**Key Insights**

- Arcturus Therapeutics is making significant progress in its mRNA therapeutic programs.

- Analysts project a substantial upside potential for ARCT, with a consensus "Buy" rating.

- GuruFocus indicates that ARCT is undervalued, presenting a potential investment opportunity.

Arcturus Therapeutics Holdings Inc. (ARCT, Financial) is making strides in the field of mRNA therapeutics. CEO Joe Payne recently announced the ongoing Phase 2 enrollment for two pivotal programs: ARCT-032, targeting cystic fibrosis, and ARCT-810, focusing on OTC deficiency. Investors can anticipate interim data for both trials by 2025. Furthermore, Arcturus's COVID-19 vaccine, named KOSTAIVE, has secured approval from the European Union, with additional regulatory submissions on the horizon.

Optimistic Outlook from Wall Street Analysts

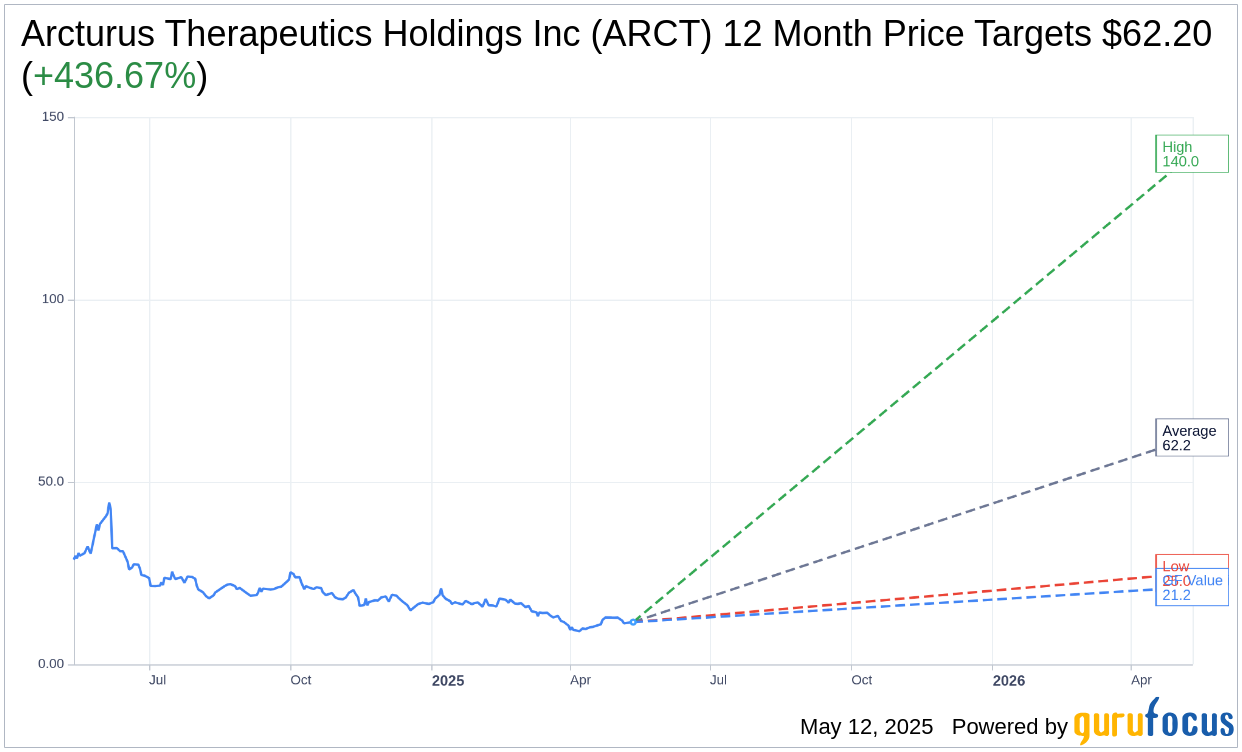

Wall Street analysts provide a positive outlook for Arcturus Therapeutics. The average one-year price target set by 10 analysts stands at $62.20, with estimates ranging from a high of $140.00 to a low of $25.00. This average target price suggests a remarkable potential upside of 436.67% from the current trading price of $11.59. For a comprehensive understanding of these projections, visit the Arcturus Therapeutics Holdings Inc (ARCT, Financial) Forecast page.

The consensus among 11 brokerage firms positions Arcturus as a solid investment, with an average recommendation of 1.5, signifying a "Buy" status. This rating is based on a scale from 1 to 5, where 1 represents a Strong Buy, and 5 indicates a Sell recommendation.

Evaluating Arcturus's Fair Value with GuruFocus Metrics

According to GuruFocus's analysis, the estimated GF Value for Arcturus Therapeutics in one year is calculated to be $21.19. This estimation implies an upside potential of 82.83% from the current price of $11.59. The GF Value is derived from historical trading multiples and the company’s past and projected business growth. For more detailed data on this evaluation, refer to the Arcturus Therapeutics Holdings Inc (ARCT, Financial) Summary page.