In the first quarter, AMBC reported a substantial increase in its revenue, reaching $40.998 million, compared to $17.865 million in the same period last year. The company's President and CEO highlighted the impressive performance of the P&C business, which saw a 70% rise in premium production, amounting to $318 million. Additionally, revenue for this division grew by 27% to $63 million when compared to the first quarter of 2024. This growth was significantly supported by the acquisition of Beat.

AMBC's strategic focus on developing a diversified portfolio aims to sustain long-term growth and buffer against market fluctuations, including challenges in property and ESL sectors observed this quarter. The company is keen on expanding its business through specialization in niche areas. Furthermore, initial outcomes from the MGAs introduced last year are promising, with some achieving profitability and others on a path toward consistent gains.

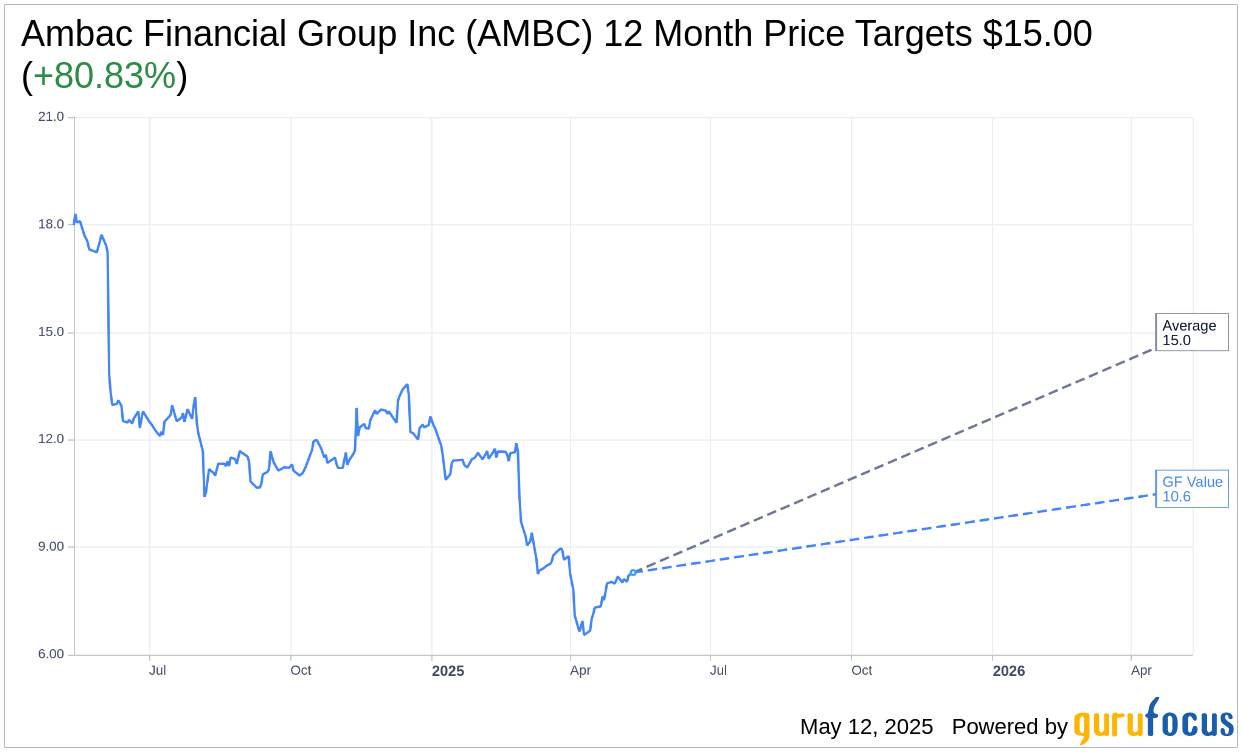

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Ambac Financial Group Inc (AMBC, Financial) is $15.00 with a high estimate of $15.00 and a low estimate of $15.00. The average target implies an upside of 79.64% from the current price of $8.35. More detailed estimate data can be found on the Ambac Financial Group Inc (AMBC) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Ambac Financial Group Inc's (AMBC, Financial) average brokerage recommendation is currently 1.5, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Ambac Financial Group Inc (AMBC, Financial) in one year is $10.63, suggesting a upside of 27.31% from the current price of $8.35. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Ambac Financial Group Inc (AMBC) Summary page.

AMBC Key Business Developments

Release Date: February 27, 2025

- Premiums: Nearly $900 million, up 74% from 2023.

- Revenue: $236 million, an increase of 89% from the prior year.

- Net Loss: $548 million or $10.23 per diluted share for Q4 2024.

- Net Loss from Continuing Operations: $22 million or $0.70 per share.

- Adjusted Net Loss: $6 million or $0.12 per diluted share for Q4 2024.

- Adjusted EBITDA Margin: 20% for 2024, with 500 basis points of margin headwinds.

- Organic Growth: 5.4% for the year.

- Everspan Gross Premium: Over $380 million, up 40% from the prior year.

- Everspan Combined Ratio: 101.6% for the year, a 500 basis points improvement over 2023.

- Adjusted EBITDA to Ambac Common Shareholders: $5.3 million for Q4 and $13.2 million for the year.

- Discontinued Operations Loss: $570 million loss on sale of the legacy financial guarantee business.

- Cash and Investments: Approximately $119 million or $2.56 per share as of the end of Q4 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Ambac Financial Group Inc (AMBC, Financial) achieved significant growth in its P&C business, generating nearly $900 million in premiums, up 74% from 2023.

- The acquisition of Beat has been transformative, providing immediate scale and enhancing the distribution platform.

- Successfully sold the legacy financial guarantee business to Oaktree for $420 million, allowing focus on scaling the specialty P&C business.

- Everspan's gross premium grew by 40% to over $380 million, with a combined ratio improvement of nearly 500 basis points over 2023.

- Cirrata generated nearly $100 million in revenue for 2024, up 93%, with a strong adjusted EBITDA margin of 20%.

Negative Points

- Ambac Financial Group Inc (AMBC) reported a net loss of $548 million for the fourth quarter of 2024, primarily due to a $570 million loss on the sale of the legacy business.

- The insurance distribution segment faced challenges with de novo startup expenses impacting adjusted EBITDA by approximately $3.8 million.

- The employer stop loss and short-term medical lines experienced market deterioration, affecting the distribution business.

- Everspan's net premiums written were negative $3 million in the quarter due to non-renewal of a reinsurance program.

- The expense ratio increased to 44.6% in the fourth quarter of 2024, driven by changes to sliding scale commissions.