MODG has reported a first-quarter revenue of $1.092 billion, surpassing market expectations of $1.08 billion. This exceptional performance can be attributed to the strong results across all business segments, as highlighted by President and CEO Chip Brewer. The Golf Equipment division notably excelled with the Elyte Driver gaining multiple accolades. Additionally, the company's strategic cost reduction and margin improvement measures initiated in 2024 have begun to yield positive results. Furthermore, MODG has entered into an agreement to sell the Jack Wolfskin business, enabling the company to concentrate on its core operations. This strategic move is poised to strengthen MODG's financial standing and liquidity in anticipation of the planned separation of Topgolf.

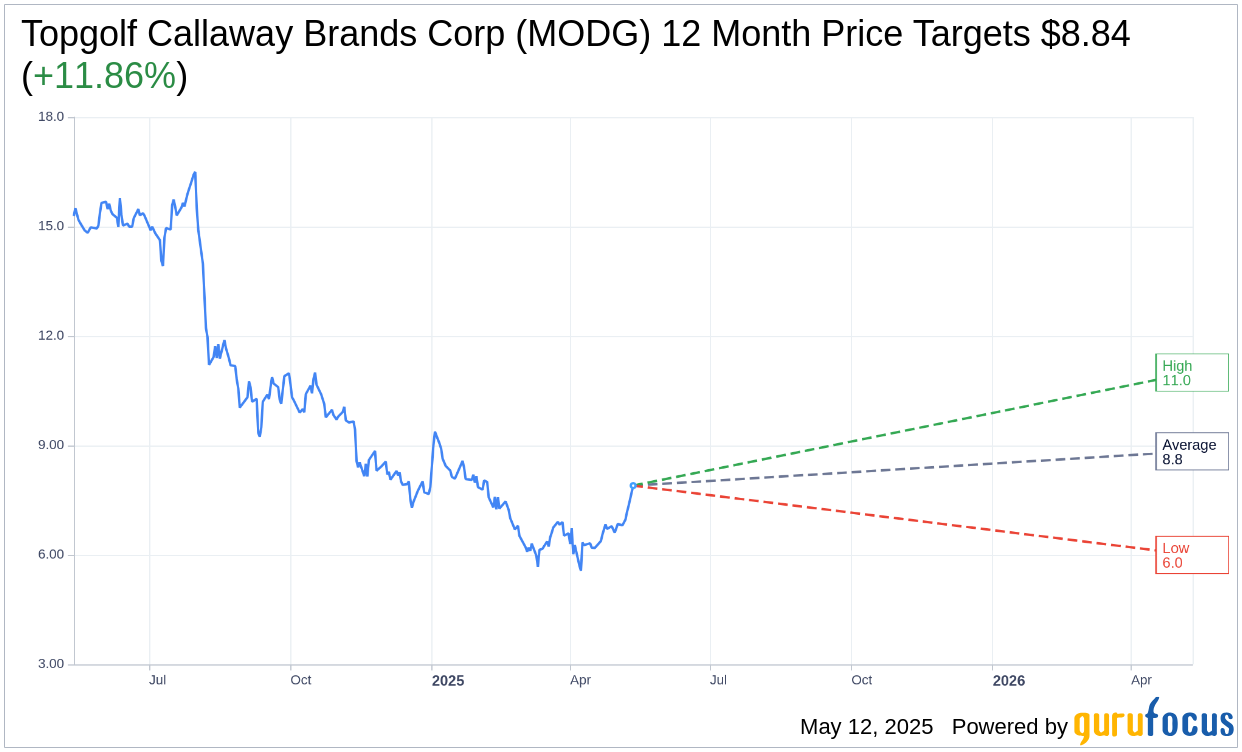

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Topgolf Callaway Brands Corp (MODG, Financial) is $8.84 with a high estimate of $11.00 and a low estimate of $6.00. The average target implies an upside of 11.86% from the current price of $7.90. More detailed estimate data can be found on the Topgolf Callaway Brands Corp (MODG) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Topgolf Callaway Brands Corp's (MODG, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Topgolf Callaway Brands Corp (MODG, Financial) in one year is $18.12, suggesting a upside of 129.37% from the current price of $7.9. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Topgolf Callaway Brands Corp (MODG) Summary page.

MODG Key Business Developments

Release Date: February 24, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Topgolf Callaway Brands Corp (MODG, Financial) reported strong Q4 performance with growth in both golf equipment and Travis Matthew brands.

- Topgolf delivered better-than-expected same venue sales and record Q4 venue level margins.

- The company generated over $100 million in free cash flow, contributing to a total company free cash flow of $203 million, strengthening its financial position.

- Golf equipment maintained its leadership position in the US golf club market share and achieved record share in golf balls.

- Travis Matthew brand is expected to deliver year-over-year growth on both the top and bottom line in 2025.

Negative Points

- Topgolf Callaway Brands Corp (MODG) faces significant headwinds from foreign exchange, impacting core business EBITDA by approximately $75 million year over year.

- Same venue sales at Topgolf were down 8% in Q4, with continued pressure expected in Q1 2025 due to unfavorable weather conditions.

- The company anticipates a decline in 2025 revenue by approximately 3% year over year at the midpoint of guidance.

- Golf equipment revenues are forecasted to be down slightly year over year, primarily due to foreign exchange and competitive launches.

- The active lifestyle category is expected to see a decline in revenues due to foreign exchange and lower revenue projections for Jack Wolfskin.