals and consumer health.

- The pharmaceuticals division exceeded expectations with significant growth in flagship products NUBEQA and KERENDIA, reaching EUR 2 billion in sales.

- The company successfully reduced its net debt to EUR 32.6 billion, reflecting a strong commitment to debt reduction.

- Bayer AG (BAYRY) completed nine positive Phase 3 trials and advanced over 20 clinical programs, indicating a robust pipeline for future growth.

- The consumer health division maintained a solid EBITDA margin of 23.3% despite currency headwinds, showcasing operational efficiency.

Negative Points

- The crop science division faced challenges with a 4% decline in sales due to pricing pressures from generics and regulatory hurdles.

- Bayer AG (BAYRY) anticipates a difficult financial performance in 2025, with net sales expected to be roughly in line with 2024 and earnings behind prior year.

- The loss of the Xarelto patent is expected to accelerate, leading to a decline in pharmaceutical sales and margins.

- The company faces ongoing litigation challenges, particularly related to glyphosate, which could impact financial performance.

- Foreign exchange headwinds significantly impacted the company's EBITDA, reducing it by almost EUR 600 million in 2024.