Stifel has adjusted its price target for Xenon Pharmaceuticals (XENE, Financial), reducing it from $62 to $60, while maintaining its Buy rating on the stock. This decision follows the company's announcement regarding a minor postponement in the Phase 3 azetukalner trial data. The enrollment completion, initially anticipated for the second half of 2025, is now expected in the coming months, shifting the data readout to early 2026.

Despite this delay, the adjustment is seen as relatively minor in the broader context by the analyst. They continue to view azetukalner as a drug with significant potential, particularly in treating epilepsy, and believe it holds strong prospects for success in other therapeutic areas as well.

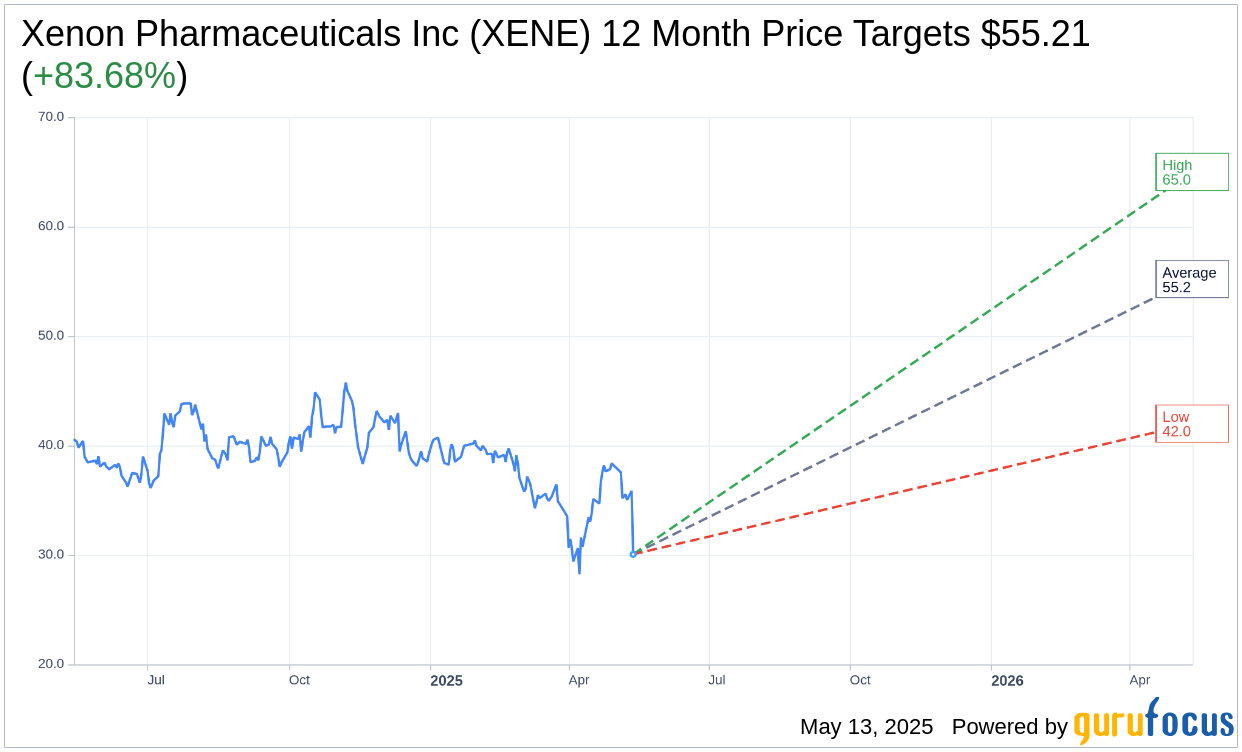

Wall Street Analysts Forecast

Based on the one-year price targets offered by 14 analysts, the average target price for Xenon Pharmaceuticals Inc (XENE, Financial) is $55.21 with a high estimate of $65.00 and a low estimate of $42.00. The average target implies an upside of 83.68% from the current price of $30.06. More detailed estimate data can be found on the Xenon Pharmaceuticals Inc (XENE) Forecast page.

Based on the consensus recommendation from 17 brokerage firms, Xenon Pharmaceuticals Inc's (XENE, Financial) average brokerage recommendation is currently 1.5, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

XENE Key Business Developments

Release Date: May 12, 2025

- Revenue: $7.5 million recognized during the first quarter from a milestone payment related to a collaboration with Neurorene.

- Cash and Cash Equivalents: $691.1 million as of March 31, 2025, compared to $754.4 million as of December 31, 2024.

- Cash Runway: Sufficient cash to fund operations into 2027 based on current operating plans.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Xenon Pharmaceuticals Inc (XENE, Financial) is nearing the end of patient recruitment for its X-TOLE2 Phase 3 epilepsy study, with top line results anticipated early next year.

- The company has a strong financial position with $691.1 million in cash and cash equivalents, expected to fund operations into 2027.

- Xenon Pharmaceuticals Inc (XENE) is expanding its clinical development work into psychiatry, with ongoing enrollment in its first Phase 3 MDD study and plans to initiate additional studies in bipolar depression.

- The company has made significant progress in its early-stage pipeline, with multiple regulatory filings expected this year to support the initiation of first-in-human trials.

- Xenon Pharmaceuticals Inc (XENE) has received positive feedback from the medical community about Azetukalner's potential to offer a novel mechanism for epilepsy treatment, with attributes such as early onset of effect and mood benefits.

Negative Points

- There is a slight delay in the X-TOLE2 study timeline compared to prior guidance, although the company remains confident in the study's conduct and quality.

- The investigator-sponsored study of Azetukalner in MDD showed numerically greater improvements but did not achieve statistical significance due to the small sample size.

- The primary endpoint of the FMRI in the investigator-sponsored study was negative, although clinical scales showed evidence of efficacy.

- Xenon Pharmaceuticals Inc (XENE) has not provided specific guidance on the timeline for topline data from its other epilepsy and depression studies, creating some uncertainty.

- The company faces competitive dynamics in the epilepsy treatment space, although it believes its novel mechanism offers a differentiated profile.