- Kroger's (KR, Financial) stock recently experienced a noteworthy decline.

- Analysts maintain mixed forecasts and ratings for Kroger's future performance.

- GuruFocus' GF Value suggests significant potential downside for the stock.

Kroger's Recent Market Movement

Kroger (KR) saw a notable decrease of 4.6%, closing at $68.58 after reaching a recent high of $73.63. This downturn occurred amidst reports of temporary tariff reductions between the U.S. and China, impacting the grocery sector stocks. Investors should monitor upcoming economic reports as they may further influence stock performance within this sector.

Wall Street Analysts Forecasts

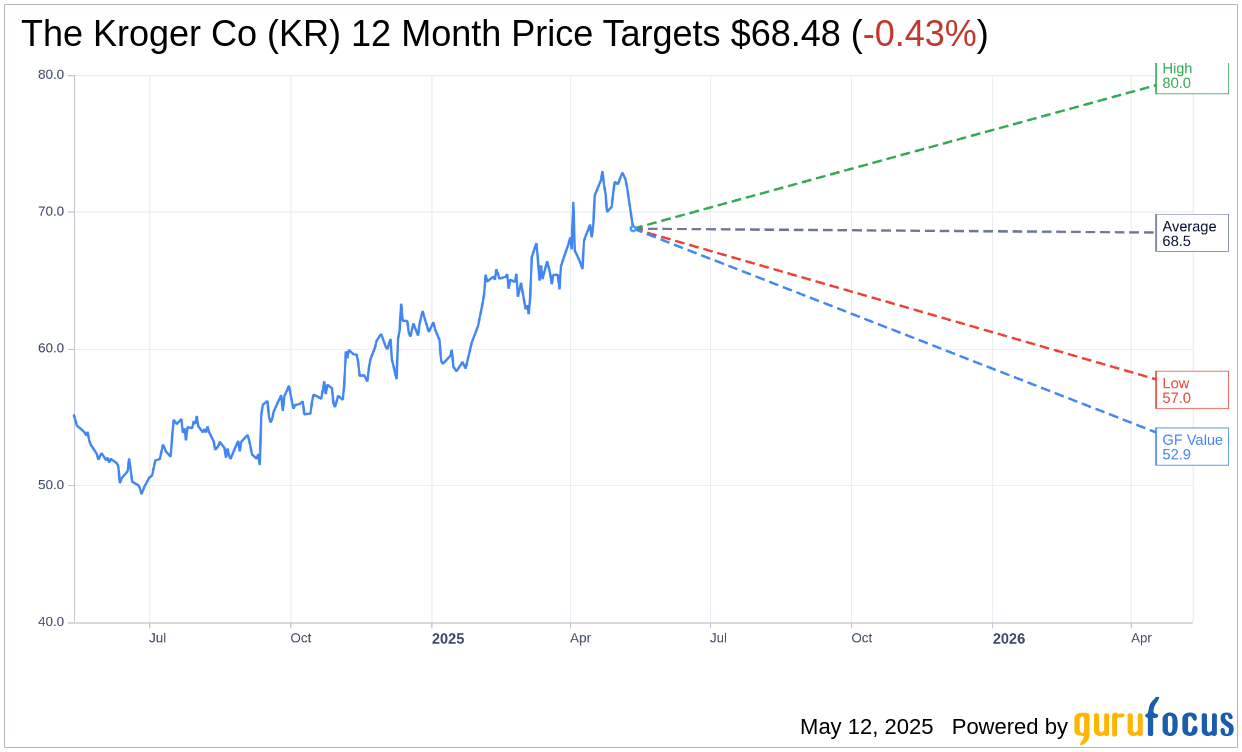

According to the latest analysis by 19 analysts, the average price target for The Kroger Co (KR, Financial) stands at $68.48. Analysts have set their high estimate at $80.00 and the low at $57.00. The average target suggests a minor downside of 0.48% from the current price of $68.81. For investors seeking more detailed estimations, please visit the The Kroger Co (KR) Forecast page.

Brokerage Recommendations

From a consensus standpoint, 25 brokerage firms have rated The Kroger Co's (KR, Financial) average brokerage recommendation as 2.3, which translates to an "Outperform" status. The rating scale ranges from 1 to 5, where 1 represents a Strong Buy, and 5 signifies a Sell. This data reflects a moderate confidence among analysts towards Kroger's potential performance.

Understanding GuruFocus' GF Value

GuruFocus estimates project a GF Value of $52.85 for The Kroger Co (KR, Financial) in a year, indicating a significant downside of 23.19% from the current stock price of $68.81. The GF Value represents the fair value that the stock should be traded at, calculated considering historical trading multiples, past business growth, and future performance projections. For further insights, investors can review the The Kroger Co (KR) Summary page.