Synlogic, Inc. (SNDX, Financial) is set to participate in a meeting organized by B. Riley in New York on May 19. This engagement forms part of the company's strategy to showcase its robust business fundamentals amidst market volatility. Investors looking to safeguard their portfolios may find interest in Synlogic's prospects, especially as it continues to present itself as a resilient player in uncertain market conditions.

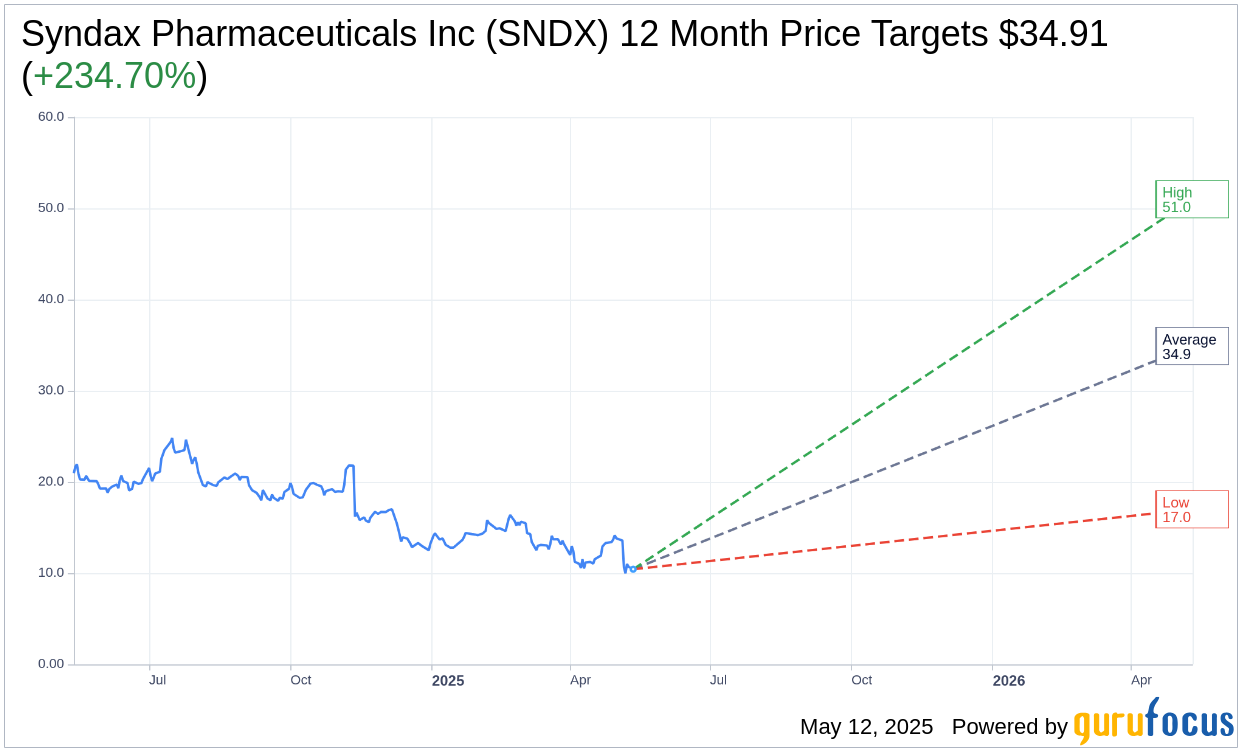

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for Syndax Pharmaceuticals Inc (SNDX, Financial) is $34.91 with a high estimate of $51.00 and a low estimate of $17.00. The average target implies an upside of 234.70% from the current price of $10.43. More detailed estimate data can be found on the Syndax Pharmaceuticals Inc (SNDX) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, Syndax Pharmaceuticals Inc's (SNDX, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

SNDX Key Business Developments

Release Date: May 05, 2025

- Revvvi Forge Net Revenue: $20 million in the first full quarter of the launch.

- Nick Timbo Net Revenue: $13.6 million from the first two months of the joint launch with Insight.

- Total Combined Net Sales: $34 million from Revvvi Forge and Nick Timbo.

- Cash and Equivalents: $602.1 million as of March 31st.

- Collaboration Loss: $200,000 share of the net commercial loss for Nick Timbo.

- Managed Care Coverage: 72% of all managed care lives have formal coverage policies for Revvvi Forge.

- Infusions Administered: More than 1,250 infusions of Nick Timbo administered year-to-date.

- Top Accounts Ordering Nick Timbo: Approximately 95% of top accounts and more than 70% of all bone marrow transplant centers have ordered.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Syndax Pharmaceuticals Inc (SNDX, Financial) reported strong financial performance with $20 million in net revenue from Revvvi Forge and $13.6 million from Nick Timbo in the first quarter of 2025.

- The company has a robust pipeline with ongoing clinical trials, including the initiation of the Evolve II trial for Revvvi Forge, targeting a high unmet medical need in AML patients.

- Syndax Pharmaceuticals Inc (SNDX) is well-funded with $602.1 million in cash and equivalents, supporting its strategic initiatives and potential market expansions.

- The company has achieved significant milestones, including the submission of a supplemental new drug application (SNDA) for Revvvi Forge, seeking priority review for the treatment of relapse or refractory mutant NPM1 AML.

- Strong market access and formulary coverage for Revvvi Forge, with approximately 72% of managed care lives covered, facilitating quick patient access to the medication.

Negative Points

- The company faces challenges in accurately estimating the total addressable market for its products, as the actual patient population may differ from initial projections.

- There is limited data on the long-term duration of therapy and refill dynamics for Revvvi Forge, making it difficult to predict future revenue streams accurately.

- Syndax Pharmaceuticals Inc (SNDX) is still in the early stages of collecting real-world evidence for its products, which may impact the ability to provide detailed insights into patient outcomes and treatment patterns.

- The company has not yet provided specific details on the powering of its Evolve II trial, which could affect investor confidence in the trial's potential success.

- Reimbursement for post-transplant use of Revvvi Forge remains uncertain, which could impact the drug's adoption and revenue potential in this setting.