On May 12, 2025, Getty Images Holdings Inc (GETY, Financial) released its 8-K filing detailing the financial results for the first quarter ended March 31, 2025. The company, a leading global visual content creator and marketplace, reported a revenue of $224.1 million, which represents a 0.8% increase year-over-year but falls short of the analyst estimate of $236.01 million. The net loss for the quarter was $102.6 million, a significant decline from the net income of $13.6 million reported in the same period last year.

Company Overview

Getty Images Holdings Inc (GETY, Financial) operates as a visual content creator and marketplace, offering a comprehensive range of content solutions through its Getty Images, iStock, and Unsplash brands. The company primarily generates revenue through subscriptions, serving a global customer base by providing access to visual content from photographers, illustrators, and videographers. The Americas contribute the most to its revenue, followed by Europe, the Middle East and Africa, and the Asia-Pacific region.

Performance Highlights and Challenges

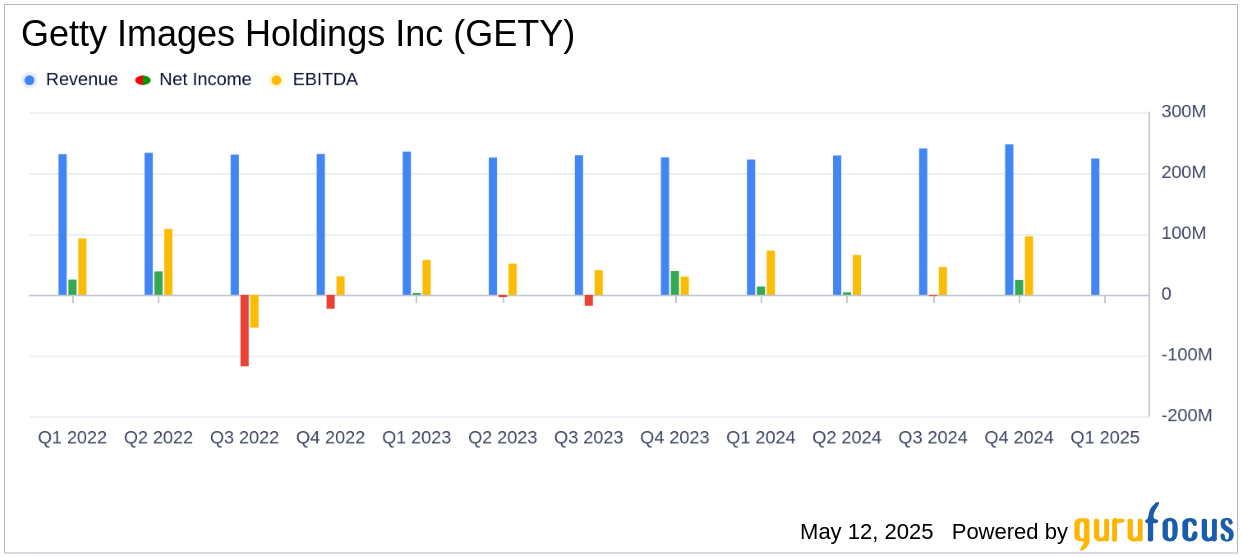

The first quarter of 2025 saw Getty Images Holdings Inc (GETY, Financial) achieving a modest revenue growth of 0.8%, with a currency-neutral growth of 2.6%. The annual subscription revenue increased by 5.4%, reaching 57.2% of total revenue, highlighting the company's strategic focus on subscription-based models. However, the company faced significant challenges, including a $53.4 million increase in tax expenses and a $41.5 million foreign exchange loss, primarily due to the revaluation of the Euro Term Loan. These factors contributed to the widened net loss margin of 45.8%, compared to a net income margin of 6.1% in Q1 2024.

Financial Achievements and Industry Context

Despite the challenges, Getty Images Holdings Inc (GETY, Financial) maintained a strong adjusted EBITDA margin of 31.3%, slightly down from 31.6% in the previous year. The adjusted EBITDA was $70.1 million, reflecting a slight year-over-year decline of 0.1%. These metrics are crucial for the interactive media industry, as they indicate the company's ability to manage operational efficiency amidst fluctuating market conditions.

Key Financial Metrics

The income statement revealed a creative revenue of $132.2 million, a decrease of 4.8% year-over-year, while editorial revenue increased by 4.0% to $82.6 million. The balance sheet showed a total debt of $1.36 billion, including $300 million in senior notes and a term loan balance of $1.06 billion. The company ended the quarter with a cash balance of $114.6 million, down from $121.2 million at the end of 2024.

| Metric | Q1 2025 | Q1 2024 | Change |

|---|---|---|---|

| Revenue | $224.1 million | - | 0.8% increase |

| Net Loss | $102.6 million | $13.6 million (Net Income) | - |

| Adjusted EBITDA | $70.1 million | - | 0.1% decrease |

Analysis and Strategic Outlook

Getty Images Holdings Inc (GETY, Financial) is navigating a challenging economic environment with strategic investments in its subscription business, which is crucial for long-term growth. The company's focus on expanding its customer base and maintaining financial discipline is evident in its updated 2025 guidance, which reflects foreign exchange impacts while reaffirming a positive currency-neutral revenue growth outlook.

“We remain committed to investing in the core assets of our company and continuing to evolve our offering in ways that deepen our relevance for our customers,” said Craig Peters, Chief Executive Officer for Getty Images.

As the company progresses through 2025, its strategic initiatives, including the proposed merger with Shutterstock, are expected to enhance its market position and operational capabilities, providing a robust platform for future growth.

Explore the complete 8-K earnings release (here) from Getty Images Holdings Inc for further details.