Key Highlights:

- Goldman Sachs upgrades Anheuser-Busch InBev (BUD, Financial) to a Buy rating predicting over 25% upside.

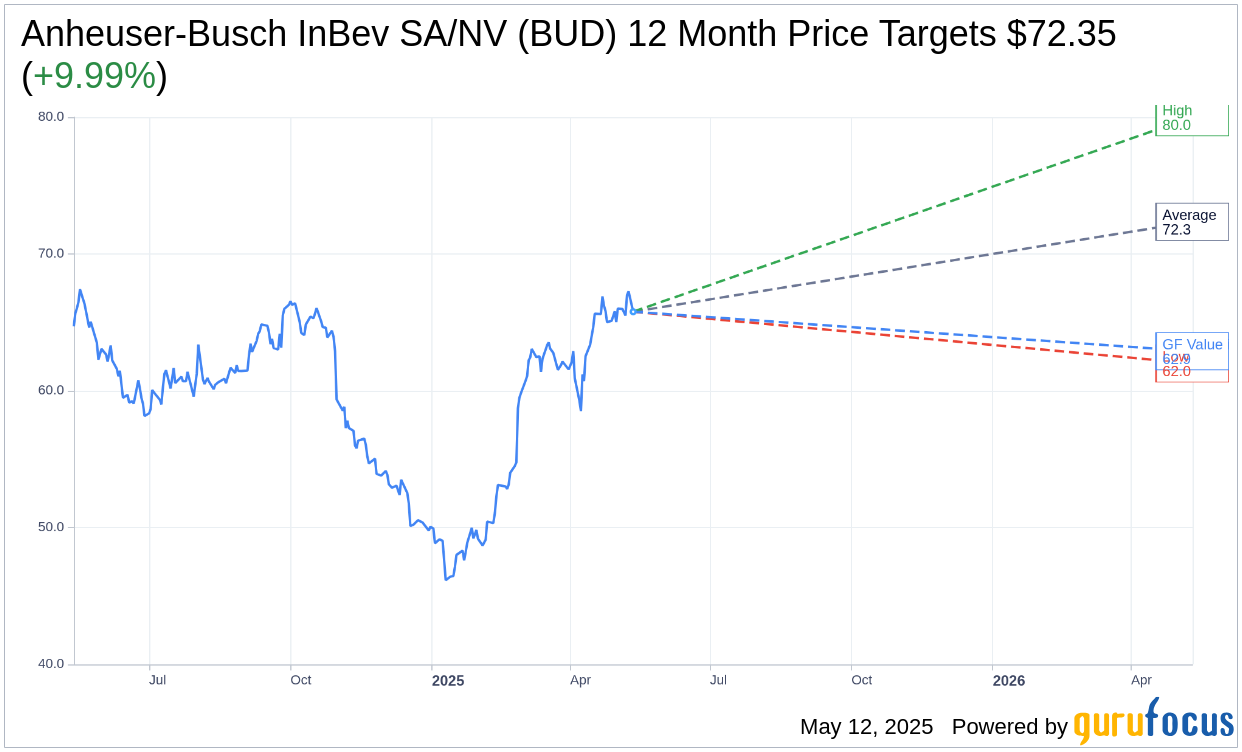

- Analysts set an average target price of $72.35, suggesting a potential rise of nearly 10%.

- GuruFocus estimates a GF Value that might slightly decline from the current stock price.

Recently, Goldman Sachs upgraded Anheuser-Busch InBev (BUD) to a Buy rating, highlighting a potential upside exceeding 25%. This optimistic outlook is driven by anticipated improvements in the company's debt strategies coupled with its strong global market position. The investment bank has set a price target of $88 with a projected organic EBITDA growth of 7%, signaling a promising growth trajectory for the beverage giant.

Wall Street Analysts' Insights

According to the latest one-year price targets from six analysts, the average target price for Anheuser-Busch InBev SA/NV (BUD, Financial) stands at $72.35. With a high estimate reaching $80.00 and a low of $62.00, this average implies a potential upside of 9.99% from the present price of $65.78. For more in-depth analysis, investors can access detailed data on the Anheuser-Busch InBev SA/NV (BUD) Forecast page.

The consensus recommendation among 10 brokerage firms places BUD with an average recommendation of 1.9, which translates to an "Outperform" status. This recommendation scale ranges from 1, indicating a Strong Buy, to 5, suggesting a Sell.

Evaluating GuruFocus Metrics

Per GuruFocus estimates, the projected GF Value of Anheuser-Busch InBev SA/NV (BUD, Financial) one year from now is $62.89, hinting at a potential downside of 4.39% compared to the current share price of $65.78. The GF Value reflects GuruFocus' calculated fair value based on the stock's historical trading multiples, past business growth, and future business performance forecasts. Investors seeking comprehensive data can visit the Anheuser-Busch InBev SA/NV (BUD) Summary page.

In summary, while Goldman Sachs and Wall Street analysts project a growth-driven upside for Anheuser-Busch InBev, GuruFocus metrics present a more conservative valuation. This divergence highlights the importance for investors to carefully consider various analyses and strategic insights to inform their investment decisions.