American Tower (AMT, Financial), through its subsidiary CoreSite, has chosen Nokia to implement an IP routing-based solution across its network. This initiative spans 30 data centers in 11 major U.S. markets. The integration of Nokia's technology aims to provide extensive scalability, enhanced performance, and increased efficiency. This upgrade will support the growing demand for cloud connectivity and interconnections, driven by the needs of artificial intelligence and high-performance computing workloads. By enhancing their infrastructure, CoreSite is set to optimize service for its nearly 40,000 customer interconnections.

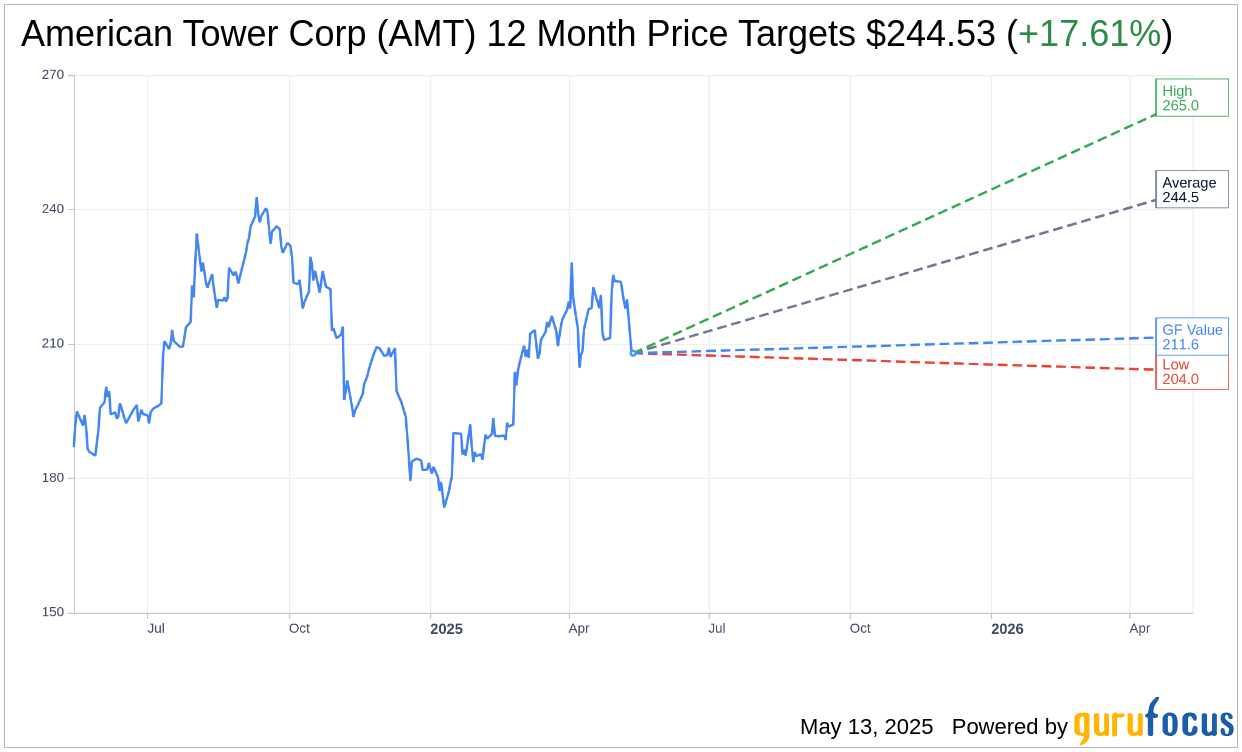

Wall Street Analysts Forecast

Based on the one-year price targets offered by 19 analysts, the average target price for American Tower Corp (AMT, Financial) is $244.53 with a high estimate of $265.00 and a low estimate of $204.00. The average target implies an upside of 17.61% from the current price of $207.92. More detailed estimate data can be found on the American Tower Corp (AMT) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, American Tower Corp's (AMT, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for American Tower Corp (AMT, Financial) in one year is $211.64, suggesting a upside of 1.79% from the current price of $207.92. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the American Tower Corp (AMT) Summary page.

AMT Key Business Developments

Release Date: April 29, 2025

- Property Revenue: Slightly positive year-over-year growth, up approximately 3% excluding noncash straight-line revenue, with a 300 basis points FX headwind.

- US and Canada Property Revenue: Declined approximately 1%, grew over 3.5% excluding noncash straight-line, with over 1% negative impact from Sprint churn.

- International Property Revenue: Roughly flat year-over-year, with approximately 8% growth excluding FX impacts.

- Data Center Business Revenue: Grew by approximately 9%.

- Consolidated Organic Tenant Billings Growth: 4.7%, supported by solid demand across the global portfolio.

- US and Canada Organic Tenant Billings Growth: 3.6%, approximately 5% excluding Sprint-related churn.

- International Organic Tenant Billings Growth: 6.7%, a modest acceleration from Q4 2024.

- Adjusted EBITDA: Grew 1.9%, over 5.5% excluding noncash straight-line impacts, with a 300 basis points FX headwind.

- Cash Adjusted EBITDA Margin: Expanded nearly 70 basis points to 68.2%.

- Attributable AFFO and AFFO per Share: Declined approximately 1% and over 1%, respectively, due to prior year contributions from the India business.

- Revised Full Year Outlook: Raised expectations for property revenue, adjusted EBITDA, attributable AFFO, and AFFO per share by $50 million, $30 million, $20 million, and $0.04, respectively, due to updated FX assumptions.

- Projected Attributable AFFO per Share: $10.44, nearly 5% growth year-over-year on an as-adjusted basis.

- Capital Expenditures: Approximately $1.7 billion, including 2,250 newly constructed sites and roughly $610 million for data center development.

- Liquidity: $11.7 billion, with low floating rate debt exposure.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- American Tower Corp (AMT, Financial) exceeded initial expectations across property revenue, adjusted EBITDA, and attributable AFFO per share for the quarter.

- The company experienced its fifth consecutive quarter of sequential increases in both application volumes and services revenue, with services revenue growing over 140% year-over-year.

- CoreSite business posted impressive results, fueled by strong leasing and continued processing favorability, adding 11 megawatts of capacity.

- AMT successfully closed the sale of its South African fiber business, marking a key step in reducing its international fiber footprint.

- The company has a strong balance sheet with enhanced financial flexibility, including $11.7 billion in liquidity and low floating rate debt exposure.

Negative Points

- AMT is closely monitoring the global economic backdrop and potential implications, including foreign exchange (FX) risks, particularly in emerging markets.

- The company is facing ongoing Sprint churn, which is expected to impact growth in the US and Canada segment for the next two quarters.

- Despite strong performance, AMT is cautious about forward-looking volatility and uncertainty, which has led to maintaining a conservative outlook.

- The international segment is experiencing low single-digit organic tenant billings growth due to ongoing churn, particularly from Oi in Latin America.

- AMT's guidance remains largely unchanged due to uncertainties in FX rates and potential macroeconomic impacts, despite a strong start to the year.