Apollo Global Management (APO, Financial) is in discussions concerning the potential restructuring of Wolfspeed's (WOLF) substantial $6.5 billion debt, according to sources. Reports indicate that the company has hired Moelis to assist with these negotiations. Wolfspeed has recently announced that it's evaluating options for restructuring its debt, including the possibility of filing for bankruptcy or pursuing an out-of-court settlement. Apollo is identified as a significant entity in Wolfspeed’s debt hierarchy, suggesting its keen interest in the outcome of these financial negotiations.

Wall Street Analysts Forecast

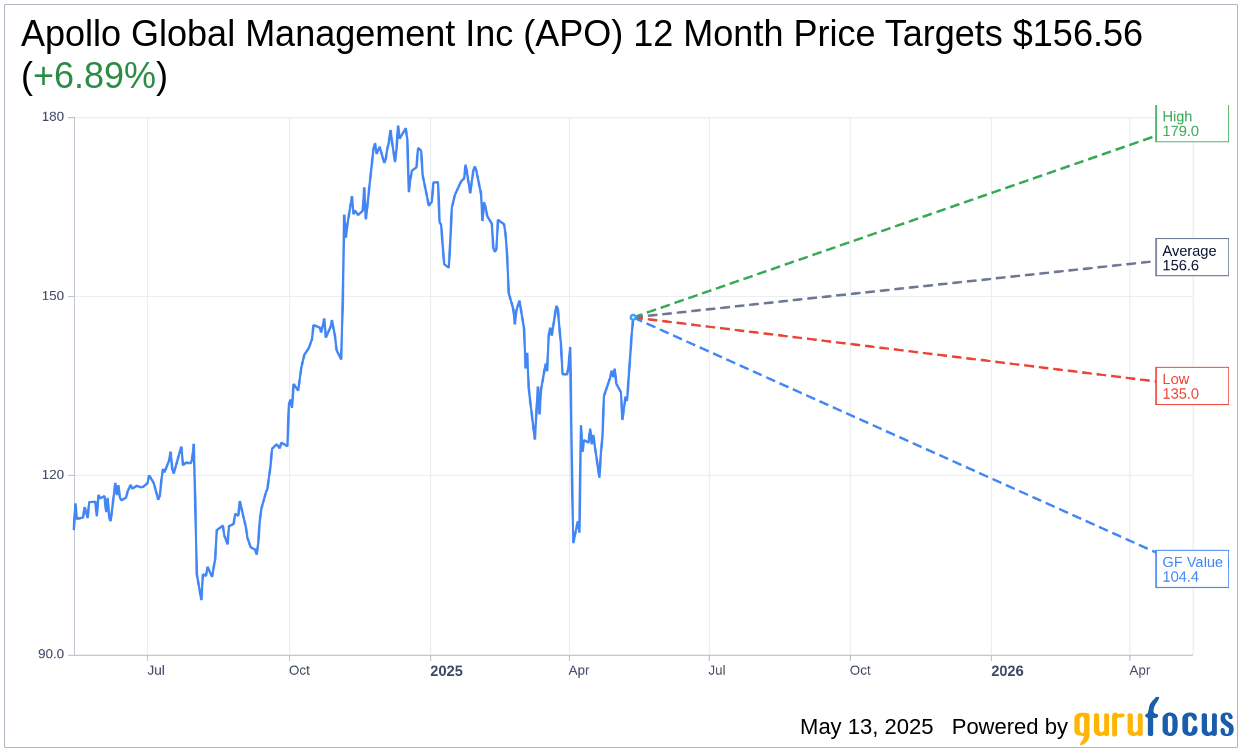

Based on the one-year price targets offered by 16 analysts, the average target price for Apollo Global Management Inc (APO, Financial) is $156.56 with a high estimate of $179.00 and a low estimate of $135.00. The average target implies an upside of 6.89% from the current price of $146.47. More detailed estimate data can be found on the Apollo Global Management Inc (APO) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Apollo Global Management Inc's (APO, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Apollo Global Management Inc (APO, Financial) in one year is $104.36, suggesting a downside of 28.75% from the current price of $146.47. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Apollo Global Management Inc (APO) Summary page.

APO Key Business Developments

Release Date: May 02, 2025

- Fee Related Earnings (FRE): $559 million, up 21% year-over-year.

- Spread Related Earnings (SRE): $826 million, excluding notable items.

- Adjusted Net Income: $1.1 billion or $1.82 per share.

- Assets Under Management (AUM): Up $785 million, a 17% increase year-over-year.

- Record Inflows: $43 billion in the quarter, including $26 billion at Athene.

- Origination Volume: $56 billion, led by platforms.

- Cash Dividend: $0.51 per share, a 10% increase from the prior quarterly run rate.

- Private Equity Fund X Net IRR: 19% at the end of the quarter.

- Global Wealth Fundraising: Nearly $5 billion in the quarter, an 85% increase year-over-year.

- Net Spread (Ex-Notables): 129 basis points, declined by 8 basis points sequentially.

- Share Repurchases: Over $700 million in the first quarter.

- Bridge Investment Group Acquisition: Announced with an equity value of approximately $1.5 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Apollo Global Management Inc (APO, Financial) reported record fee-related earnings of $559 million, marking a 21% year-over-year increase.

- The company declared a cash dividend of $0.51 per share, representing a 10% increase from the prior quarterly run rate.

- Apollo achieved record inflows of $43 billion in the quarter, with significant contributions from Athene.

- The firm demonstrated strong investment performance, particularly in private equity, with Fund X achieving a net IRR of 19%.

- Apollo's origination activity was robust, with $56 billion in assets originated during the quarter, showcasing a 30% growth year-over-year.

Negative Points

- Apollo Global Management Inc (APO) faces headwinds from competitive pressure in the retail channel, impacting net spread results.

- The company anticipates a mid-single-digit growth rate for 2025, down from previous expectations due to market-driven uncertainties.

- There is a noted increase in the cost of funds, up 28%, which is affecting the company's financial performance.

- The firm is experiencing higher asset prepayments, which are running above forecasted levels, creating additional financial challenges.

- Apollo's business is under-earning on the new business written in the quarter relative to its potential, due to current market conditions.