The company, identified by the ticker NOTE, anticipates achieving an adjusted EBITDA of around $2 million for the second quarter. This projection reflects the firm's efforts to maintain financial stability even amidst challenging market conditions. With solid fundamentals, NOTE continues to position itself as a resilient option for investors seeking reliable financial performance. The company aims to navigate the current economic environment while delivering value to its stakeholders.

Wall Street Analysts Forecast

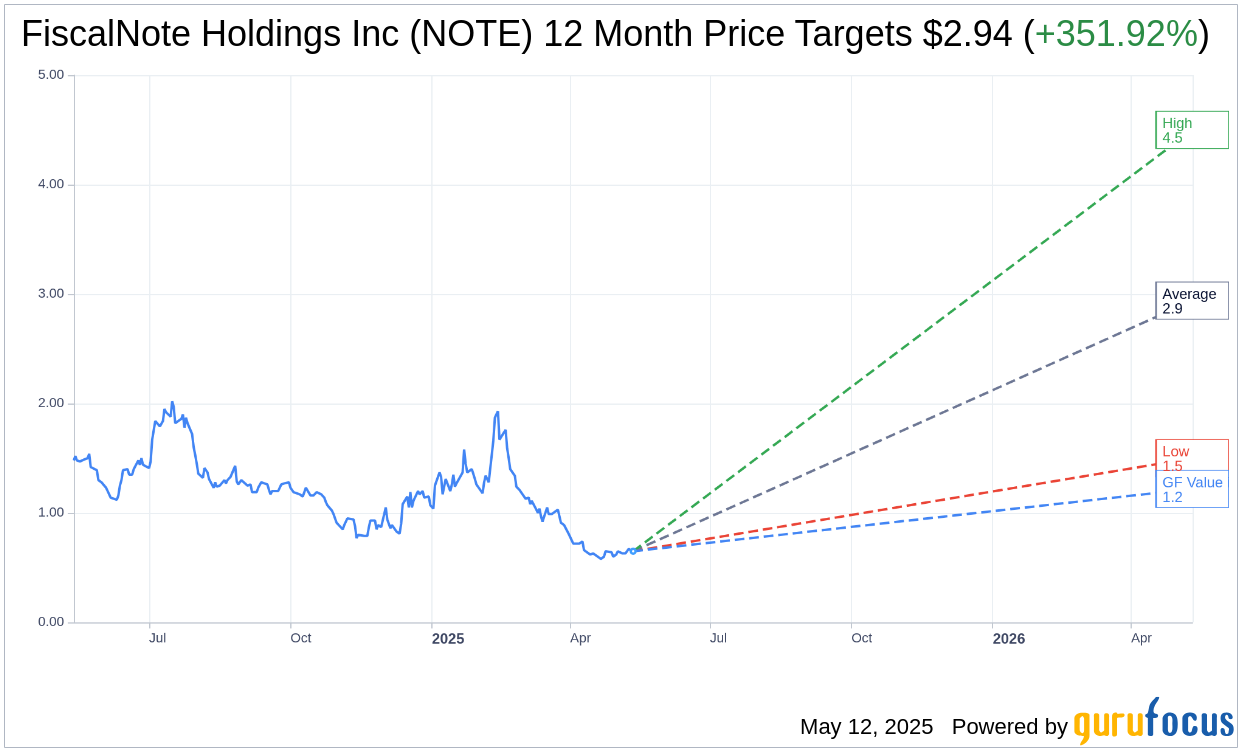

Based on the one-year price targets offered by 4 analysts, the average target price for FiscalNote Holdings Inc (NOTE, Financial) is $2.94 with a high estimate of $4.50 and a low estimate of $1.50. The average target implies an upside of 351.92% from the current price of $0.65. More detailed estimate data can be found on the FiscalNote Holdings Inc (NOTE) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, FiscalNote Holdings Inc's (NOTE, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for FiscalNote Holdings Inc (NOTE, Financial) in one year is $1.22, suggesting a upside of 87.69% from the current price of $0.65. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the FiscalNote Holdings Inc (NOTE) Summary page.

NOTE Key Business Developments

Release Date: March 13, 2025

- Total Revenue for Q4 2024: $29.5 million.

- Annual Recurring Revenue (ARR) for Q4 2024: $107 million.

- Net Revenue Retention for Q4 2024: 98%.

- Adjusted EBITDA for 2024: $9.8 million, a year-over-year improvement of more than $17 million.

- Adjusted Gross Margin for Q4 2024: 87%.

- GAAP Net Loss for Q4 2024: $13.4 million.

- Cash Flow from Operations for 2024: Negative $5.3 million, a $30 million improvement compared to 2023.

- Cash and Cash Equivalents at Year-End 2024: $35.3 million.

- Senior Term Loan Balance at Year-End 2024: $89 million, reduced by $70 million over the year.

- 2025 Revenue Guidance: $94 million to $100 million.

- 2025 Adjusted EBITDA Guidance: $10 million to $12 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- FiscalNote Holdings Inc (NOTE, Financial) reported a significant improvement in adjusted EBITDA, reaching $9.8 million for 2024, a year-over-year increase of more than $17 million.

- The company successfully reduced its senior debt by more than 60% in 2024, demonstrating strong financial management.

- The launch of the PolicyNote platform in January has shown promising adoption trends and strong customer engagement.

- FiscalNote Holdings Inc (NOTE) achieved its first full year of positive adjusted EBITDA in 2024, marking a significant milestone.

- The company has streamlined operations and divested noncore businesses, leading to a more focused and efficient organization.

Negative Points

- FiscalNote Holdings Inc (NOTE) experienced a decline in annual recurring revenue (ARR) from $109 million in 2023 to $107 million in 2024 on a pro forma basis.

- The typical end-of-year ARR uptick did not materialize at the end of 2024, impacting 2025 revenue guidance.

- Net revenue retention decreased slightly from 99% in the prior year to 98% in 2024.

- The company anticipates market volatility, particularly in the private sector, which could impact corporate buying decisions and timelines.

- FiscalNote Holdings Inc (NOTE) reported a GAAP net loss of $13.4 million for Q4 2024, although this was significantly lower than the prior year period.