- Super Micro Computer shares rise in premarket trading on positive analyst outlook.

- Analysts provide a mixed forecast, with a significant potential upside.

- Super Micro's strategic position in AI bolsters its future growth prospects.

Super Micro Computer (SMCI, Financial) experienced a 2.1% increase in premarket trading following Raymond James' initiation of coverage with an "Outperform" rating. This optimistic view highlights Super Micro's robust position in AI-optimized infrastructure. Despite facing challenges such as tariff impacts and technological transitions, the company's growing influence in the AI sector and substantial growth potential lend support to this positive outlook.

Wall Street Analysts Forecast

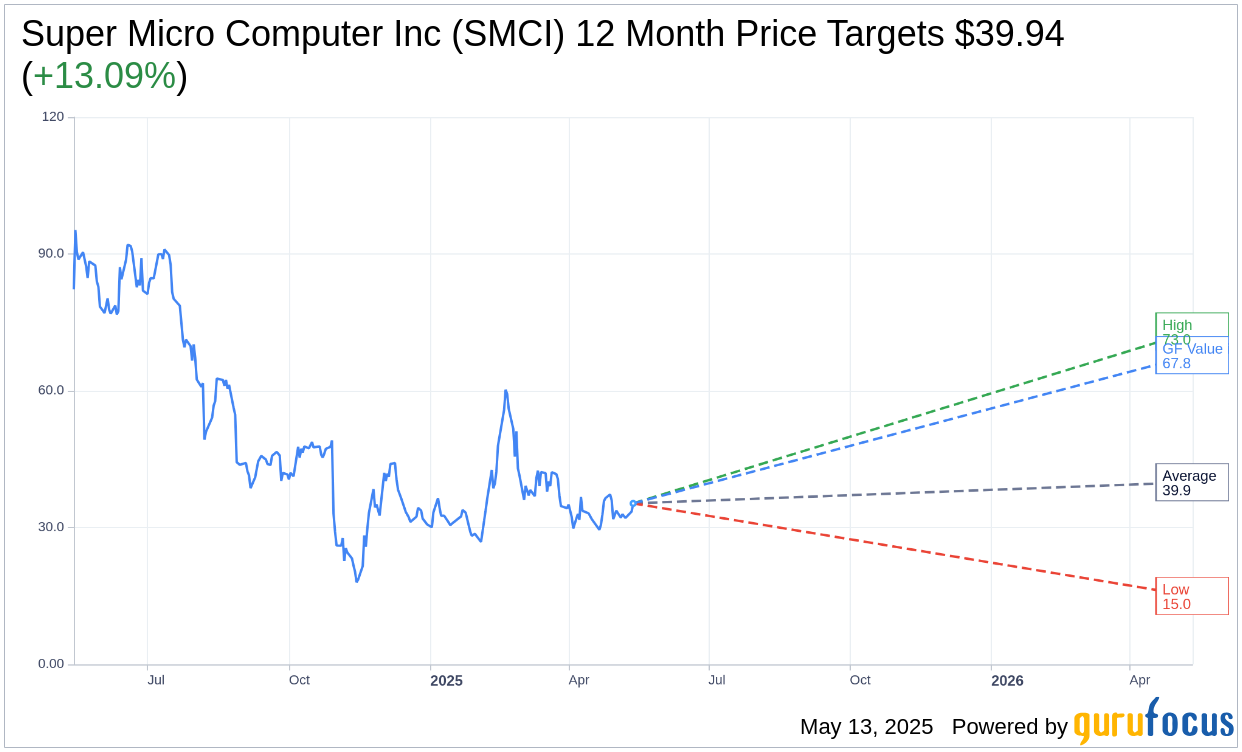

According to estimates from 14 analysts, the average one-year price target for Super Micro Computer Inc (SMCI, Financial) is $39.94. The projections include a high estimate of $73.00 and a low forecast of $15.00. This average target suggests a potential upside of 13.09% from the current stock price of $35.32. Investors seeking more detailed estimate data can visit the Super Micro Computer Inc (SMCI) Forecast page.

Brokerage Recommendations

Based on the consensus from 16 brokerage firms, the average recommendation for Super Micro Computer Inc (SMCI, Financial) currently stands at 2.8, which denotes a "Hold" status on a scale where 1 represents a Strong Buy and 5 signifies a Sell.

GuruFocus Valuation and Potential Upside

GuruFocus estimates the GF Value for Super Micro Computer Inc (SMCI, Financial) to be $67.82 in one year, indicating a considerable potential upside of 92.04% from the current price of $35.32. This GF Value is derived from the historical trading multiples of the stock, prior business growth, and future performance forecasts. For more comprehensive data, you can explore the Super Micro Computer Inc (SMCI) Summary page.