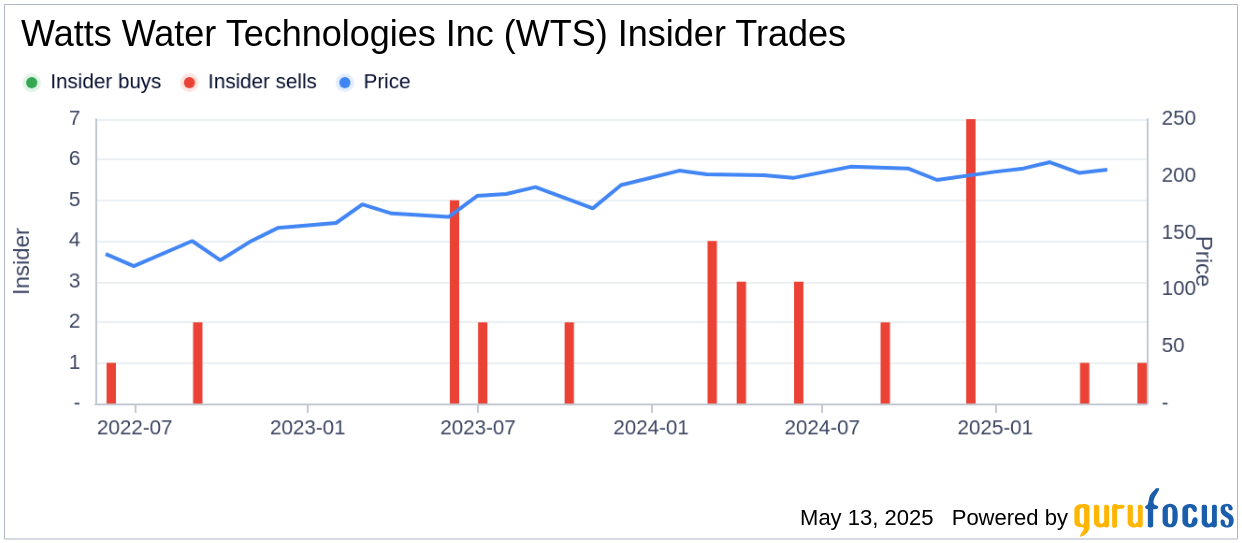

On May 12, 2025, Shashank Patel, the Chief Financial Officer of Americas & Europe at Watts Water Technologies Inc (WTS, Financial), sold 8,000 shares of the company. Following this transaction, the insider now owns 2,754 shares of the company. The transaction details can be found in the SEC Filing. Watts Water Technologies Inc is a global provider of plumbing, heating, and water quality solutions for residential, industrial, municipal, and commercial settings. The company designs, manufactures, and sells an extensive line of products to the water industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.