- Simon Property Group (SPG, Financial) exceeded Q1 earnings expectations.

- Average analyst price target suggests potential stock upside of 9.88%.

- Current brokerage recommendations indicate an "Outperform" status for SPG.

Simon Property Group (NYSE: SPG) recently reported outstanding first-quarter performance by surpassing analysts' earnings and revenue projections. Despite witnessing a decline in net operating income and occupancy rates, the company reaffirmed its 2025 real estate funds from operations (FFO) per share guidance, set between $12.40 and $12.65. In the first quarter alone, the real estate FFO per share stood at $2.95, comfortably exceeding the anticipated $2.91, while revenue soared to $1.47 billion against the forecasted $1.34 billion.

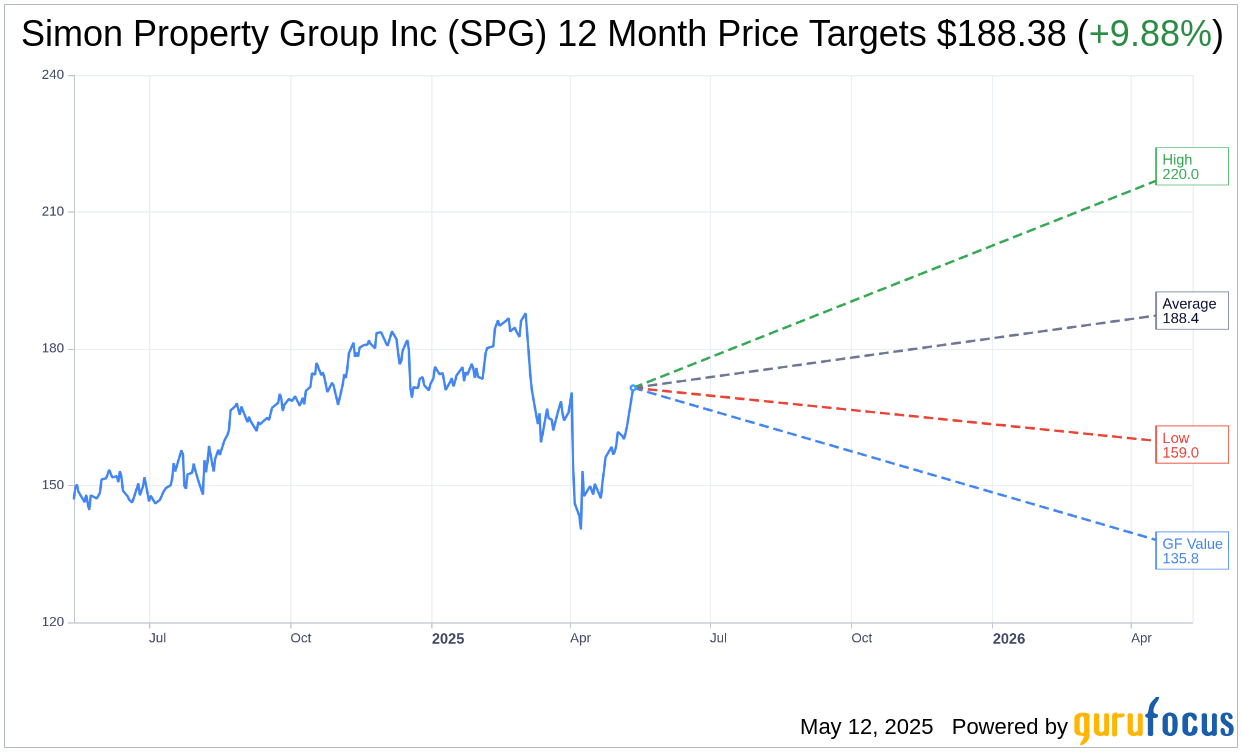

Wall Street Analysts Forecast

Analysts have expressed optimism about Simon Property Group’s potential growth. Among 17 analysts, the consensus one-year price target averages at $188.38, with projections ranging from a high of $220.00 to a low of $159.00. This average target price hints at a potential upside of 9.88% from the current market price of $171.44. For further detailed analysis, visit the Simon Property Group Inc (SPG, Financial) Forecast page.

Brokerage Recommendations and GF Value Estimate

Simon Property Group (SPG, Financial) holds an "Outperform" rating based on the consensus recommendation from 20 brokerage firms, yielding an average rating of 2.2 on a scale where 1 represents a Strong Buy and 5 a Sell.

Looking through the lens of GuruFocus estimates, the one-year projected GF Value for Simon Property Group is $135.76. This suggests a potential downside of 20.81% from its current price of $171.44. The GF Value represents GuruFocus' evaluation of the stock's fair market value, calculated based on historical trading multiples, former business growth, and future performance estimates. For more in-depth insights, check the Simon Property Group Inc (SPG, Financial) Summary page.