Exploring the Strategic Moves in the First Quarter of 2025

Introduction to Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio)

Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio) recently submitted their 13F filing for the first quarter of 2025, offering a glimpse into their strategic investment decisions. The firm, led by Executive Director Mr. Barrow, is based in Dallas and is renowned for its disciplined value investing approach. Mr. Barrow, a graduate of the University of South Carolina, has a notable track record, having managed the Vanguard Windsor II and Selected Value Funds, which outperformed the market with an average annual return of 9.33% over a decade ending in 2010. The firm's equity portfolios are characterized by below-market price-to-earnings and price-to-book ratios, coupled with above-market dividend yields, regardless of market conditions.

Summary of New Buy

Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio) added a total of 38 stocks to their portfolio. The most significant addition was Vertiv Holdings Co (VRT, Financial), with 5,434,741 shares, accounting for 1.42% of the portfolio and a total value of $392.39 million. The second largest addition was Lennar Corp (LEN, Financial), consisting of 2,856,426 shares, representing approximately 1.19% of the portfolio, with a total value of $327.86 million. The third largest addition was Everest Group Ltd (EG, Financial), with 881,483 shares, accounting for 1.16% of the portfolio and a total value of $320.27 million.

Key Position Increases

Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio) also increased stakes in a total of 91 stocks. The most notable increase was in Elevance Health Inc (ELV, Financial), with an additional 487,672 shares, bringing the total to 1,270,594 shares. This adjustment represents a significant 62.29% increase in share count, a 0.77% impact on the current portfolio, and a total value of $552.66 million. The second largest increase was in Western Alliance Bancorp (WAL, Financial), with an additional 2,571,092 shares, bringing the total to 4,385,837. This adjustment represents a significant 141.68% increase in share count, with a total value of $336.96 million.

Summary of Sold Out

Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio) completely exited 45 holdings in the first quarter of 2025. Notable exits include U.S. Bancorp (USB, Financial), where they sold all 2,701,560 shares, resulting in a -0.44% impact on the portfolio. Another significant exit was Broadcom Inc (AVGO, Financial), with the liquidation of all 250,810 shares, causing a -0.2% impact on the portfolio.

Key Position Reduces

Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio) also reduced positions in 94 stocks. The most significant change was a reduction in Enbridge Inc (ENB, Financial) by 13,778,577 shares, resulting in a -76.41% decrease in shares and a -1.99% impact on the portfolio. The stock traded at an average price of $43.52 during the quarter and has returned 0.09% over the past 3 months and 6.38% year-to-date. Another notable reduction was in Lithia Motors Inc (LAD, Financial) by 1,607,998 shares, resulting in a -99.99% reduction in shares and a -1.96% impact on the portfolio. The stock traded at an average price of $340.53 during the quarter and has returned -17.03% over the past 3 months and -10.46% year-to-date.

Portfolio Overview

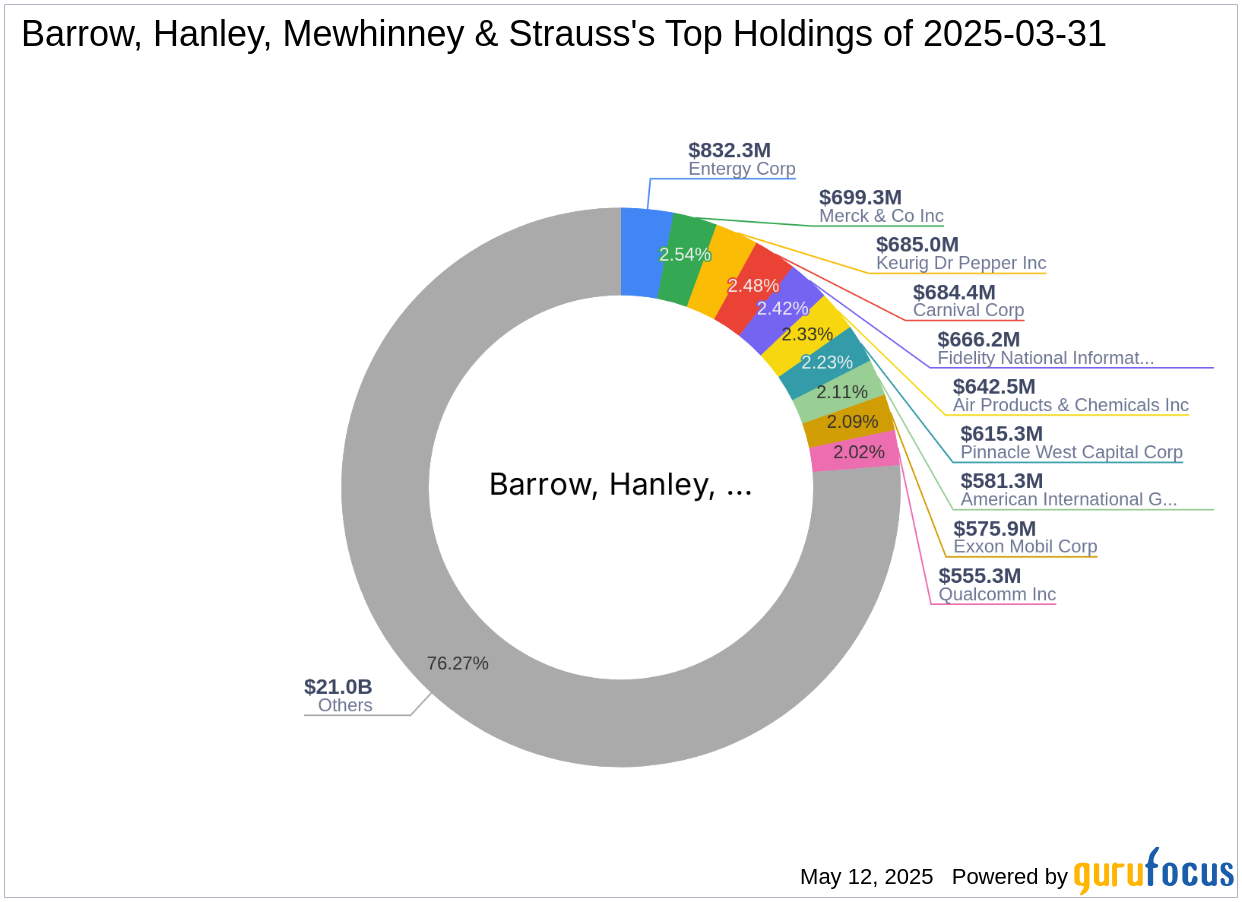

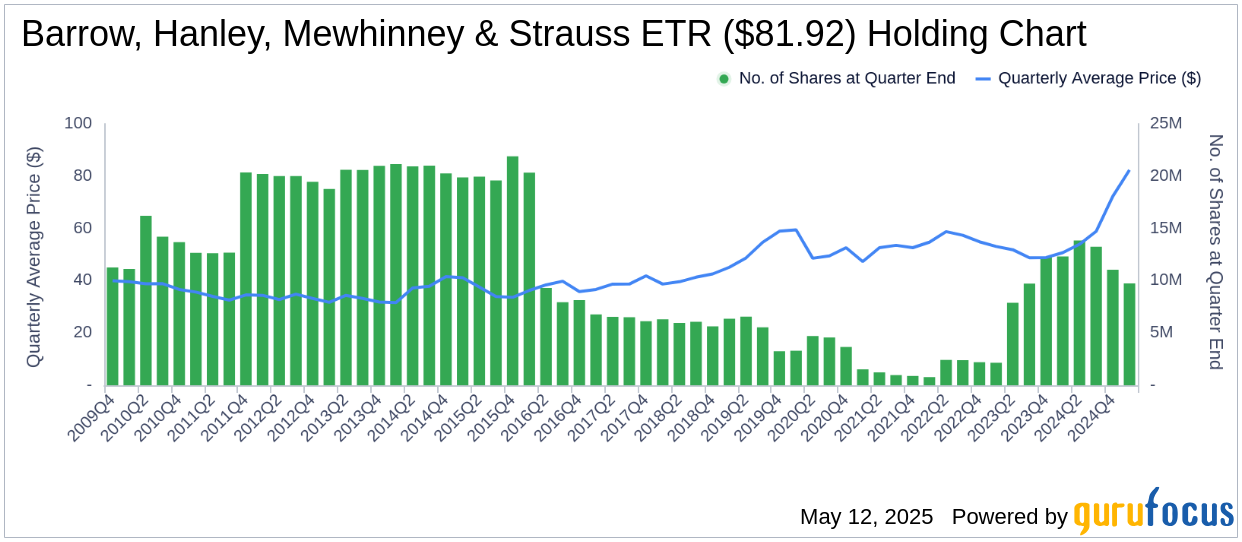

As of the first quarter of 2025, Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio)'s portfolio included 318 stocks. The top holdings included 3.02% in Entergy Corp (ETR, Financial), 2.54% in Merck & Co Inc (MRK, Financial), 2.49% in Keurig Dr Pepper Inc (KDP, Financial), 2.48% in Carnival Corp (CCL, Financial), and 2.42% in Fidelity National Information Services Inc (FIS, Financial).

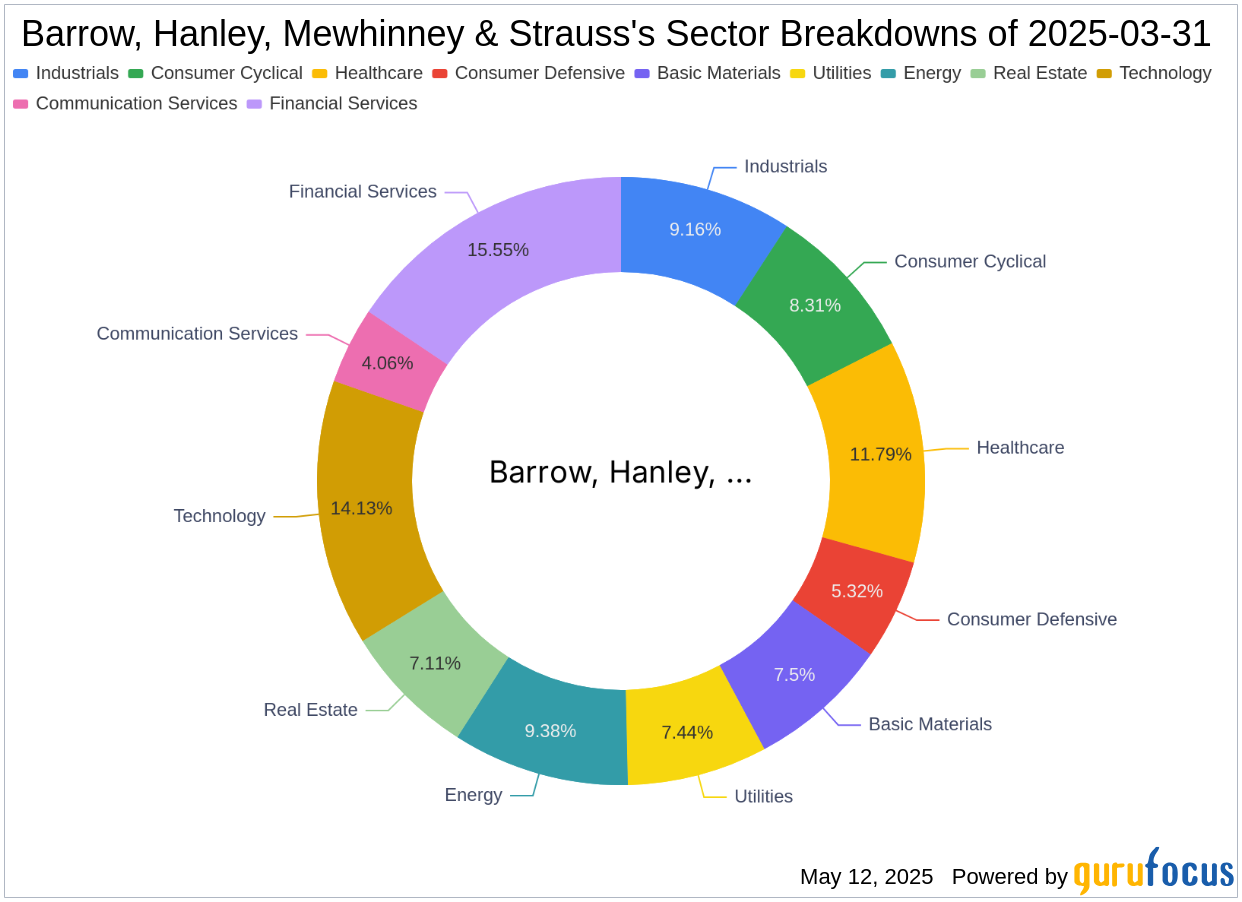

The holdings are mainly concentrated in all 11 industries: Financial Services, Technology, Healthcare, Energy, Industrials, Consumer Cyclical, Basic Materials, Utilities, Real Estate, Consumer Defensive, and Communication Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.