UBS has revised its price target for Methanex (MEOH, Financial), reducing it from $51 to $50. Despite this adjustment, the firm continues to rate the shares as a Buy, indicating confidence in the company's potential. This change reflects UBS's ongoing analysis and market conditions affecting Methanex. Investors are advised to consider these factors when evaluating their portfolios.

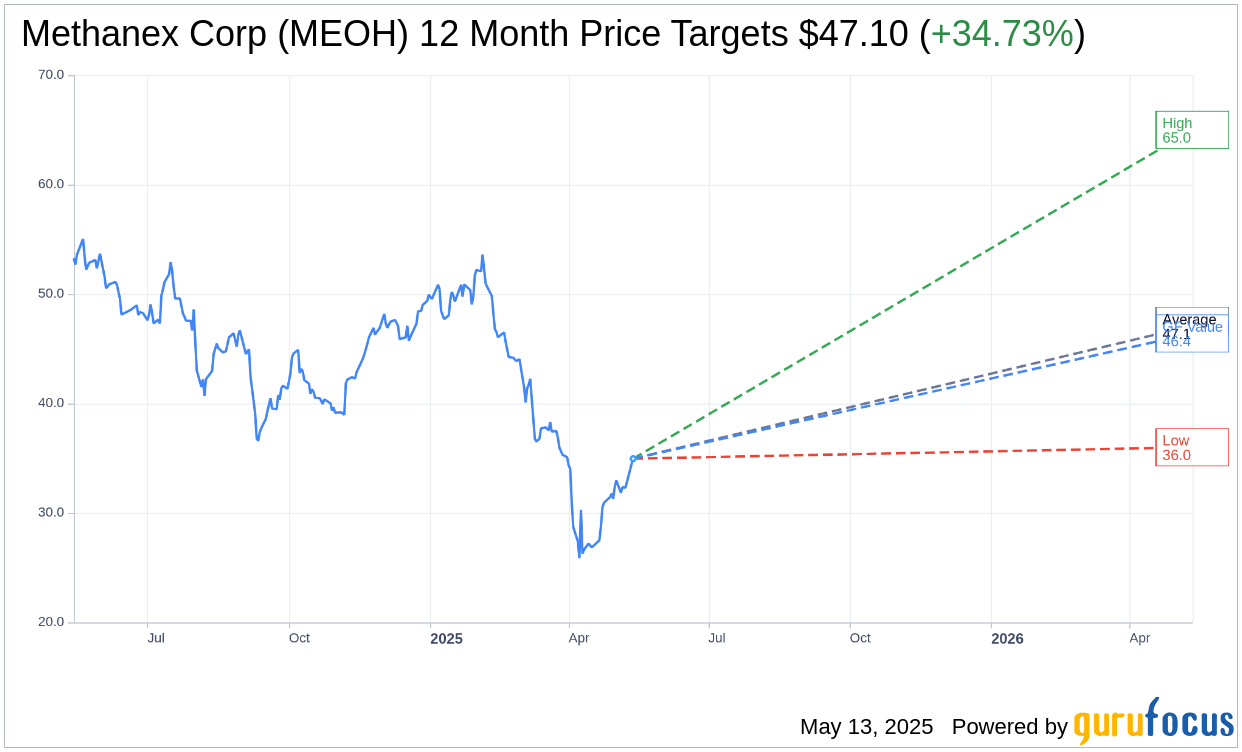

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Methanex Corp (MEOH, Financial) is $47.10 with a high estimate of $65.00 and a low estimate of $36.00. The average target implies an upside of 34.73% from the current price of $34.96. More detailed estimate data can be found on the Methanex Corp (MEOH) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Methanex Corp's (MEOH, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Methanex Corp (MEOH, Financial) in one year is $46.40, suggesting a upside of 32.72% from the current price of $34.96. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Methanex Corp (MEOH) Summary page.

MEOH Key Business Developments

Release Date: May 01, 2025

- Average Realized Price: $404 per ton.

- Produced Sales: Approximately 1.7 million tons.

- Revenue: $248 million.

- Adjusted Net Income: $1.30 per share.

- Adjusted EBITDA: Higher compared to Q4 2024.

- Cash Position: $1.031 billion.

- Undrawn Revolving Credit Facility: $500 million.

- Bond Issuance: $600 million.

- Term Loan Commitments: $650 million.

- Forecasted Average Realized Price for Q2: $360 to $370 per metric ton.

- Expected Q2 Adjusted EBITDA: Lower than Q1 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Methanex Corp (MEOH, Financial) reported a higher adjusted EBITDA compared to the fourth quarter of 2024, driven by increased average realized prices and higher produced sales.

- The company successfully restarted its G3 plant, which had been offline due to an unplanned outage, and is now operating at full rates.

- Both plants in Chile have been operating at full rates, with improved reliability and removal of technical constraints.

- Methanex Corp (MEOH) ended the first quarter with a strong financial position, holding $1.031 billion in cash and access to a $500 million undrawn revolving credit facility.

- The company is progressing with the regulatory process for the OCI acquisition, which is expected to close in Q2 2025, enhancing its asset base and financial capacity.

Negative Points

- Methanex Corp (MEOH) experienced lower methanol production in the first quarter compared to the fourth quarter, due to planned and unplanned outages in Geismar and gas curtailments in Egypt.

- The company anticipates lower adjusted EBITDA in the second quarter of 2025 due to a lower forecasted average realized price and reduced sales from the G3 outage.

- Methanol pricing in China has decreased by approximately $20 per metric ton from Q1 levels, driven by anticipated increased supply and moderation in global energy pricing.

- Gas curtailments in Egypt are expected to continue, particularly in the summer months, impacting production.

- The company is cautiously managing potential impacts of tariffs on global economic activity, which could affect methanol demand if an economic slowdown occurs.