Bernstein has initiated coverage on Saint-Gobain (CODYY, Financial), assigning it a Market Perform rating and establishing a price target of EUR 100. As the firm begins its analysis of European building materials, it emphasizes a strategic preference for two market extremes. On one hand, they favor the highly localized and commoditized heavy side of the sector, which benefits from robust pricing power. On the other, they focus on the differentiated end of the light side that operates in dynamic global markets, given its significant expansion prospects and strong pricing capabilities.

Wall Street Analysts Forecast

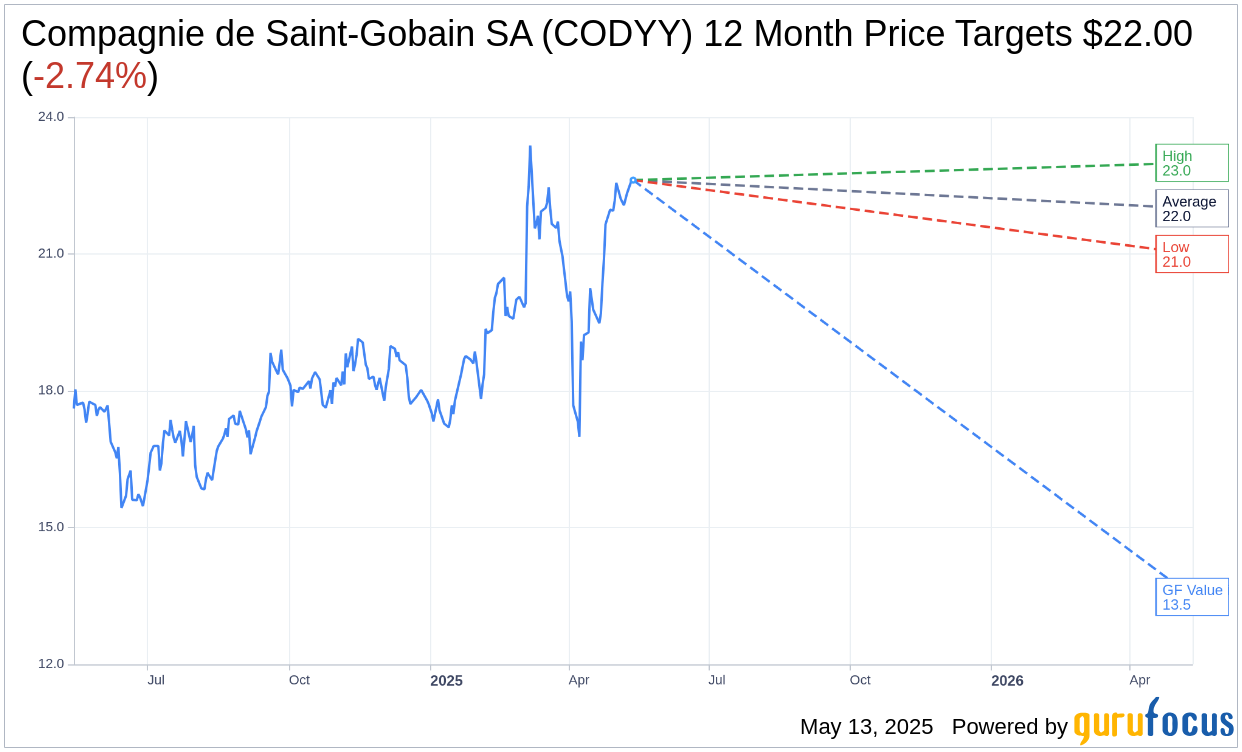

Based on the one-year price targets offered by 2 analysts, the average target price for Compagnie de Saint-Gobain SA (CODYY, Financial) is $22.00 with a high estimate of $23.00 and a low estimate of $21.00. The average target implies an downside of 2.74% from the current price of $22.62. More detailed estimate data can be found on the Compagnie de Saint-Gobain SA (CODYY) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Compagnie de Saint-Gobain SA's (CODYY, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Compagnie de Saint-Gobain SA (CODYY, Financial) in one year is $13.48, suggesting a downside of 40.41% from the current price of $22.62. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Compagnie de Saint-Gobain SA (CODYY) Summary page.