Key Highlights:

- Nvidia (NVDA, Financial) is strategically positioned to benefit from new AI chip supply agreements in the Middle East.

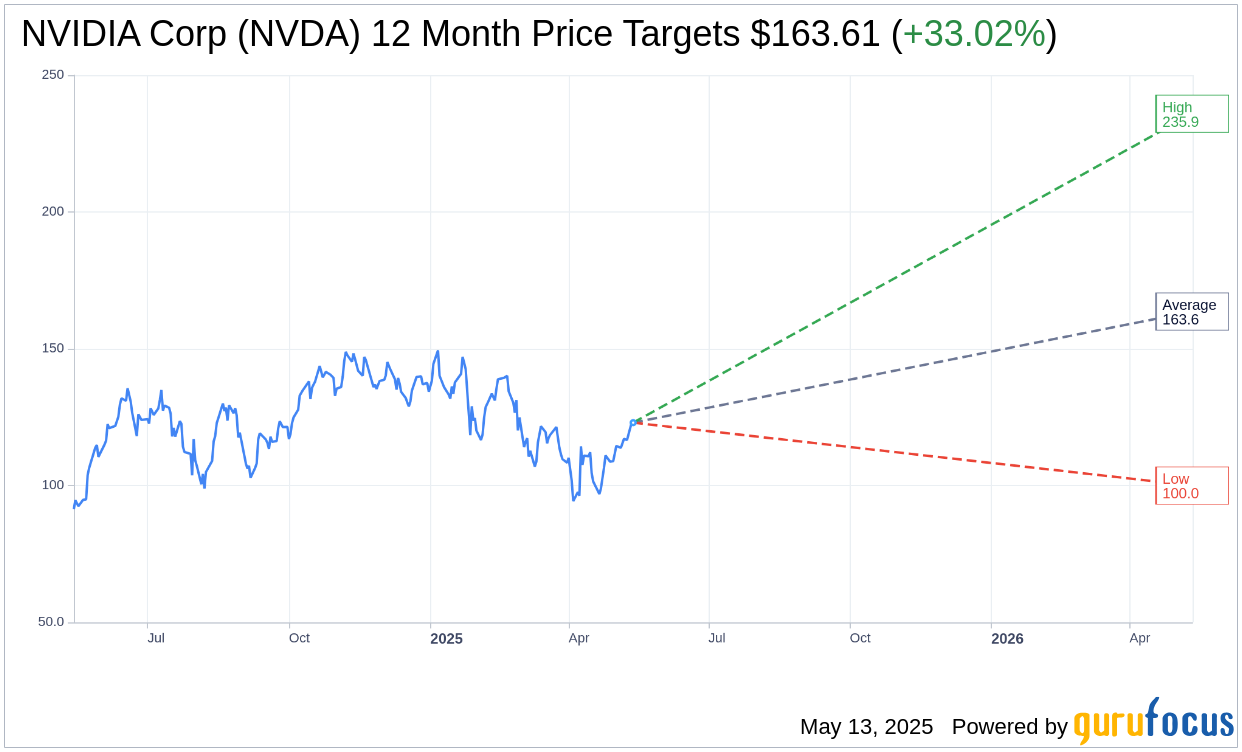

- Wall Street analysts project significant upside potential for Nvidia, with a one-year price target averaging $163.61.

- The GF Value estimate indicates a possible 116.66% upside, suggesting Nvidia may be undervalued at the current price.

Nvidia's Strategic Opportunities in the Middle East

Nvidia (NASDAQ: NVDA) is on the cusp of expanding its market reach, tapping into lucrative opportunities by potentially supplying AI chips to Middle Eastern companies. The U.S. administration's move towards forging agreements with UAE-based G42 and Saudi's Humain could catalyze Nvidia's growth, aligning with ongoing discussions about easing export controls on AI technology. This strategic positioning presents a promising landscape for Nvidia and its industry peers.

Wall Street Analysts' Insights

Analysts have set their sights on Nvidia's growth potential, with one-year price targets from 51 experts suggesting an average of $163.61. This reflects a considerable upside of 33.02% from its current trading price of $123.00, with estimates ranging from a high of $235.92 to a low of $100.00. For those seeking deeper insights, further statistics are accessible on the NVIDIA Corp (NVDA, Financial) Forecast page.

Brokerage Recommendations

The consensus among 64 brokerage firms rates Nvidia Corp (NVDA, Financial) at an average of 1.8, signifying an "Outperform" status. This rating, on a scale of 1 to 5—where 1 indicates a Strong Buy and 5 a Sell—highlight investors' confidence in Nvidia's prospects in the current market scenario.

Evaluating Nvidia's GF Value

GuruFocus' proprietary metrics suggest the GF Value for Nvidia Corp (NVDA, Financial) in one year stands at $266.49. This estimate forecasts an eye-catching upside of 116.66% from its current price of $123.00, positing that the stock may currently be undervalued. The GF Value is a projection of the fair market value, calculated by reviewing historical trading multiples, past business growth, and future performance estimates. Detailed analytics are available on the NVIDIA Corp (NVDA) Summary page.