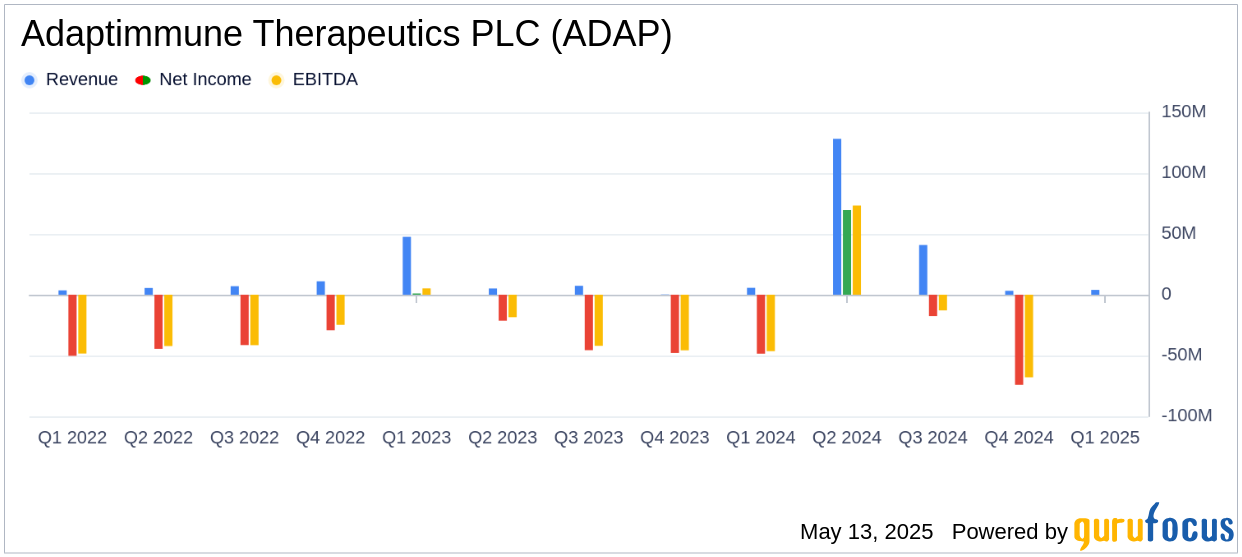

Adaptimmune Therapeutics PLC (ADAP, Financial) released its 8-K filing on May 13, 2025, detailing its financial performance for the first quarter ended March 31, 2025. The company, known for its innovative cell therapies targeting solid tumor cancers, reported $4 million in net sales from its newly launched product, Tecelra, and provided a full-year sales guidance of $35-$45 million for the product.

Company Overview and Strategic Developments

Adaptimmune Therapeutics PLC is a commercial-stage biopharmaceutical company focused on redefining cancer treatment through cell therapies. The company has developed a proprietary platform to identify cancer targets, engineer T-cell receptors, and produce therapeutic candidates. Its key programs include MAGE-A4 SPEAR T-cell therapy and NY-ESO SPEAR T-cell, among others.

Performance and Challenges

In Q1 2025, Adaptimmune reported $4 million in Tecelra sales, falling short of the estimated revenue of $6.17 million. Despite this, the company is optimistic about Tecelra's growth, with 28 Authorized Treatment Centers (ATCs) now operational and a 100% manufacturing success rate. The company plans to expand to approximately 30 ATCs by year-end, which could bolster future sales.

Financial Achievements and Industry Impact

The launch of Tecelra marks a significant milestone for Adaptimmune, as it is the first commercial product in its sarcoma franchise. The company's ability to invoice 14 doses and aphrese 21 patients in Q1 2025 demonstrates its operational capabilities and potential for growth in the cell therapy market. This progress is crucial for Adaptimmune as it positions itself as a leader in the biotechnology industry.

Key Financial Metrics

Adaptimmune's total liquidity stood at $60 million as of March 31, 2025. This liquidity is a critical measure of the company's financial health, providing insight into its ability to sustain operations and invest in future growth. The company's ongoing cost reduction measures and strategic options are aimed at addressing the substantial doubt about its ability to continue as a going concern, as disclosed in its 2024 Annual Report.

Commentary and Future Outlook

Adrian Rawcliffe, Adaptimmune's Chief Executive Officer, stated, "The launch of Tecelra continues to rapidly accelerate, as evidenced by all launch metrics. The shape of the pipeline of patients being tested and apheresed continues to support a robust acceleration of sales in Q2 and the second half of the year."

Analysis and Conclusion

While Adaptimmune's Q1 2025 revenue fell short of expectations, the strong momentum in Tecelra's launch and the company's strategic initiatives provide a positive outlook for future growth. The company's focus on expanding its ATC network and maintaining high manufacturing success rates are key factors that could drive revenue growth in the coming quarters. However, the company's financial stability remains a concern, necessitating careful management of liquidity and strategic planning to ensure long-term success.

Explore the complete 8-K earnings release (here) from Adaptimmune Therapeutics PLC for further details.