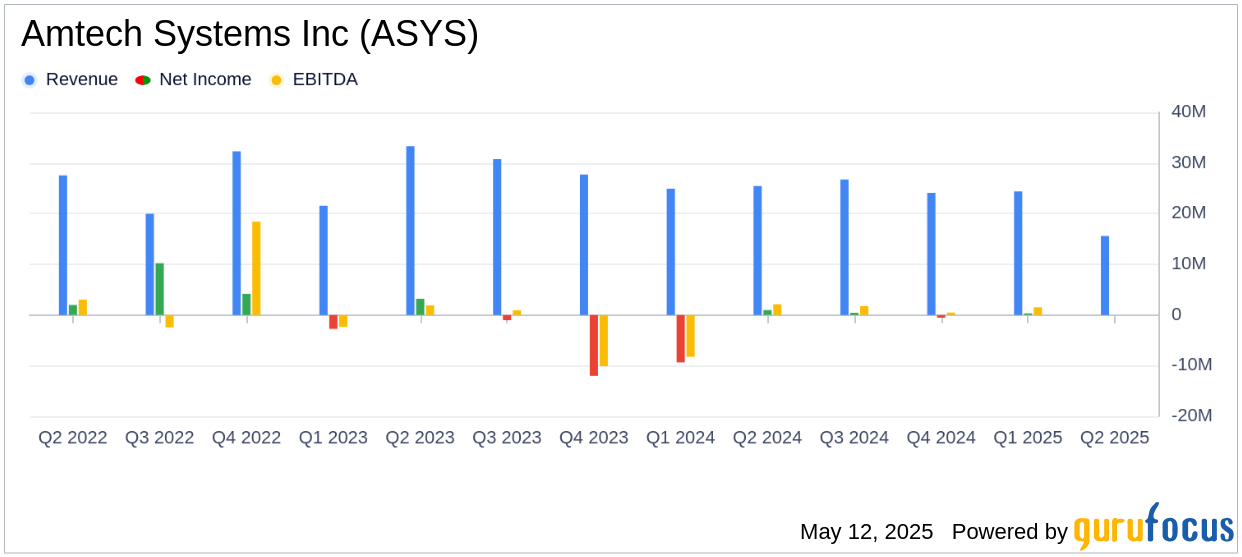

On May 12, 2025, Amtech Systems Inc (ASYS, Financial) released its 8-K filing for the second quarter of fiscal 2025, ending March 31, 2025. The company, a manufacturer of capital equipment for semiconductor fabrication, reported a net revenue of $15.6 million, falling short of the estimated $18.50 million. The GAAP net loss was $31.8 million, or $2.23 per share, significantly below the analyst estimate of a $0.03 loss per share. Amtech Systems Inc operates through two segments: Thermal Processing Solutions and Semiconductor Fabrication Solutions, with the majority of its revenue generated from the Asia region.

Performance and Challenges

Amtech Systems Inc faced a challenging quarter, with revenue decreasing by 36% sequentially and 39% year-over-year. The decline was primarily due to a shipping delay on a disputed order worth approximately $4.9 million and a prolonged downturn in the mature node semiconductor market. This downturn led to reduced sales of wafer cleaning equipment and diffusion furnaces, although there was an increase in sales of advanced packaging solutions.

The company also recorded significant non-cash asset impairments and inventory write-downs, totaling $22.9 million in impairment charges. These challenges highlight the systemic demand weakness in the mature node semiconductor market, which could pose ongoing difficulties for Amtech Systems Inc.

Financial Achievements and Industry Importance

Despite the setbacks, Amtech Systems Inc reported cash provided by operations of $0.2 million and ended the quarter with a cash balance of $13.4 million, up from $11.1 million at the end of September 2024. This focus on operational cash generation and strong accounts receivable collections is crucial for maintaining liquidity in the volatile semiconductor industry.

Amtech's CEO, Mr. Bob Daigle, expressed optimism about the strong demand for semiconductor packaging equipment supporting AI infrastructure builds. He stated,

I continue to be very encouraged by the strong demand we’re experiencing for semiconductor packaging equipment that supports AI infrastructure builds and by the meaningful progress we’ve made in improving our cost structure."

Key Financial Metrics

The company's GAAP gross margin turned negative at -2.1%, a significant drop from 38.4% in the previous quarter, primarily due to lower sales volume and $6.0 million in non-cash inventory write-downs. The non-GAAP gross margin was 36.3%, reflecting adjustments for stock compensation and other non-recurring expenses.

Amtech Systems Inc's backlog stood at $19.1 million, with customer orders totaling $15.7 million for the quarter. These metrics are vital for assessing future revenue potential and operational stability.

Analysis and Outlook

Amtech Systems Inc's performance in Q2 fiscal 2025 underscores the challenges faced by companies in the semiconductor equipment industry, particularly those serving mature node markets. The company's strategic focus on advanced packaging solutions and AI infrastructure-related equipment could provide growth opportunities, but the near-term outlook remains challenging.

For the third quarter ending June 30, 2025, Amtech Systems Inc expects revenues between $16-19 million, with a nominally neutral adjusted EBITDA. The company continues to optimize its cost structure to enhance profitability through market cycles.

Explore the complete 8-K earnings release (here) from Amtech Systems Inc for further details.