Key Highlights:

- Waste Management (WM, Financial) maintains a quarterly dividend, delivering a forward yield of 1.46%.

- Analyst projections suggest a potential upside of 9.72% from current levels.

- Current "Outperform" status, supported by a consensus recommendation from 24 brokerage firms.

Waste Management Inc. (NYSE: WM) has reaffirmed its commitment to returning value to shareholders by declaring a quarterly dividend of $0.825 per share. This dividend, reflecting a forward yield of 1.46%, will be payable on June 20 to those on record as of June 6. Though the company's first-quarter revenue did not meet expectations, affecting its after-hours trading performance, Waste Management continues to demonstrate resilience.

Wall Street Analysts' Forecast

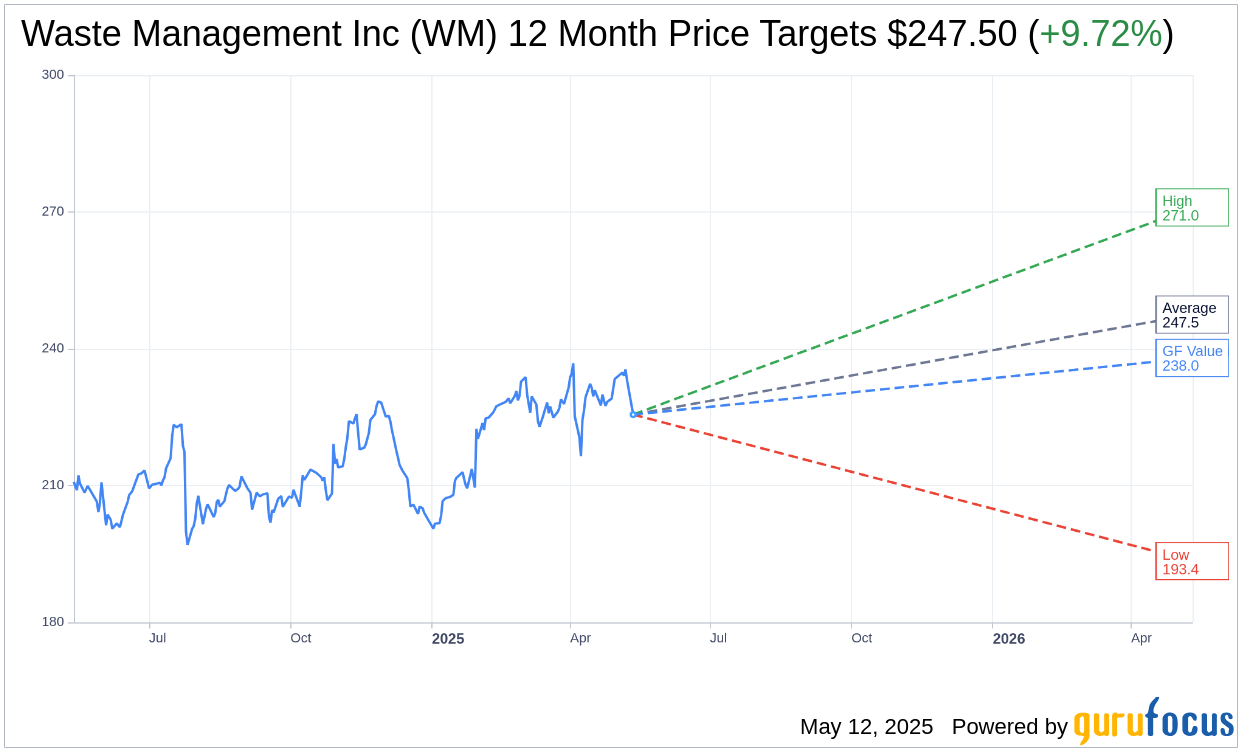

Insights from 19 financial analysts project a promising future for Waste Management Inc (WM, Financial), with a one-year average price target of $247.50. Estimates range from a high of $271.00 to a low of $193.44, translating to a potential upside of 9.72% from the current trading price of $225.57. For further in-depth analysis, visit the Waste Management Inc (WM) Forecast page.

Analyst Ratings and GF Value

The consensus recommendation from 24 brokerage firms places Waste Management Inc (WM, Financial) in an "Outperform" category, with an average rating of 2.3 on a scale where 1 signifies Strong Buy and 5 denotes Sell. This reflects a robust investor sentiment around the stock.

According to GuruFocus' proprietary calculations, the estimated GF Value for Waste Management Inc (WM, Financial) in the coming year stands at $237.99. This assessment indicates a further potential upside of 5.51% from the current price of $225.57. The GF Value metric is GuruFocus's approximation of the stock's fair trading value, taking into account historical trading multiples, historical business performance, and future growth projections. For more comprehensive details, refer to the Waste Management Inc (WM) Summary page.