Summary:

- Runway Growth Finance Corp. (RWAY, Financial) reports robust first-quarter investment income of $35.4 million.

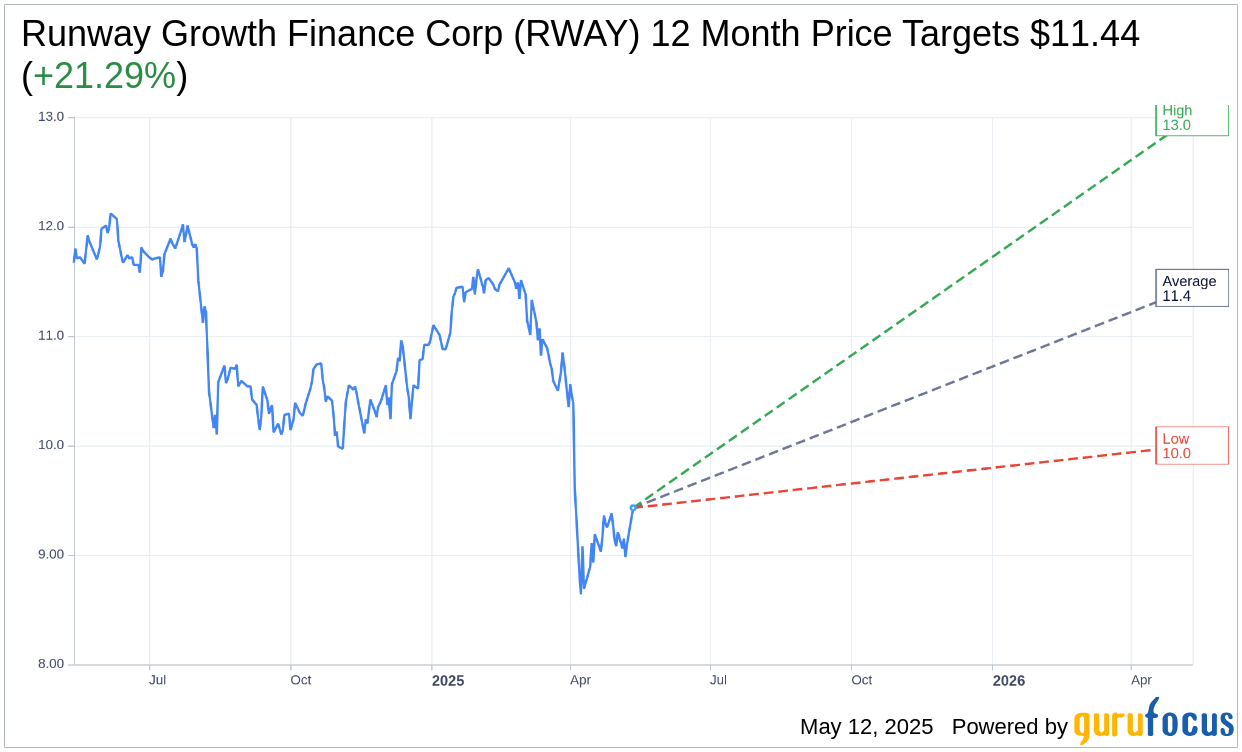

- Analysts project an average upside potential of 21.29% with a price target of $11.44.

- GuruFocus estimates a significant upside of 281.76% based on GF Value.

Runway Growth Finance Corp. (RWAY) has reported a strong performance in the first quarter with an investment income of $35.4 million and a net investment income of $15.6 million. Following its merger with BC Partners Credit, the company remains committed to disciplined underwriting and selectivity in its portfolio strategies, which is evident in its total notable investments of $50.7 million in existing companies.

Wall Street Analysts Forecast

In terms of stock performance predictions for Runway Growth Finance Corp (RWAY, Financial), insights from eight analysts indicate an average target price of $11.44, with forecasts ranging from a high of $13.00 to a low of $10.00. This average target suggests a potential upside of 21.29% from the current trading price of $9.43. For more comprehensive estimation data, visit the Runway Growth Finance Corp (RWAY) Forecast page.

The consensus from 10 brokerage firms assigns Runway Growth Finance Corp (RWAY, Financial) an average recommendation of 2.5, placing it in the "Outperform" category. This rating is part of a scale ranging from 1 to 5, where 1 is a Strong Buy recommendation and 5 is a Sell.

According to GuruFocus estimates, the calculated GF Value for Runway Growth Finance Corp (RWAY, Financial) over the next year is projected at $36.00. This suggests a remarkable upside of 281.76% from the current price point of $9.43. The GF Value is derived from the historical trading multiples of the stock, along with past business growth and future performance forecasts. For more detailed analysis, visit the Runway Growth Finance Corp (RWAY) Summary page.