Apple (AAPL, Financial) is adding a suite of new accessibility tools—Eye Tracking, Head Tracking, Switch Control for Brain Computer Interfaces, Assistive Access, Music Haptics, Name Recognition in Sound Recognition, expanded Voice Control and Large Text CarPlay support—all designed to let users navigate iOS and Apple Vision Pro hands-free.

Eye and Head Tracking let you select and type by gazing or nodding, while the new Switch Control partners with Synchron's implantable Stentrode electrodes to read neural signals and operate your device.

Tim Cook says, “Accessibility is part of our DNA,” and this neural-interface leap could transform life for users with paralysis or ALS by unlocking tens of thousands of potential new users. Apple's partnership with Synchron taps into cutting-edge BCI work—akin to Elon Musk's Neuralink, which plans to implant its Blindsight device in 20–30 patients later this year—positioning Apple at the forefront of consumer-grade neural tech.

Beyond BCIs, Apple is simplifying TV navigation with Assistive Access and giving deaf and hard-of-hearing users Name Recognition in Sound Recognition, while Music Haptics and expanded Voice Control support widen its reach. These updates follow reports that the Wall Street Journal first broke about Switch Control's neural feature and come as Apple aims to cement its promise of “technology for everyone.”

Why it matters: By weaving brain signals into iPhone control, Apple isn't just expanding its accessibility toolkit—it's betting neural interfaces are the next consumer frontier. Investors will watch adoption metrics and any FDA feedback on the Stentrode partnership when Apple reports Q3 results later this summer.

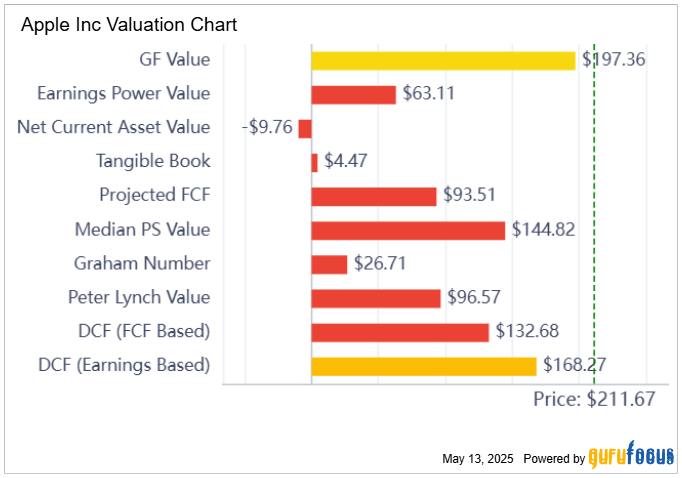

Apple's current share price of $211.67 sits well above most traditional valuation benchmarks, signaling that investors are pricing in robust growth expectations. The GuruFocus “GF Value” estimate of $197.36 comes closest to today's levels, suggesting only a slim margin of safety, while the earnings-based DCF at $168.27 and the FCF-based DCF at $132.68 offer more conservative anchors.

Metrics rooted in historical performance—like the Median PS Value of $144.82 and Peter Lynch's $96.57 figure—imply that the stock is trading at a substantial premium to its past sales and earnings power.

Measures that focus on balance-sheet strength, such as the Tangible Book at $4.47 and the negative Net Current Asset Value of –$9.76, barely register against Apple's real-world market heft.

Even the Graham Number of $26.71 and the Earnings Power Value of $63.11 point to a valuation far below where the market has placed the stock. In sum, unless Apple delivers outsized growth or margin expansion, today's price appears to rest on optimistic forecasts rather than the support of most conservative valuation frameworks.