Bally's (BALY, Financial) revealed a 2.6% increase in Q1 revenue for its Casinos & Resorts division, reaching $351.2 million compared to the previous year. The company's International Interactive segment reported earnings of $191.7 million for the same period, while its North America Interactive sector experienced a notable 12.5% rise, achieving $44.5 million in revenue year-over-year.

Earlier in the first quarter of 2025, Bally's expanded its operations through strategic transactions with The Queen Casino & Entertainment and Standard General. This expansion added four regional gaming properties to Bally's portfolio, promoting significant long-term growth opportunities, according to CEO Robeson Reeves.

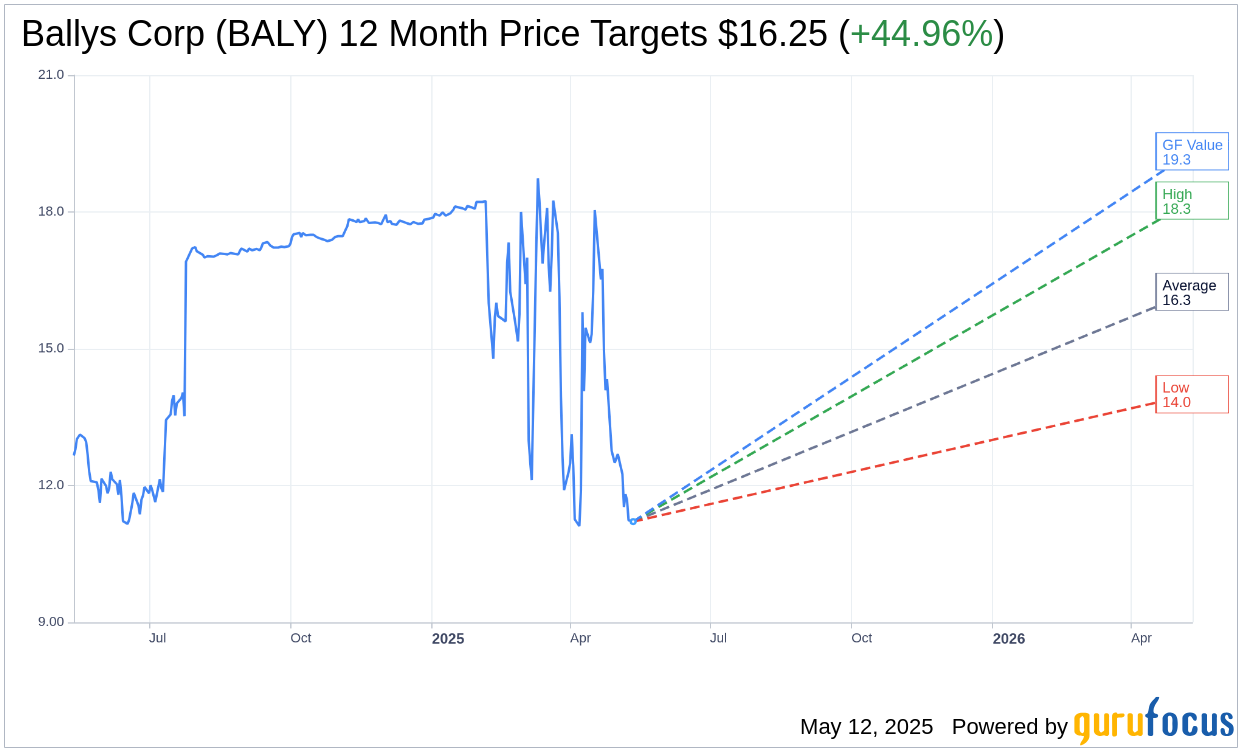

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for Ballys Corp (BALY, Financial) is $16.25 with a high estimate of $18.25 and a low estimate of $14.00. The average target implies an upside of 44.96% from the current price of $11.21. More detailed estimate data can be found on the Ballys Corp (BALY) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Ballys Corp's (BALY, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Ballys Corp (BALY, Financial) in one year is $19.33, suggesting a upside of 72.44% from the current price of $11.21. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Ballys Corp (BALY) Summary page.