Lument Finance Trust (LFT, Financial) announced its financial results for the first quarter, revealing that its distributable earnings per share (EPS) stood at 8 cents. This figure fell short of analysts' consensus estimate, which anticipated 9 cents per share.

Wall Street Analysts Forecast

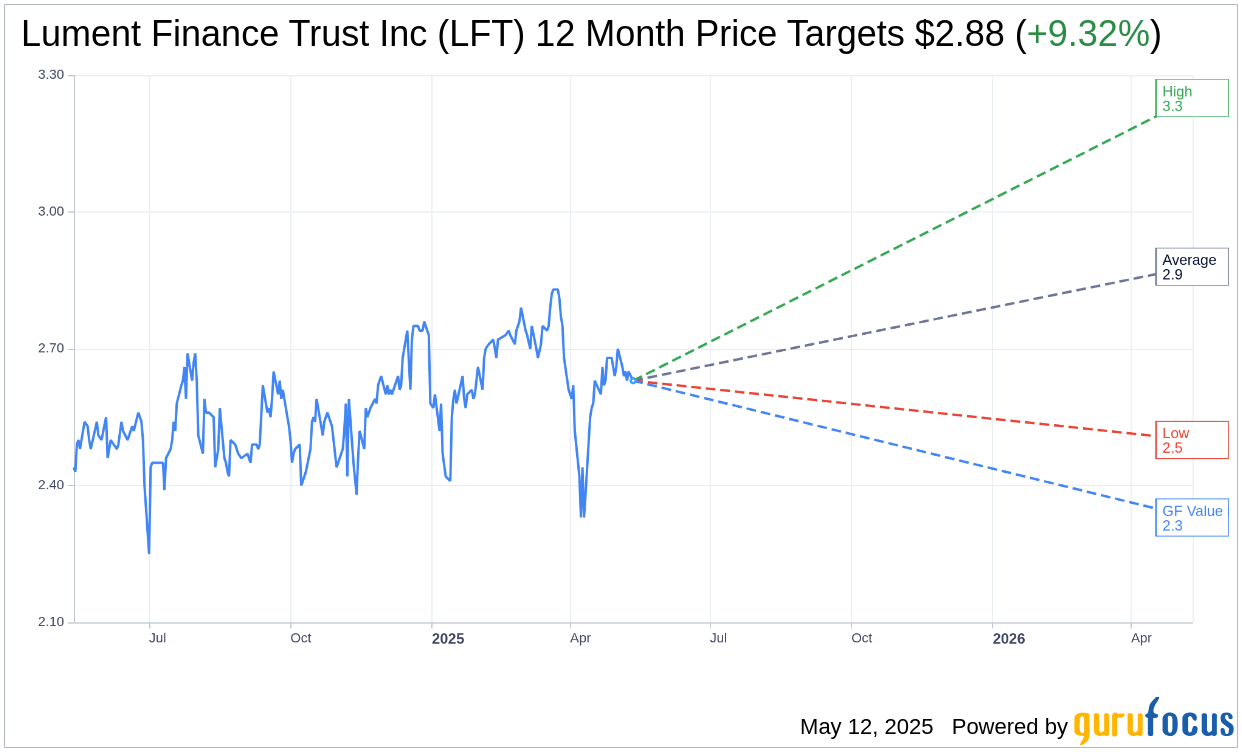

Based on the one-year price targets offered by 2 analysts, the average target price for Lument Finance Trust Inc (LFT, Financial) is $2.88 with a high estimate of $3.25 and a low estimate of $2.50. The average target implies an upside of 9.32% from the current price of $2.63. More detailed estimate data can be found on the Lument Finance Trust Inc (LFT) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Lument Finance Trust Inc's (LFT, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Lument Finance Trust Inc (LFT, Financial) in one year is $2.33, suggesting a downside of 11.41% from the current price of $2.63. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Lument Finance Trust Inc (LFT) Summary page.

LFT Key Business Developments

Release Date: March 20, 2025

- GAAP Net Income: $0.07 per share for Q4 2024; $0.34 per share for fiscal year 2024.

- Distributable Earnings: $0.10 per share for Q4 2024; $0.44 per share for fiscal year 2024.

- Quarterly Dividend: $0.08 per share for Q4 2024, plus a one-time special dividend of $0.09 per share.

- Total Dividends for 2024: $0.40 per common share.

- Net Interest Income: $9.4 million for Q4 2024.

- Loan Payoffs: $144 million in Q4 2024, compared to $51 million in Q3 2024.

- Exit Fees: $1.1 million recognized in Q4 2024, compared to $150,000 in Q3 2024.

- Total Operating Expenses: $2.8 million in Q4 2024, compared to $2.9 million in Q3 2024.

- Allowance for Credit Losses: Net increase of $1.8 million in Q4 2024.

- Unrestricted Cash Balance: $69 million as of December 31, 2024.

- Total Equity: $238 million as of December 31, 2024.

- Book Value of Common Stock: $3.40 per share as of December 31, 2024, down from $3.50 per share as of September 30, 2024.

- Portfolio Composition: 65 floating rate loans with an aggregate unpaid principal balance of approximately $1.1 billion as of December 31, 2024.

- Portfolio Collateralization: 92% of the portfolio collateralized by multi-family properties.

- Weighted Average Risk Rating: Improved to 3.5 from 3.6 at the end of Q3 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Lument Finance Trust Inc (LFT, Financial) reported a GAAP net income of $0.07 per share for the fourth quarter and $0.34 per share for the fiscal year 2024.

- The company declared a quarterly dividend of $0.08 per share and a one-time special dividend of $0.09 per share, totaling $0.40 per common share for 2024.

- LFT's portfolio is primarily comprised of multi-family properties, which are supported by strong demand and resilient rental trends.

- The company successfully achieved full recovery of principal on two previously 5-rated loans, demonstrating effective asset management.

- LFT maintains a strong liquidity position with an unrestricted cash balance of $69 million at the end of the fourth quarter.

Negative Points

- The macroeconomic environment remains challenging with geopolitical uncertainty and financial market volatility impacting operations.

- Interest rates are expected to remain elevated, affecting borrowing costs and financial strategies.

- LFT's investment activity was limited due to constraints on available reinvestment capital.

- The company has six loans rated as 5, indicating higher risk, with an aggregate principal amount of $98 million.

- Specific reserves for credit losses increased to $3.7 million, reflecting challenges in the loan portfolio.