Key Highlights:

- Apollo Global Management (APO, Financial) is set to acquire a controlling stake in PowerGrid Services.

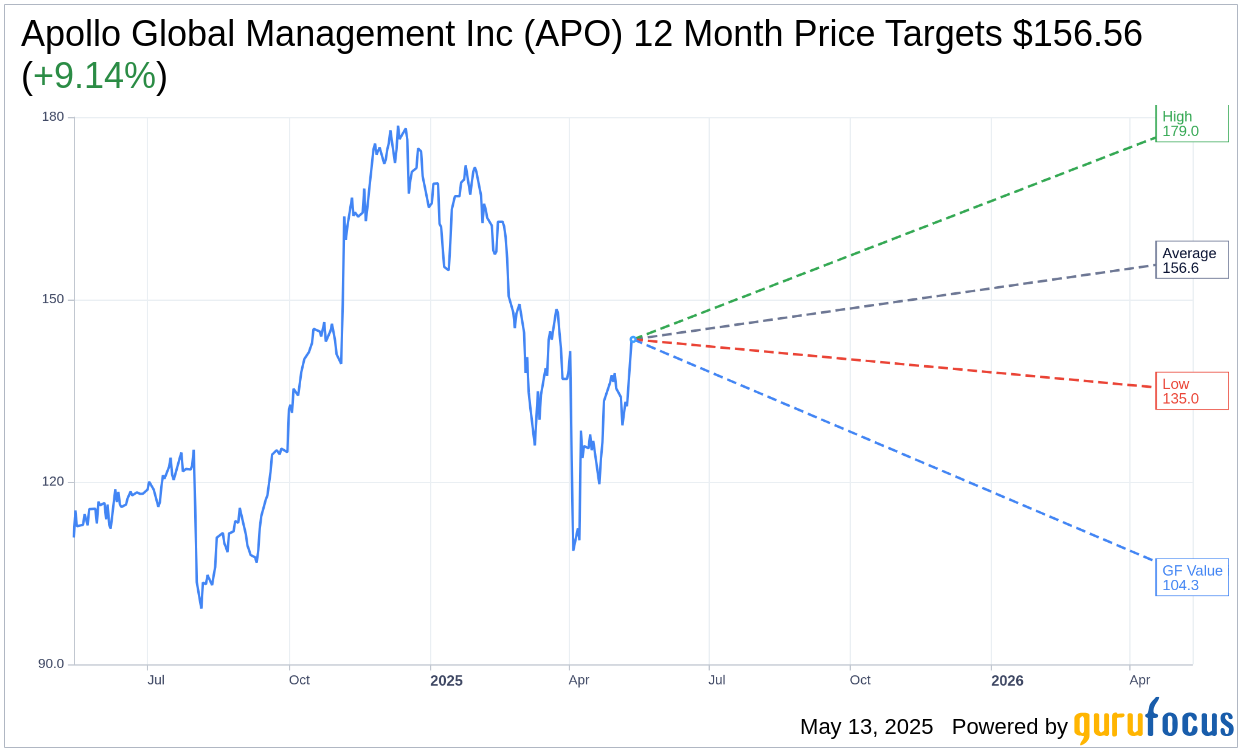

- Analysts forecast an average price target of $156.56 for APO, suggesting potential upside.

- GuruFocus estimates a GF Value for APO significantly below the current price.

Apollo Global Management Inc. (NYSE: APO) has recently disclosed plans for its funds to acquire a majority stake in PowerGrid Services, a company renowned for providing essential maintenance and construction services to U.S. electric utilities. This strategic move will see Apollo Funds collaborate closely with existing investors, including PowerGrid's management team and The Sterling Group, aiming to drive further growth and expansion.

Projected Financial Performance and Analyst Insights

According to the projections from 16 financial analysts, Apollo Global Management Inc (APO, Financial) holds an average one-year price target of $156.56. The forecasts span from a high of $179.00 to a low of $135.00, indicating an expected upside of 9.14% from its current trading price of $143.45. For more comprehensive data, visit the Apollo Global Management Inc (APO) Forecast page.

Furthermore, analyst consensus from 21 brokerage firms rates Apollo Global Management Inc (APO, Financial) with an average recommendation of 2.0, which translates to an "Outperform" status. This rating scale ranges from 1 to 5, where 1 is a Strong Buy, and 5 is a Sell.

On the flip side, the GF Value metric from GuruFocus estimates Apollo Global Management Inc (APO, Financial) to trade at $104.33 within a year, reflecting a potential downside of 27.27% relative to its current price of $143.45. The GF Value is a calculated fair value based on historical trading multiples, business growth history, and future performance forecasts. For more details, please refer to the Apollo Global Management Inc (APO) Summary page.