Morgan Stanley has increased its price target for Keysight Technologies (KEYS, Financial) from $156 to $180, while maintaining an Overweight rating. The firm anticipates a modest revenue increase, consistent with previous quarters, and expects orders to align closely with revenues in fiscal Q2. Analysts believe the cautious outlook for fiscal year 2025 could lead to potential earnings revisions, presenting an opportunity for the company.

Wall Street Analysts Forecast

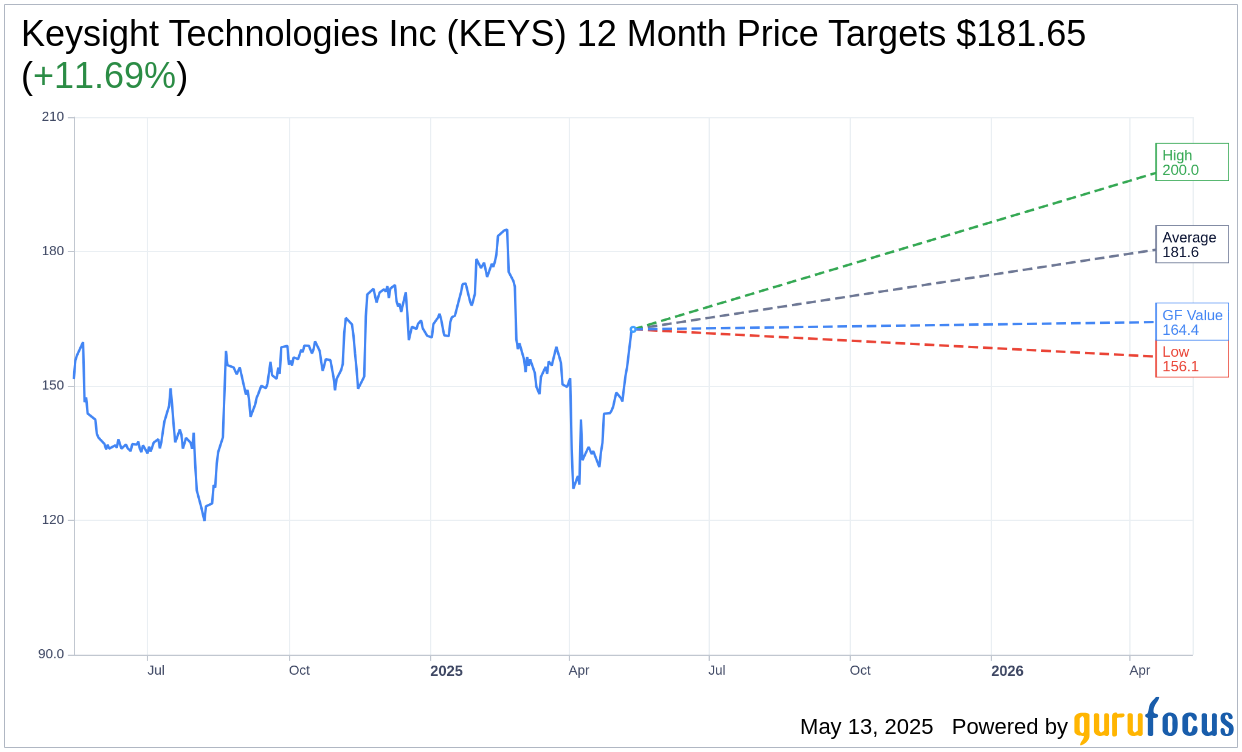

Based on the one-year price targets offered by 11 analysts, the average target price for Keysight Technologies Inc (KEYS, Financial) is $181.65 with a high estimate of $200.00 and a low estimate of $156.12. The average target implies an upside of 11.69% from the current price of $162.63. More detailed estimate data can be found on the Keysight Technologies Inc (KEYS) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, Keysight Technologies Inc's (KEYS, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Keysight Technologies Inc (KEYS, Financial) in one year is $164.36, suggesting a upside of 1.06% from the current price of $162.63. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Keysight Technologies Inc (KEYS) Summary page.

KEYS Key Business Developments

Release Date: February 25, 2025

- Revenue: $1.298 billion, up 3% year-over-year.

- Earnings Per Share (EPS): $1.82, exceeding guidance.

- Orders: $1.263 billion, up 4% year-over-year.

- Gross Margin: 65.8%.

- Operating Expenses: $500 million, up 2% year-over-year.

- Operating Margin: 27%.

- Net Income: $317 million.

- Communication Solutions Group Revenue: $883 million, up 5% year-over-year.

- Electronic Industrial Solutions Group Revenue: $415 million, down 1% year-over-year.

- Cash and Cash Equivalents: $2 billion.

- Cash Flow from Operations: $378 million.

- Free Cash Flow: $346 million.

- Share Repurchase: 450,000 shares at an average price of $167, totaling $75 million.

- Backlog: $2.3 billion.

- Q2 Revenue Outlook: $1.270 billion to $1.290 billion.

- Q2 EPS Outlook: $1.61 to $1.67.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Keysight Technologies Inc (KEYS, Financial) delivered strong first-quarter results with revenue of $1.3 billion and earnings per share of $1.82, both exceeding the high end of guidance.

- Orders grew year over year for the second consecutive quarter, up 4% to $1.3 billion, indicating positive sales funnel and customer engagement.

- The Communications Solutions Group saw a 5% revenue growth, driven by strong demand in wireline and stability in wireless, as well as growth in aerospace defense and government.

- Keysight Technologies Inc (KEYS) is well-positioned for future growth, with strong customer trust and engagement in delivering market-leading products and solutions.

- The company has made strategic progress in growing software and services, which accounted for approximately 40% of revenue, indicating a successful transformation towards a software-centric model.

Negative Points

- Revenue for the Electronic Industrial Solutions Group was down 1%, reflecting mixed demand across end markets, particularly in automotive and general electronics.

- The smartphone supply chain remains muted, affecting the wireless business despite stability in other areas.

- Ongoing continuing resolutions have led to a decrease in orders in the aerospace defense and government sectors.

- The macro environment remains mixed, with uncertainties stemming from potential US policy actions, impacting the company's outlook.

- Operating expenses increased by 2% year over year, and the company anticipates further sequential increases in OpEx, which could impact profitability.