Aquestive Therapeutics (AQST, Financial) announced first-quarter 2025 revenues of $8.72 million, missing the projected $12.23 million. Despite this shortfall, the company reached a significant milestone by submitting a New Drug Application (NDA) for Anaphylm, an innovative oral treatment for severe allergic reactions, including anaphylaxis. This development marks a major stride in potentially introducing the first non-invasive epinephrine therapy to the market.

Aquestive anticipates an FDA decision on their NDA submission in the second quarter of 2025. Should approval be granted, they are preparing for a U.S. launch in early 2026. The company is channeling its efforts towards the pre-commercialization and regulatory approval processes for Anaphylm, recognizing its potential in a growing market that currently exceeds billions of dollars. Consequently, Aquestive plans to downscale activities on other projects like AQST-108 and will not contest a court ruling regarding Libervant, allowing them to allocate more resources towards Anaphylm’s potential launch.

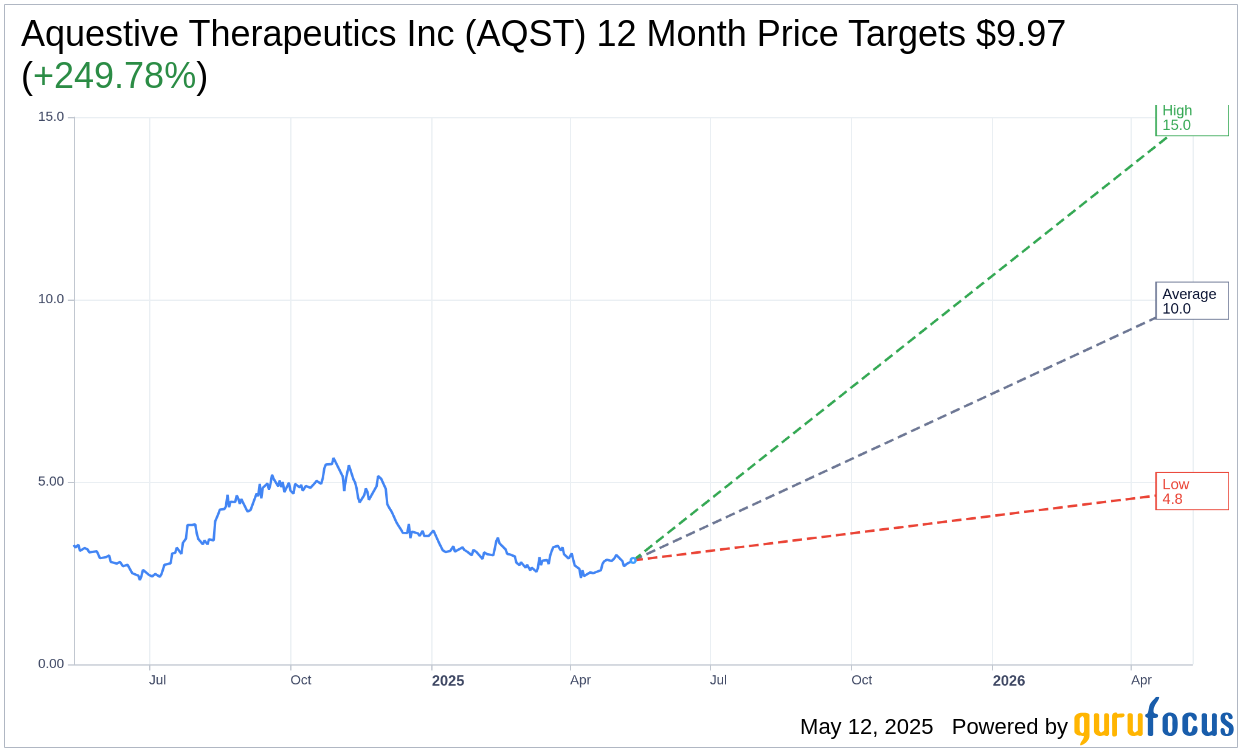

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Aquestive Therapeutics Inc (AQST, Financial) is $9.97 with a high estimate of $15.00 and a low estimate of $4.75. The average target implies an upside of 249.78% from the current price of $2.85. More detailed estimate data can be found on the Aquestive Therapeutics Inc (AQST) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Aquestive Therapeutics Inc's (AQST, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Aquestive Therapeutics Inc (AQST, Financial) in one year is $1.34, suggesting a downside of 52.98% from the current price of $2.85. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Aquestive Therapeutics Inc (AQST) Summary page.

AQST Key Business Developments

Release Date: March 06, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Aquestive Therapeutics Inc (AQST, Financial) has begun the FDA filing process for its Afilm epinephrine sublingual film, with expectations for NDA acceptance by June 2025.

- The company is on track to launch Anafilm in the first quarter of 2026, aligning with the allergy season, which could enhance market penetration.

- Pediatric studies for Anafilm have progressed as expected, with data supporting a product label similar to existing EpiPen autoinjectors.

- Aquestive Therapeutics Inc (AQST) has strengthened its balance sheet by raising over $78 million from institutional healthcare investors.

- The company is preparing for potential international market expansion, targeting submissions in the EU, UK, and Canada.

Negative Points

- Total revenue decreased by 10% in Q4 2024 compared to Q4 2023, primarily due to declines in license and royalty revenue.

- Research and development expenses increased significantly, driven by clinical trial costs for NFLM and AQST 108 programs.

- Selling, general, and administrative expenses rose sharply due to increased commercial spending and regulatory fees.

- Aquestive Therapeutics Inc (AQST) reported a net loss of $17.1 million for Q4 2024, a substantial increase from the $8.1 million loss in Q4 2023.

- The company faces legal challenges regarding Libervan's market exclusivity, which could impact its availability and revenue potential.