Key Takeaways:

- CyberArk (CYBR, Financial) reported a strong Q1 performance, with notable earnings and revenue growth.

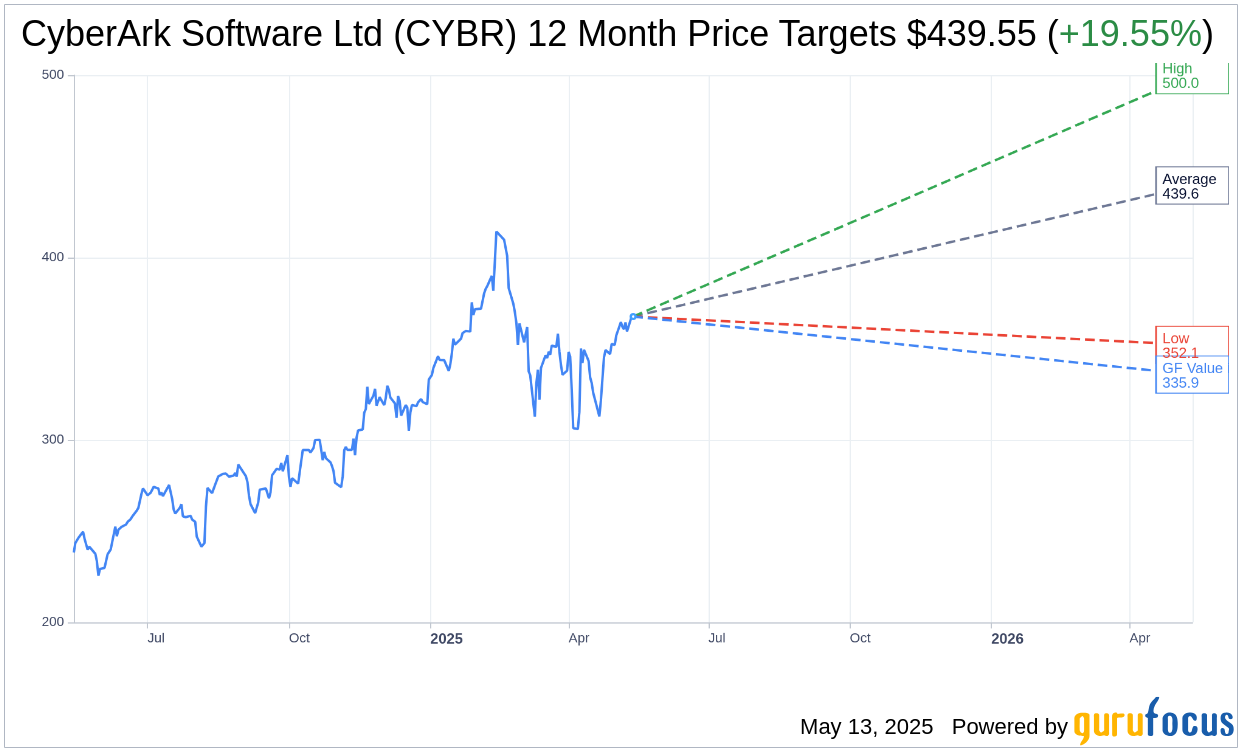

- Analysts predict a potential 19.55% upside from the current stock price.

- Despite high optimism, GuruFocus suggests a possible future downside based on historical valuations.

CyberArk Software Ltd (NASDAQ: CYBR) recently announced its financial results for the first quarter, showcasing impressive growth and earnings that exceeded market expectations.

Strong Q1 Financial Performance

CyberArk reported a Q1 Non-GAAP EPS of $0.98, beating analyst estimates by $0.19. The company's revenue surged to $317.6 million, marking a significant 43.3% increase year-over-year and exceeding expectations by $12.02 million. A standout highlight was the substantial growth in subscription revenue, which soared by 60% year-over-year, totaling $250.6 million.

Analysts' Perspective on CyberArk

According to forecasts from 35 Wall Street analysts, the average target price for CyberArk stands at $439.55. Price targets range from a high of $500.00 to a low of $352.11. The average target indicates a potential upside of 19.55% from the current trading price of $367.66. Investors can find more detailed estimates on the CyberArk Software Ltd (CYBR, Financial) Forecast page.

The consensus among 38 brokerage firms rates CyberArk as an "Outperform," with an average recommendation score of 1.7. The rating scale ranges from 1 (Strong Buy) to 5 (Sell), with CyberArk receiving favorable outlooks from analysts.

GuruFocus Valuation Insights

Despite the optimistic forecasts, GuruFocus presents a conservative valuation perspective. The estimated GF Value for CyberArk in one year is $335.85, suggesting a potential downside of 8.65% from the current price of $367.66. The GF Value is calculated based on historical trading multiples, along with past and projected business performance. For more valuation details, visit the CyberArk Software Ltd (CYBR, Financial) Summary page.

As CyberArk navigates its financial journey, investors should weigh both the optimistic analyst predictions and the cautious valuation insights from GuruFocus. This comprehensive view will aid in making informed investment decisions.