CyberArk (CYBR, Financial) has reported impressive financial results for the first quarter, with revenue reaching $317.6 million, exceeding the anticipated $305.58 million. This solid performance underscores the strength of the company's comprehensive platform and resilient business model.

In the first quarter, CyberArk's total annual recurring revenue (ARR) climbed to $1.215 billion, supported by $46 million in net new ARR. This growth reflects the company's consistent execution and innovation efforts, which have contributed to robust top-line expansion.

A notable achievement for CyberArk is their 18% non-GAAP operating margin, coupled with generating $96 million in free cash flow. This illustrates the company's ability to scale profitably while maintaining strong financial health.

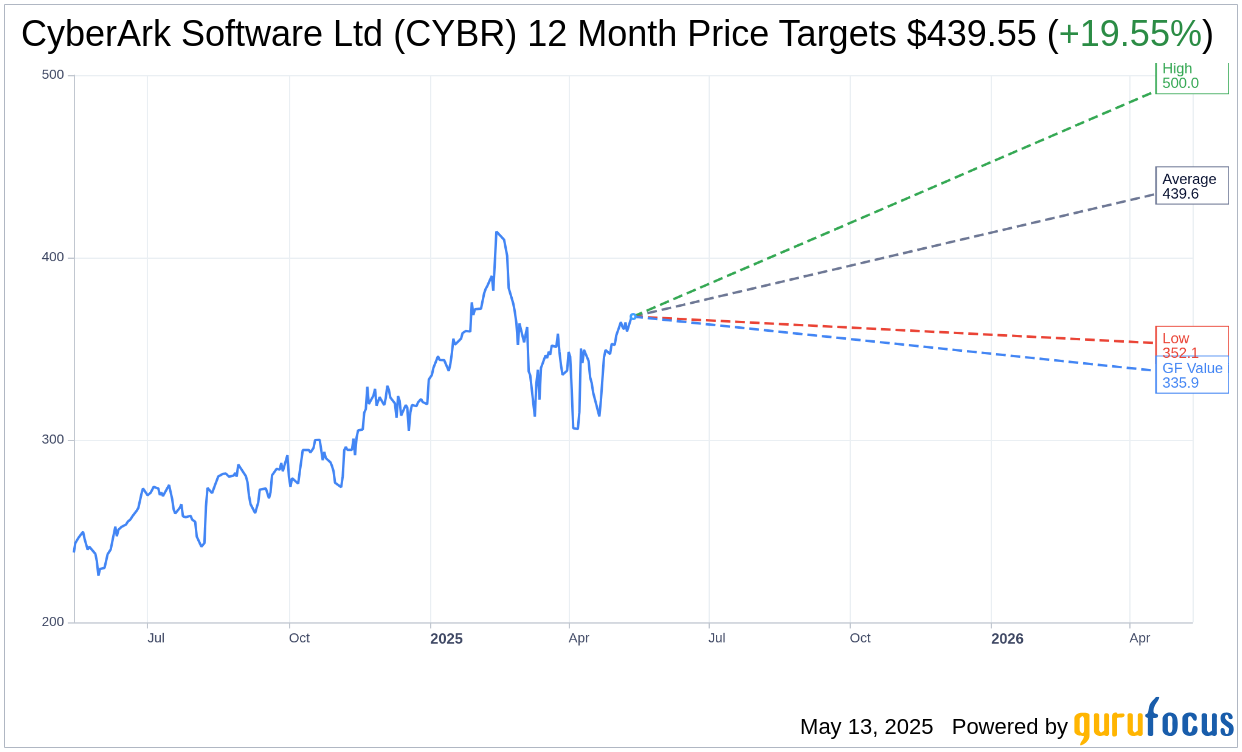

Wall Street Analysts Forecast

Based on the one-year price targets offered by 35 analysts, the average target price for CyberArk Software Ltd (CYBR, Financial) is $439.55 with a high estimate of $500.00 and a low estimate of $352.11. The average target implies an upside of 19.55% from the current price of $367.66. More detailed estimate data can be found on the CyberArk Software Ltd (CYBR) Forecast page.

Based on the consensus recommendation from 38 brokerage firms, CyberArk Software Ltd's (CYBR, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for CyberArk Software Ltd (CYBR, Financial) in one year is $335.85, suggesting a downside of 8.65% from the current price of $367.66. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the CyberArk Software Ltd (CYBR) Summary page.

CYBR Key Business Developments

Release Date: February 13, 2025

- Annual Recurring Revenue (ARR): Exceeded $1 billion, reaching $1.169 billion, including $166 million from Venafi.

- Revenue: Total revenue for Q4 was $314.4 million, with $47 million contributed by Venafi.

- Subscription Revenue: Reached $243 million, representing 77% of total revenue, with $41 million from Venafi.

- Operating Margin: Increased to 19% for Q4, with an organic margin of about 16%.

- Free Cash Flow: Record $221 million for 2024, with a 22% margin, including $15 million from Venafi.

- Net Income: $40.4 million or $0.80 per diluted share for Q4.

- Geographic Revenue Growth: Americas grew 17%, EMEA 26%, and APJ 19% year-over-year organically.

- New Logos: 346 new logos signed in Q4, totaling 1,013 for the full year.

- Employee Count: Approximately 3,800 employees worldwide, including 400 from Venafi.

- Zilla Acquisition: Acquired for $165 million in cash and $10 million in earnout, with $5 million ARR and over 125 customers.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- CyberArk Software Ltd (CYBR, Financial) surpassed the $1 billion ARR milestone, demonstrating strong growth and market presence.

- The company achieved a significant increase in operating margin to 15% and generated $221 million in free cash flow for 2024.

- CyberArk's acquisition of Zilla Security is expected to enhance its identity governance capabilities, offering faster deployment and integration compared to legacy systems.

- The integration of Venafi has been accretive to CyberArk's financial performance, contributing significantly to ARR and revenue growth.

- CyberArk's unified identity security platform is gaining traction, with customers increasingly adopting multiple solutions across the platform, leading to larger deal sizes and new customer acquisitions.

Negative Points

- There are concerns about the complexity and integration challenges associated with the recent acquisitions of Venafi and Zilla Security.

- The company faces a competitive landscape with other vendors offering stitched-together solutions, which may challenge CyberArk's unified platform approach.

- The conversion of maintenance ARR to subscription ARR is progressing slowly, indicating potential challenges in transitioning existing customers.

- CyberArk's guidance for 2025 includes a $6 million FX headwind, which could impact financial performance.

- There is uncertainty regarding federal government spending, which could affect CyberArk's revenue from government contracts.