Key Highlights:

- AMD partners with Saudi Arabia's HUMAIN to boost AI infrastructure with a $10 billion investment.

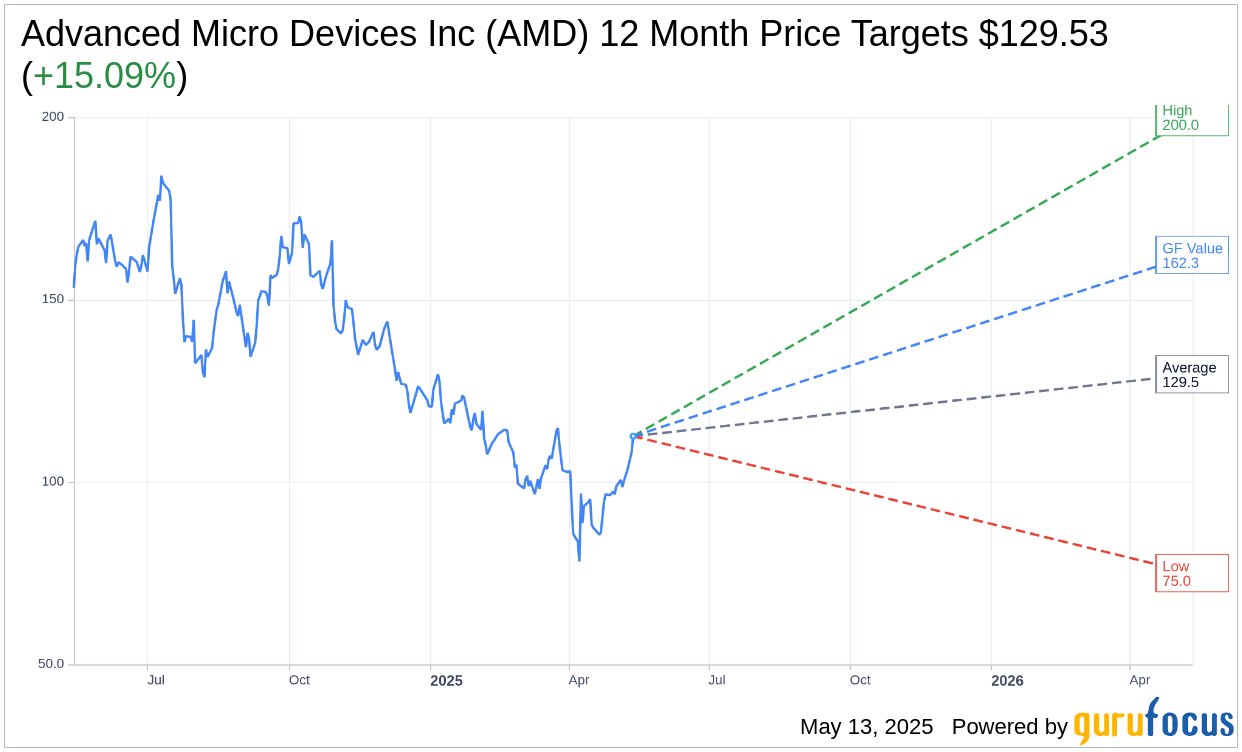

- Analysts forecast a potential 15% upside for AMD's stock, with a target price of $129.53.

- GuruFocus estimates a significant 44% upside based on GF Value projections.

Strategic Alliance with Saudi Arabia

Advanced Micro Devices (AMD, Financial) has embarked on a groundbreaking partnership with Saudi Arabia's HUMAIN, committing a substantial $10 billion investment over several years. This venture is designed to propel AI infrastructure enhancements, aiming to build 500 megawatts of AI compute capacity in the region within a five-year timeframe. Following this announcement, AMD shares experienced a nearly 4% surge, reflecting positive market reception.

Wall Street Analysts Forecast

The one-year price targets from 41 analysts foresaw Advanced Micro Devices Inc (AMD, Financial) reaching an average target price of $129.53. With estimates spanning from a high of $200.00 to a low of $75.00, the average target indicates a potential upside of 15.09% from the current stock price of $112.55. For more comprehensive estimates, visit the Advanced Micro Devices Inc (AMD) Forecast page.

Brokerage Recommendations

Among 52 brokerage firms, the consensus places Advanced Micro Devices Inc (AMD, Financial) at an average brokerage recommendation of 2.2, signifying an "Outperform" rating. This rating uses a scale from 1 to 5, where 1 denotes a Strong Buy, and 5 indicates a Sell. Such a position suggests confidence in AMD's capability to outperform its peers in the market.

GuruFocus Value Estimation

According to GuruFocus, the estimated GF Value for Advanced Micro Devices Inc (AMD, Financial) one year from now is projected at $162.26. This represents a potential 44.17% upside from the current price of $112.55. The GF Value is an estimate of the stock's fair trading value, calculated using historical multiples, past business growth, and forecasted business performance. For further insights, visit the Advanced Micro Devices Inc (AMD) Summary page.