As of March 31, 2025, Acumen Pharmaceuticals (ABOS, Financial) reported that its cash, cash equivalents, and marketable securities had decreased to $197.9 million. This marks a reduction from $231.5 million recorded on December 31, 2024. The decline in cash reserves has been attributed to funding the company's ongoing operations. Despite this decrease, the available funds are projected to sustain Acumen Pharmaceuticals' clinical and operational efforts through the beginning of 2027.

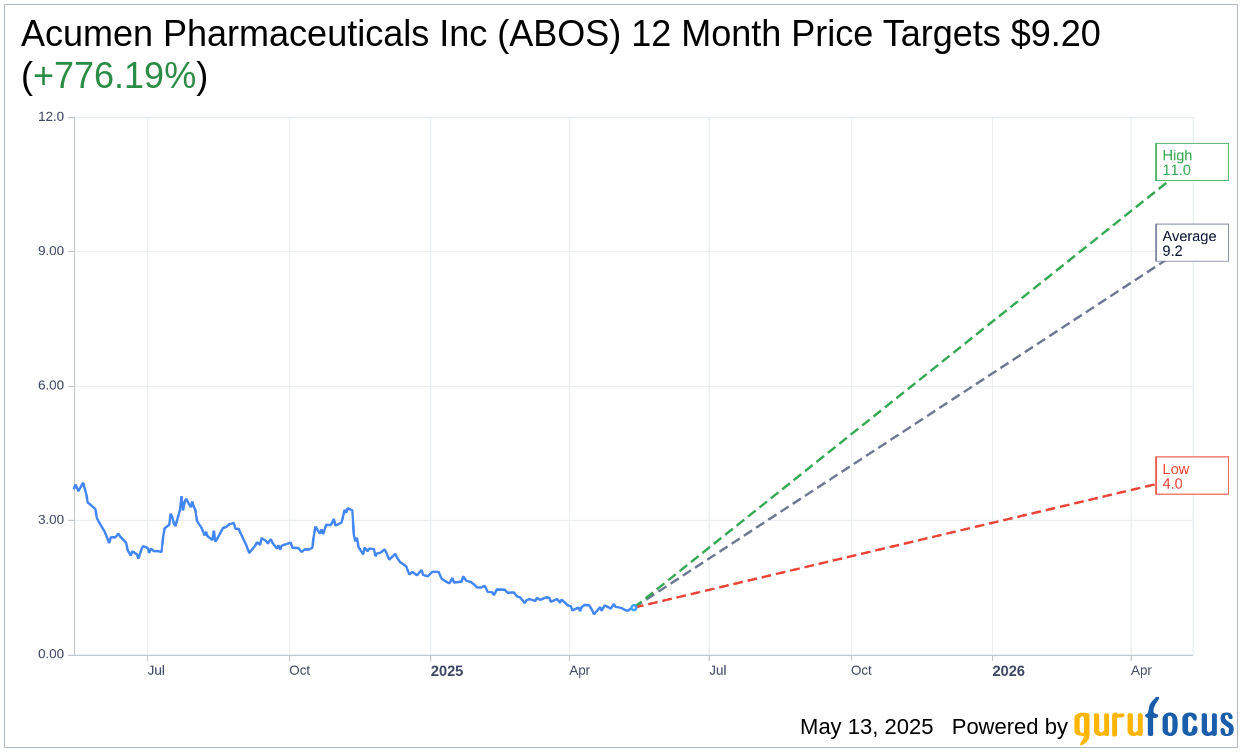

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Acumen Pharmaceuticals Inc (ABOS, Financial) is $9.20 with a high estimate of $11.00 and a low estimate of $4.00. The average target implies an upside of 776.19% from the current price of $1.05. More detailed estimate data can be found on the Acumen Pharmaceuticals Inc (ABOS) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Acumen Pharmaceuticals Inc's (ABOS, Financial) average brokerage recommendation is currently 1.5, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

ABOS Key Business Developments

Release Date: March 27, 2025

- Cash and Marketable Securities: $231.5 million as of the end of 2024.

- R&D Expenses: $93.8 million in 2024, increased due to ALTITUDE-AD trial support.

- G&A Expenses: $20.2 million in 2024, roughly flat compared to the prior year.

- Loss from Operations: $114 million in 2024.

- Net Loss: $102.3 million in 2024, after accounting for interest income.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Acumen Pharmaceuticals Inc (ABOS, Financial) successfully completed enrollment of 542 participants in the ALTITUDE-AD Phase II study ahead of schedule, demonstrating strong operational execution.

- The company reported positive results from the INTERCEPT-AD Phase I study, showing that sabirnetug was well tolerated and demonstrated novel target engagement of A-beta oligomers.

- Acumen Pharmaceuticals Inc (ABOS) has a strong financial position with $231.5 million in cash and marketable securities, expected to support operations into the first half of 2027.

- The subcutaneous formulation of sabirnetug showed promising results, expanding treatment options and convenience for patients and providers.

- The company is actively engaging with the research community and clinical investigators, enhancing the recognition and potential of sabirnetug as a next-generation treatment for early Alzheimer's disease.

Negative Points

- The company reported a net loss of $102.3 million for the year 2024, reflecting increased R&D expenses primarily due to the ALTITUDE-AD trial.

- There is uncertainty regarding the timeline for the availability of biochemical biomarker data at the top line readout of the ALTITUDE-AD study.

- The subcutaneous formulation of sabirnetug showed a high incidence of injection site reactions, although they were mild.

- The company faces competition in the Alzheimer's treatment space, with other companies exploring anti-amyloid mechanisms and preclinical AD trials.

- The full impact and relevance of sabirnetug's effects on plaques and cognitive performance remain to be fully determined in the ongoing ALTITUDE-AD study.