Analysts at Canaccord have revised their outlook for Curaleaf (CURLF, Financial), reducing the price target from C$6 to C$5. Despite this adjustment, the investment firm continues to maintain a Buy rating for the cannabis company’s shares.

Wall Street Analysts Forecast

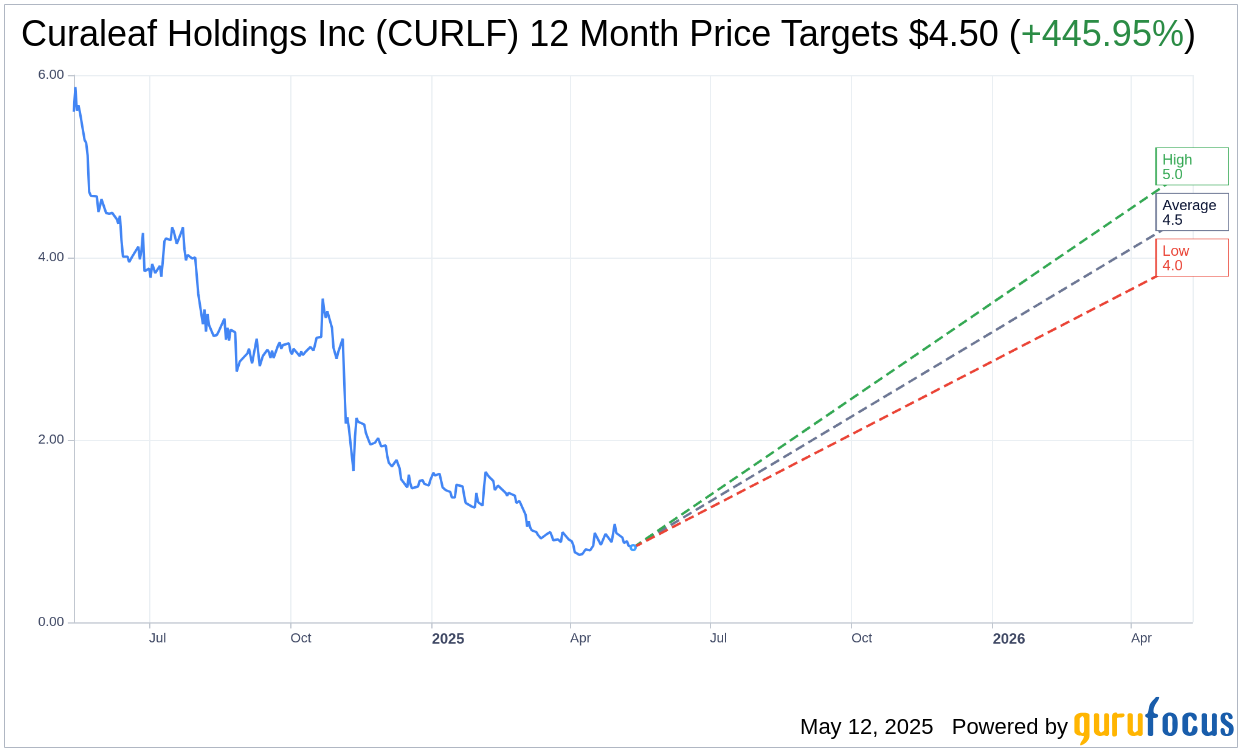

Based on the one-year price targets offered by 2 analysts, the average target price for Curaleaf Holdings Inc (CURLF, Financial) is $4.50 with a high estimate of $5.00 and a low estimate of $4.00. The average target implies an upside of 445.95% from the current price of $0.82. More detailed estimate data can be found on the Curaleaf Holdings Inc (CURLF) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Curaleaf Holdings Inc's (CURLF, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Curaleaf Holdings Inc (CURLF, Financial) in one year is $3.97, suggesting a upside of 381.65% from the current price of $0.82425. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Curaleaf Holdings Inc (CURLF) Summary page.

CURLF Key Business Developments

Release Date: May 08, 2025

- Revenue: $310 million, a 6% sequential decline and a 9% decrease year over year.

- Gross Margin: Expanded by 250 basis points to 50% from the previous quarter.

- Adjusted EBITDA: $65 million, representing a 21% margin.

- Cash and Cash Equivalents: Ended the quarter with $122 million.

- Operating Cash Flow: $42 million from continuing operations.

- Free Cash Flow: $26 million from continuing operations.

- Debt Reduction: Paid down $20 million in acquisition-related debt.

- International Revenue Growth: 74% year over year, driven by Germany and the UK.

- Retail Revenue: $231 million, a 14% decline year over year.

- Wholesale Revenue: Increased 12% year over year to $78 million.

- SG&A Expenses: $107 million, a $3 million increase from the previous year.

- Net Loss: $55 million or a loss of $0.07 per share.

- Capital Expenditures: $16 million in the first quarter.

- Store Openings: Plans for approximately 12 new store openings in 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Curaleaf Holdings Inc (CURLF, Financial) reported a gross margin expansion of 250 basis points to 50% from the previous quarter, reflecting improved efficiencies in cultivation operations.

- The company generated $65 million in adjusted EBITDA, representing a 21% margin, despite challenges from international and hemp businesses.

- Curaleaf Holdings Inc (CURLF) strengthened its balance sheet by reducing working capital accounts and ending the quarter with $122 million in cash.

- International segment delivered 74% year-over-year growth, with Germany and the UK leading the performance.

- The company successfully launched new products, including Anthem pre-rolls and ACE extraction technology, which have been well-received in the market.

Negative Points

- Total revenue for the first quarter was $310 million, a 6% sequential decline and a 9% decrease compared to the same period last year.

- Domestic revenue declined 8% sequentially due to macro factors such as price compression and normal seasonality.

- Price compression remains a significant headwind across the industry, affecting margins and revenue.

- The company reported a net loss from continuing operations of $55 million or a loss of $0.07 per share.

- Curaleaf Holdings Inc (CURLF) faces potential headwinds from tariffs and consumer demand shifts, which could impact cost structure and profitability.