- BrainsWay (BWAY, Financial) meets earnings expectations with a Q1 GAAP EPS of $0.02 and revenue surpassing estimates at $11.54 million.

- Significant growth reported with a 42% increase in Deep TMS system shipments year-over-year.

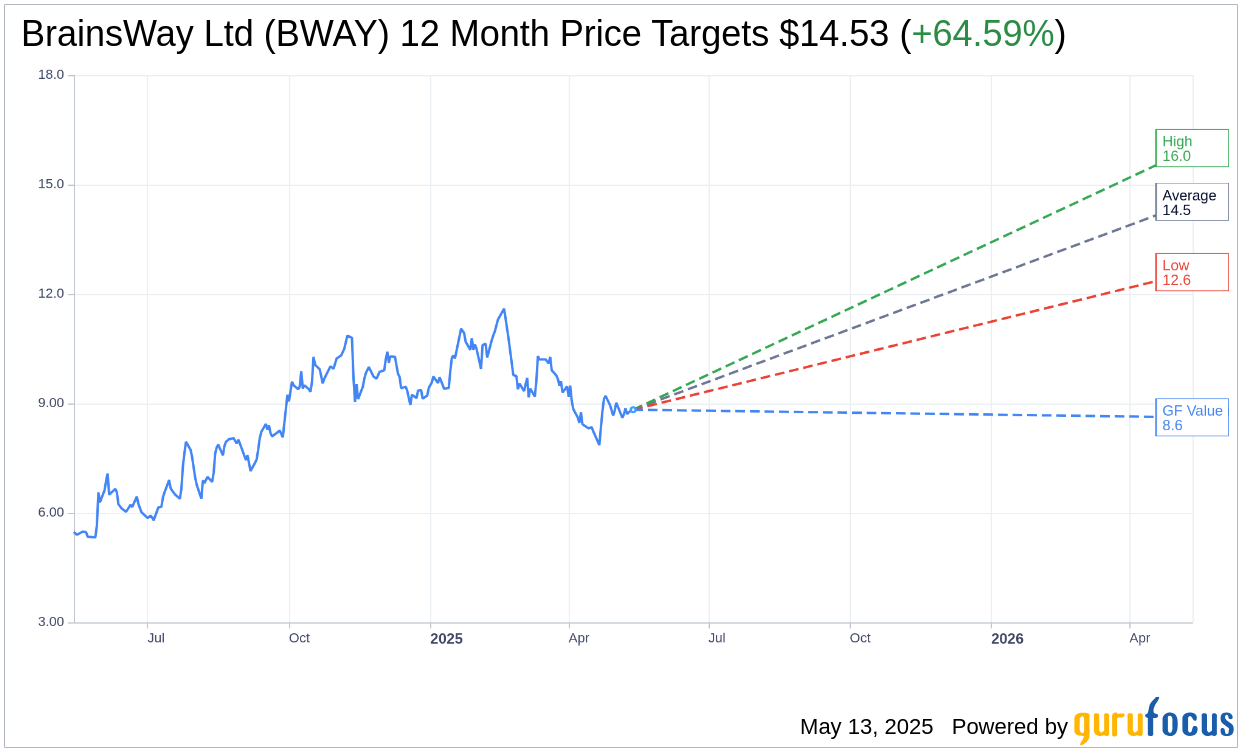

- Analysts' average price target suggests a potential 64.59% upside for BWAY shares.

BrainsWay Ltd (NASDAQ: BWAY) has recently unveiled its financial results for the first quarter, presenting a promising outlook for investors. The company recorded a Q1 GAAP EPS of $0.02, aligning with market expectations. Revenue reached $11.54 million, exceeding forecasts by $0.09 million, and demonstrating an impressive 27% growth year-over-year. Furthermore, BrainsWay successfully shipped 81 Deep TMS systems, indicating a robust 42% increase compared to the prior year. The company continues to forecast its 2025 revenue guidance, maintaining a positive trajectory.

Wall Street Analysts Forecast

Current evaluations from Wall Street analysts provide a promising outlook for BrainsWay Ltd (BWAY, Financial). Analyzing the one-year price targets from 3 analysts, the average target price is pegged at $14.53. This forecast features a high estimate of $16.00 and a low of $12.60. With the current stock price at $8.83, this suggests a substantial 64.59% potential upside. Detailed projections and data are accessible on the BrainsWay Ltd (BWAY) Forecast page.

According to consensus from 3 brokerage firms, the average recommendation for BrainsWay Ltd (BWAY, Financial) stands at 1.7, suggesting an "Outperform" rating. This rating scale operates from 1 to 5, where 1 represents a Strong Buy, and 5 denotes a sell recommendation, further highlighting the stock's potential for positive performance.

On the valuation front, GuruFocus's estimated GF Value positions BrainsWay Ltd (BWAY, Financial) at $8.62 over the upcoming year, indicating a slight downside of 2.38% from its current price of $8.83. This valuation reflects GuruFocus’s calculated fair value based on historical trading multiples, past business growth, and future performance estimates. For a more comprehensive analysis, consult the BrainsWay Ltd (BWAY) Summary page.