Carrier Global (CARR, Financial) has revealed a plan to boost its U.S. operations with a $1 billion investment over the next five years. This increased funding is set to create around 4,000 skilled jobs in research and development, manufacturing, and field services, enhancing its current commitments. The investment aims to expand existing facilities and build a modern manufacturing plant to produce key components for heat pumps and battery assemblies, vital for Carrier’s Home Energy Management System.

The initiative will drive advancements in liquid cooling for data centers and battery-driven climate solutions under Carrier Energy, the company’s innovative internal start-up focused on improving home energy efficiency and enhancing grid flexibility. Part of this investment includes Carrier’s TechVantage program, launched earlier this year, which plans to recruit 1,000 U.S. service technicians and train over 100,000 professionals in climate solutions service and sales within the same five-year period. This strategy is designed to develop the necessary workforce to install and maintain high-performance climate systems.

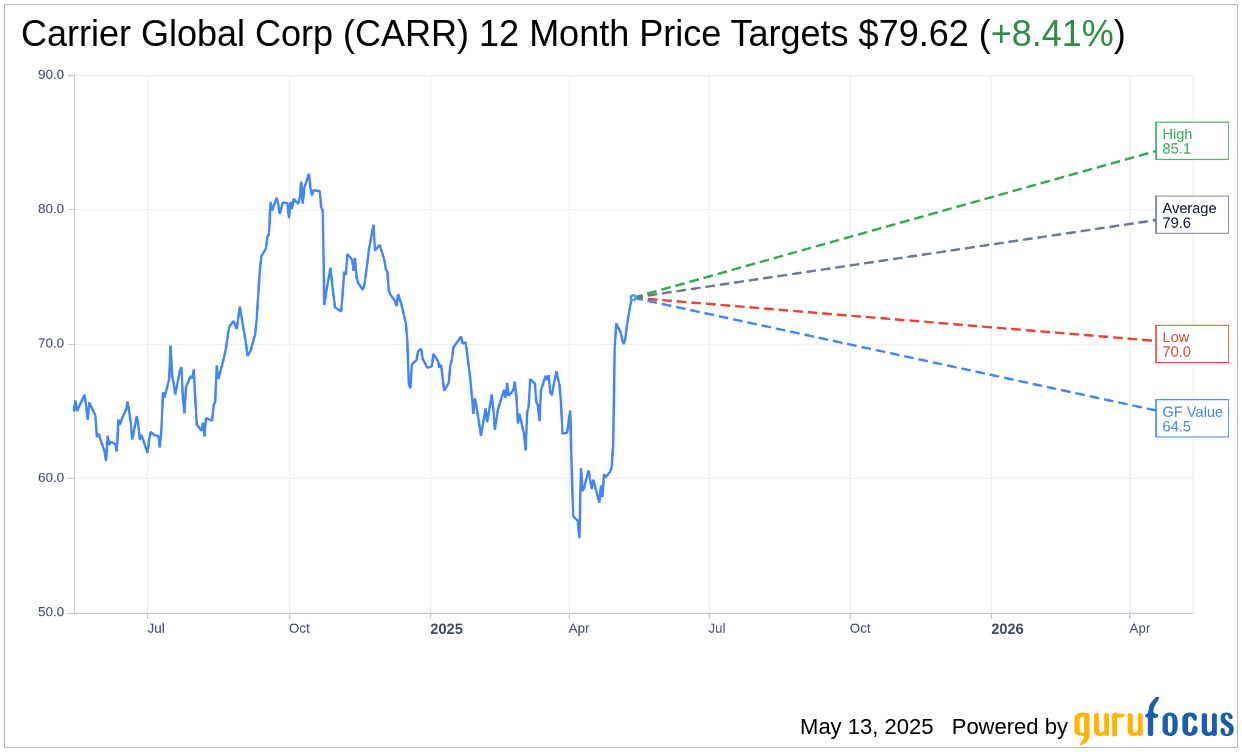

Wall Street Analysts Forecast

Based on the one-year price targets offered by 21 analysts, the average target price for Carrier Global Corp (CARR, Financial) is $79.62 with a high estimate of $85.12 and a low estimate of $70.00. The average target implies an upside of 8.41% from the current price of $73.44. More detailed estimate data can be found on the Carrier Global Corp (CARR) Forecast page.

Based on the consensus recommendation from 26 brokerage firms, Carrier Global Corp's (CARR, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Carrier Global Corp (CARR, Financial) in one year is $64.46, suggesting a downside of 12.23% from the current price of $73.44. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Carrier Global Corp (CARR) Summary page.

CARR Key Business Developments

Release Date: May 01, 2025

- Revenue: Reported sales of $5.2 billion with 2% organic sales growth.

- Adjusted EPS: $0.65, up 27% year-over-year.

- Free Cash Flow: $420 million.

- Shareholder Returns: $1.5 billion returned through dividends and share repurchases.

- Debt Reduction: Paid down $1.2 billion in debt.

- CSA Segment Organic Sales Growth: 9%.

- Adjusted Operating Margin Expansion: 210 basis points compared to last year.

- Full Year Adjusted EPS Guidance: Increased to $3 to $3.10, up about 20% year-over-year.

- Organic Orders Growth: Up high single digits.

- Backlog Increase: Total company backlog up about 10% year-over-year and 15% sequentially.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Carrier Global Corp (CARR, Financial) reported a strong start to 2025 with orders up high single digits and double-digit growth in Climate Solutions, Europe, and Transportation.

- The company achieved 27% adjusted EPS growth on 2% organic growth, with a free cash flow of $420 million.

- Carrier Global Corp (CARR) introduced new products, such as the first air-cooled commercial heat pump in Europe, enhancing energy efficiency and operational performance.

- The aftermarket segment showed robust growth, with commercial HVAC aftermarket up about 10% and margin upgrades growing by 20%.

- Carrier Global Corp (CARR) increased its full-year adjusted EPS guidance to $3 to $3.10, reflecting a 20% year-over-year increase.

Negative Points

- The Climate Solutions segment in Asia, Middle East, and Africa underperformed, with organic sales down 6% due to weakness in residential China and parts of Southeast Asia.

- Light Commercial sales were lower than expected, down around 35%, impacting the overall sales outlook.

- The residential and light commercial business in Europe saw a 10% decline in organic sales, although it is expected to return to modest growth in the second quarter.

- Carrier Global Corp (CARR) faces a $300 million tariff exposure, which it plans to offset through pricing strategies.

- The company's legacy residential light commercial business in Europe is operating with low single-digit margins, indicating room for improvement.