The investment firm UBS has revised its price target for Broadstone Net Lease (BNL, Financial), decreasing it from $18 to $17. Despite this adjustment, UBS maintains a Neutral rating for the company's shares. Analyst Michael Goldsmith led this evaluation, reflecting on the firm's outlook amid current market conditions.

Wall Street Analysts Forecast

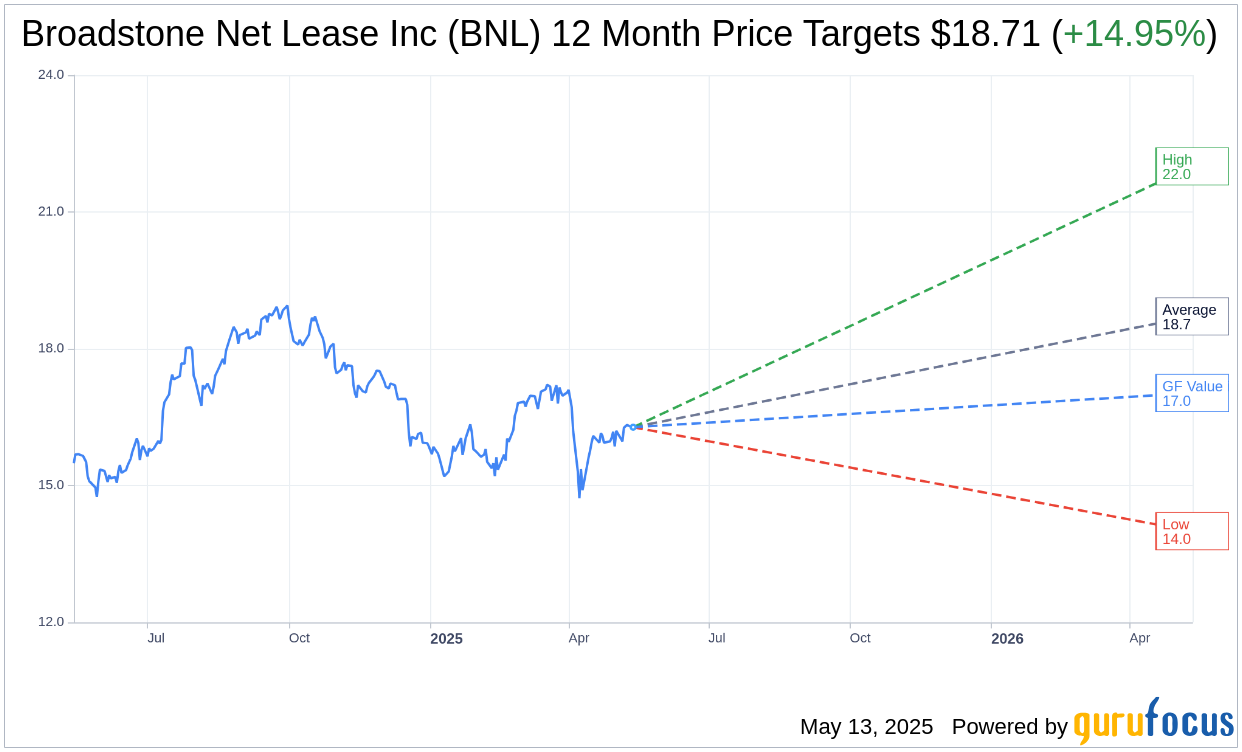

Based on the one-year price targets offered by 7 analysts, the average target price for Broadstone Net Lease Inc (BNL, Financial) is $18.71 with a high estimate of $22.00 and a low estimate of $14.00. The average target implies an upside of 14.95% from the current price of $16.28. More detailed estimate data can be found on the Broadstone Net Lease Inc (BNL) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Broadstone Net Lease Inc's (BNL, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Broadstone Net Lease Inc (BNL, Financial) in one year is $17.03, suggesting a upside of 4.61% from the current price of $16.28. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Broadstone Net Lease Inc (BNL) Summary page.

BNL Key Business Developments

Release Date: May 01, 2025

- New Property Investments: $103.9 million in new property acquisitions, build-to-suit developments, and revenue-generating CapEx year-to-date.

- Committed Build-to-Suit Developments: $305.9 million with $255.8 million remaining to be funded through Q3 2026.

- Acquisitions Under Control: $132.9 million of acquisitions under control.

- Revenue Generating CapEx Commitments: $4.5 million with existing tenants.

- Occupancy Rate: 99.1% occupancy for the first quarter.

- Rent Collection Rate: 99.1% rent collection for the first quarter.

- AFFO Guidance: Maintaining 2025 AFFO guidance range at $1.45 to $1.49 per share, approximately 3% growth at the midpoint.

- Adjusted Funds from Operations (AFFO): $71.8 million or $0.36 per share for the quarter.

- Core G&A Expenses: $7.4 million for the quarter.

- Bad Debt: 86 basis points, primarily due to non-payment from Stanislaus.

- Dividend: $0.29 per share, payable to holders of record as of June 30, 2025.

- Pro Forma Leverage: 5.0 times net debt.

- Available Credit Facility: Approximately $826 million available on the revolving credit facility.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Broadstone Net Lease Inc (BNL, Financial) reported strong first-quarter results, demonstrating disciplined execution and strategic benefits.

- The company has invested $103.9 million in new property acquisitions, build-to-suit developments, and revenue-generating CapEx year-to-date.

- BNL has a committed pipeline of $305.9 million in build-to-suit developments, with construction underway and on time, ensuring future revenue growth.

- The company maintains a high-quality, diversified portfolio with 99.1% occupancy and rent collection, showcasing resilience.

- BNL has successfully managed tenant credit matters, such as the Zip's car wash sites, with minimal bad debt impact expected for 2025.

Negative Points

- The macroeconomic environment presents risks, including potential tariffs and economic conditions that could impact consumer spending.

- BNL is closely monitoring credit risks in consumer-centric industries and healthcare properties, with some tenants on a watch list.

- The company decided to maintain its 2025 AFFO guidance due to macroeconomic uncertainty, despite positive developments.

- There is a potential impact from tariffs on manufacturing tenants, which account for 17.5% of BNL's ABR.

- The build-to-suit pipeline faces challenges from broader macroeconomic uncertainty, affecting some opportunities.