- Western Union's stock faces pressure due to potential regulatory changes impacting profitability.

- Analysts offer mixed forecasts, but growth potential remains significant.

- GuruFocus estimates suggest a substantial upside opportunity for investors.

Western Union (WU, Financial) recently experienced a 2.5% decline in its stock value. This dip followed a proposal by Republican lawmakers to impose a 5% tax on money transfers sent abroad by undocumented individuals. If enacted, this regulation could increase operational burdens and verification responsibilities for Western Union, potentially affecting its profitability and operational costs.

Wall Street Analysts Forecast

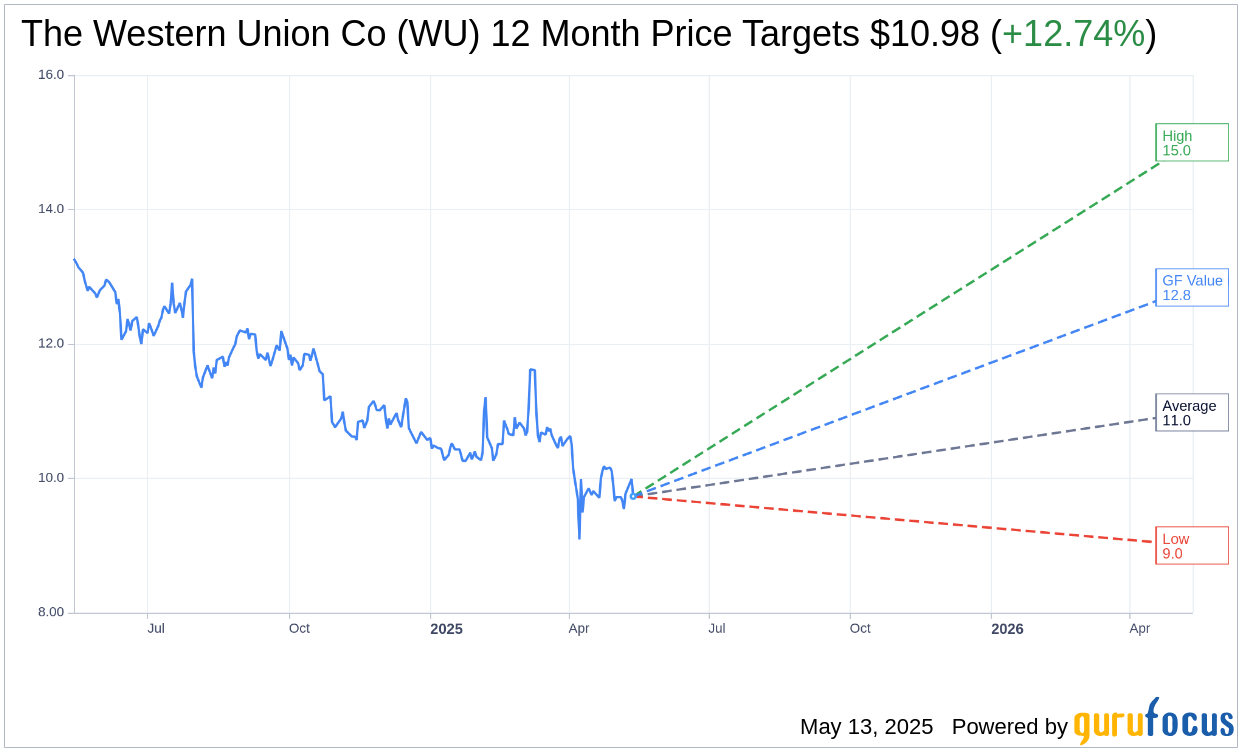

In terms of future projections, 13 analysts have provided one-year price targets for The Western Union Co (WU, Financial). The average target price stands at $10.98, with a high estimate of $15.00 and a low estimate of $9.00. This average target suggests an upside of 12.74% from the current price of $9.74. For more comprehensive estimate data, investors can visit the The Western Union Co (WU) Forecast page.

The consensus recommendation from 18 brokerage firms positions The Western Union Co (WU, Financial) at an average recommendation of 3.5, indicating a "Hold" status. The rating scale ranges from 1 (Strong Buy) to 5 (Sell).

GuruFocus Valuation Insights

According to estimates from GuruFocus, the estimated GF Value for The Western Union Co (WU, Financial) in a year's time is $12.84. This valuation suggests an impressive 31.9% upside from the current price of $9.735. The GF Value represents GuruFocus's estimate of the stock's fair market value, calculated from historical trading multiples, past business growth trends, and future business performance estimates. For more detailed data, investors can explore the The Western Union Co (WU) Summary page.

In conclusion, while Western Union faces challenges from potential regulatory changes, analyst forecasts and GuruFocus estimates highlight a significant upside potential. Investors may find value opportunities by monitoring the evolving financial landscape and considering diverse insights presented by analysts and proprietary metrics.