- Bank of America Securities upgrades CubeSmart (CUBE, Financial) to "Buy" due to promising full-year guidance.

- CubeSmart's strong presence in urban markets like New York City boosts investor confidence.

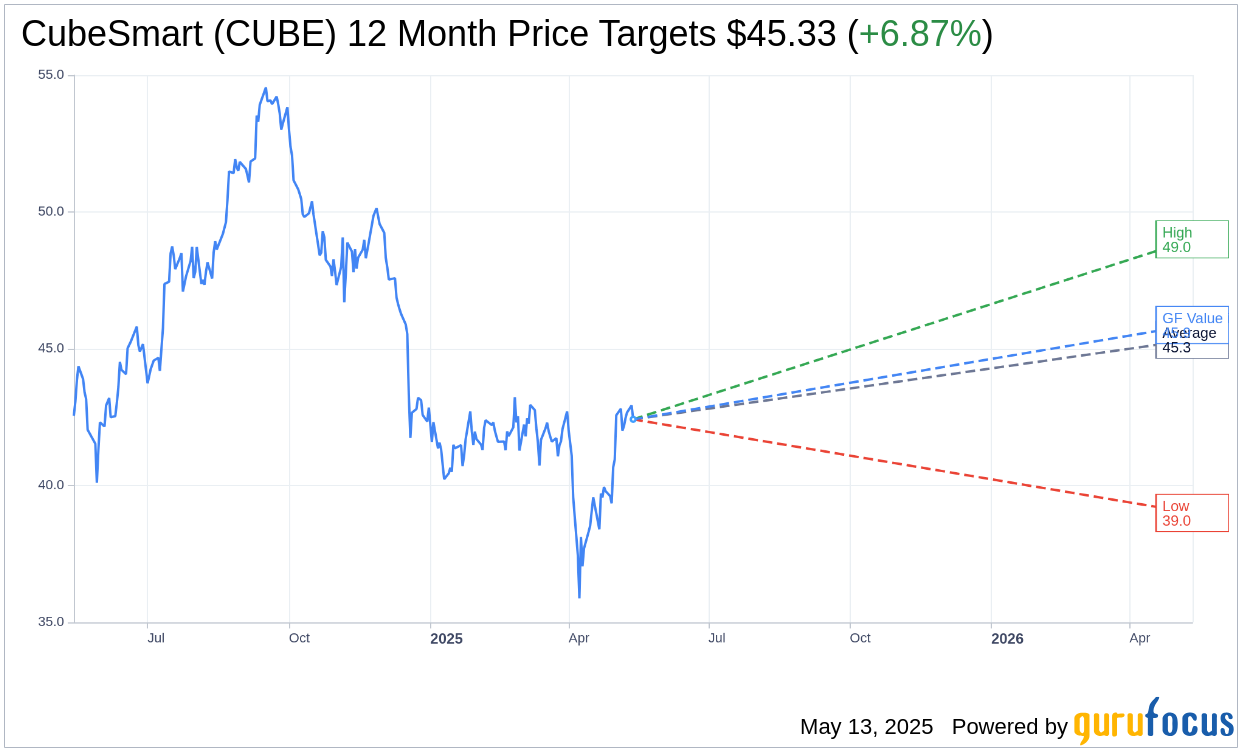

- Average analyst price target for CubeSmart indicates a potential upside of 6.87%.

Bank of America Securities has elevated CubeSmart's (CUBE) stock rating from Neutral to Buy, emphasizing the company's optimistic full-year guidance and its robust urban market presence. Recently, CubeSmart, a leader in the self-storage REIT sector, raised the lower end of its 2025 Funds From Operations (FFO) guidance. This move suggests strong confidence in its financial position amid current economic uncertainties. Furthermore, CubeSmart's substantial market exposure in thriving urban locales, such as New York City, further strengthens this positive outlook.

Wall Street Analysts Forecast

According to price target predictions from 15 analysts, the average target price for CubeSmart (CUBE, Financial) is determined to be $45.33, with estimates ranging from a high of $49.00 to a low of $39.00. This average projection suggests a potential upside of 6.87% from the current trading price of $42.42. For detailed information on these projections, visit the CubeSmart (CUBE) Forecast page.

Considering the consensus recommendation from 18 brokerage firms, CubeSmart's (CUBE, Financial) average brokerage recommendation currently stands at 2.8, indicative of a "Hold" status. The recommendation scale spans from 1, denoting a Strong Buy, to 5, indicating a Sell.

Drawing from GuruFocus estimates, the projected GF Value for CubeSmart (CUBE, Financial) over the next year is $45.87. This estimate implies an upside potential of 8.13% from the present price of $42.42. The GF Value represents GuruFocus' fair value estimation, derived from the historical trading multiples of the stock, along with past business growth and anticipated future business performance. More comprehensive data is accessible on the CubeSmart (CUBE) Summary page.