Magnachip Semiconductor Corp. (MX, Financial) reported a decline in revenue for the first quarter, registering $44.722 million compared to $48.858 million in the previous year. Despite this dip, the company's CEO, YJ Kim, highlighted the ongoing progress in their Power Analog Solutions (PAS) and Power IC segments. In the first quarter, Magnachip introduced 27 new-generation PAS products that are now ready for commercial sampling, targeting sectors such as Industrial, Automotive, Consumer, and Communication.

The company has ambitious plans, with over 40 new-generation PAS products slated for launch in 2025 and around 55 more in 2026. These advancements are projected to not only create new revenue streams but also enhance gross margins in the future. Although there are geopolitical and macroeconomic challenges to consider, Magnachip anticipates both sequential and year-over-year growth in revenue from its PAS and PIC operations in the upcoming quarter.

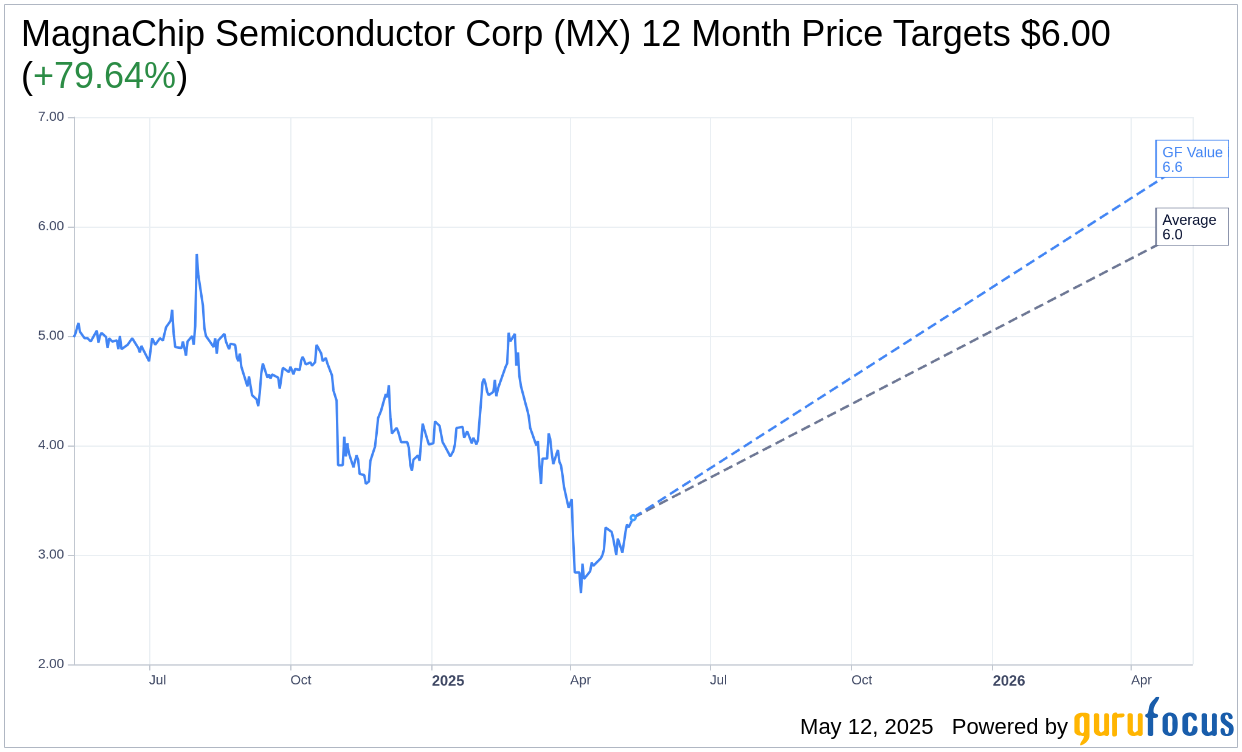

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for MagnaChip Semiconductor Corp (MX, Financial) is $6.00 with a high estimate of $6.00 and a low estimate of $6.00. The average target implies an upside of 79.64% from the current price of $3.34. More detailed estimate data can be found on the MagnaChip Semiconductor Corp (MX) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, MagnaChip Semiconductor Corp's (MX, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for MagnaChip Semiconductor Corp (MX, Financial) in one year is $6.62, suggesting a upside of 98.2% from the current price of $3.34. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the MagnaChip Semiconductor Corp (MX) Summary page.

MX Key Business Developments

Release Date: March 12, 2025

- Total Revenue: $63 million, up 24% year over year, down 5.1% sequentially.

- Gross Profit Margin: 25.2%, up 2.5 percentage points year over year, up 1.9 percentage points sequentially.

- Standard Products Revenue: $60.7 million, up 47.5% year over year, down 5.1% sequentially.

- Power Solutions (PAS) Revenue: $43.5 million, up 33.2% year over year, down 8.7% sequentially.

- MSS Revenue: $17.3 million, up 102% year over year, up 5.1% sequentially.

- Operating Loss: $15.7 million, compared to $11 million in Q3 and $15.9 million in Q4 2023.

- Adjusted Operating Loss: $7 million, compared to $9 million in Q3 and $14.1 million in Q4 last year.

- Net Loss: $16.3 million, compared to $9.6 million in Q3 and $6 million in Q4 last year.

- Adjusted EBITDA: Negative $2.6 million, compared to negative $4.9 million in Q3 and negative $10 million in Q4 last year.

- Cash Position: $138.6 million at the end of Q4.

- CapEx: $7.4 million in Q4; $11.6 million for the full year 2024.

- Q1 2025 Revenue Guidance: $42 million to $47 million, down 8.9% sequentially, up 11.5% year over year at the midpoint.

- Q1 2025 Gross Profit Margin Guidance: 18.5% to 20.5%.

- Full Year 2025 Revenue Growth Expectation: Mid- to high single-digit year over year.

- Full Year 2025 Gross Profit Margin Expectation: 19.5% to 21.5%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- MagnaChip Semiconductor Corp (MX, Financial) announced a strategic shift to become a pure-play power company, focusing on power discrete and power IC businesses to drive profitability.

- The company plans to launch over 40 new generation power products in 2025, with 27 new products launching in Q4 2025, which are expected to drive higher revenue per wafer and improve gross margins.

- Q4 2024 revenue was $63 million, up 24% year over year, and the gross profit margin exceeded guidance, indicating strong financial performance.

- The company has a robust plan to invest $65 million to $70 million over the next three years to upgrade production equipment at their Gumi Fab, aiming for top-line growth and bottom-line improvement.

- MagnaChip Semiconductor Corp (MX) has set clear financial targets with their 3-3-3 strategy, aiming for $300 million annual revenue with a 30% gross margin within three years.

Negative Points

- The company is exploring strategic options for its display business, which will be classified as discontinued operations, indicating potential challenges in this segment.

- Q4 2024 saw an operating loss of $15.7 million, and the company recorded a net loss of $16.3 million, reflecting ongoing financial challenges.

- The wind down of Transitional Foundry Services is impacting fab utilization, contributing to a lower gross profit margin outlook for 2025.

- MagnaChip Semiconductor Corp (MX) faces underutilization issues at its Gumi Fab due to the phaseout of Transitional Foundry Services, affecting profitability.

- The company anticipates a sequential decline in Q1 2025 revenue due to seasonality and the wind down of Transitional Foundry Services, indicating short-term revenue challenges.