The Trade Desk (TTD, Financial) is a leading programmatic advertising technology company, providing a global demand-side platform that enables ad buyers to run data-driven digital campaigns across the “open internet”—channels like connected TV (CTV), online video, display, audio and more. In essence, The Trade Desk's platform allows advertisers (often via their agencies) to bid on and place ads in real time outside the walled gardens of tech giants. The company has built a reputation as the go-to independent ad buying platform, leveraging proprietary data and targeting tools to help marketers reach audiences across millions of websites and streaming apps in a unified way. This high-value niche has fueled The Trade Desk's rapid growth over the past decade and earned it a premium valuation among adtech peers.

In February 2025, however, The Trade Desk hit an uncharacteristic bump in the road. As covered in my previous article, the company reported its first earnings miss in over eight years. Fourth-quarter 2024 revenue came in at $741 million, up a solid 22% year-over-year (YoY), but slightly below management's $756 million guidance. That shortfall snapped a remarkable 33-quarter streak of meeting or beating expectations, and it sent the stock plunging 27% in after-hours trading as investors reacted with shock. In the wake of that disappointment, CEO Jeff Green struck a tone of accountability but also determination. He emphasized that The Trade Desk must continue to prove its worth, and he vowed to do exactly that by “reorganizing for growth.”

Management outlined a comprehensive plan to get The Trade Desk back on track. In late 2024, the company undertook what Jeff Green called “the largest reorganization in company history,” overhauling its operations to reignite growth. Key initiatives included restructuring client-facing teams and clarifying roles across brand and agency accounts, reorganizing the engineering department into smaller, fast-moving teams, and accelerating the product release cycle to weekly updates. The broader goal was to make The Trade Desk more responsive and scalable as it enters its next phase of growth. Additionally, Green and team rolled out a 15-point strategic growth plan with an emphasis on CTV, the company's fastest-growing channel, and other emerging opportunities. The message was clear: The Trade Desk acknowledged its execution missteps and was making bold changes to restore its growth trajectory.

That brings us to today. With the first quarter of 2025 now in the books, investors have been awaiting evidence as to whether these “reorganizing for growth” efforts are paying off. In this article, I will analyze The Trade Desk Q1 2025 earnings and business updates, examining whether the company is back on track and how the investment case has evolved since the last report.

Q1 Results & Cost Reductions

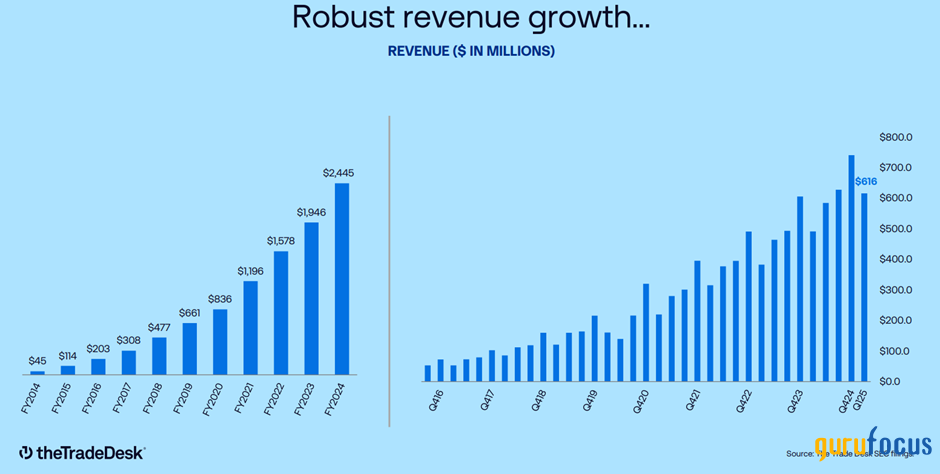

The Trade Desk's Q1 2025 results suggest that the post-miss comeback is well underway. The company delivered revenue of $616 million for the quarter, up 25% YoY. This marked not only an acceleration from the 22% YoY growth in Q4 2024 but also a solid beat relative to management's own guidance of at least $575 million. CEO Jeff Green noted that “We're encouraged by the early impact of the strategic upgrades at the company we implemented in Q4, which contributed to our outperformance”. In my view, this quarter was the first step toward restoring market confidence.

Source: The Trade Desk Investor Presentation

Profitability improved meaningfully. Although gross margin declined 210 basis points to 76.8%, operating margin expanded to 8.8%, and GAAP net income rose to $51 million, up from $32 million a year ago. Adjusted EBITDA reached $208 million with a 34% margin, while adjusted net income reached $165 million, or $0.33 per diluted share. The company accelerated growth without sacrificing profitability, an encouraging sign given the concerns around cost control following the Q4 disappointment.

Free cash flow was strong at $230 million, representing a 37% margin. Combined with revenue growth, The Trade Desk's “Rule of 40” score landed at 63. The balance sheet remains solid, with $1.7 billion in cash and no debt. While stock-based compensation (SBC) remains high at 21% of revenue, the cash position allowed The Trade Desk to repurchase shares to help mitigate dilution. Share count rose just 1% despite the SBC.

Momentum has clearly shifted. For instance, Citi analyst Ygal Arounian, who was cautious following Q4's stumble, raised his price target from $63 to $82 after the Q1 results and reiterated his Buy rating. He pointed to the 25% revenue growth and “optimistic guidance” for Q2, despite a challenging macro backdrop. One standout point in the report was Kokai, The Trade Desk's major platform upgrade, which had been cited as a potential headwind in Q4. In Q1, it turned into a tailwind, with management stating adoption was ahead of schedule and delivering performance benefits for clients.

In my opinion, this shift in Kokai's narrative is significant. The platform was introduced to push the industry forward by integrating AI across every layer of media buying, and the early signs suggest it's doing just that. Concerns about competition from Amazon's DSP also appear to have eased, at least for now, as The Trade Desk demonstrated it is holding its ground and continuing to differentiate itself.

Guidance for Q2 2025 came in at “at least $682 million” in revenue, which implies 17% YoY growth, following a tough comparison period, as Q2 2024 was impacted by political advertising. While slower than Q1, I believe this leaves room for an upside surprise. It also represents a beat relative to consensus expectations, which were about 0.8% lower. The company also guided to $259 million in adjusted EBITDA, a 38% margin at the midpoint. Jeff Green acknowledged “increased macro volatility to start the year”, but struck a confident tone for the rest of 2025. He emphasized that The Trade Desk is “well positioned to outpace the market” as marketers seek alternatives to walled gardens and embrace the open internet.

This tone, combined with the solid beat and improving fundamentals, has gone a long way toward answering the comeback question. Finally, it's worth highlighting where the growth in Q1 came from, as it sheds light on The Trade Desk's strategic positioning. CTV remained the “largest and fastest-growing advertising channel” for the company, not surprising given the secular trend of TV ad dollars moving from linear broadcasting to streaming platforms. Its deep integrations with major platforms like Netflix (NFLX, Financial), Hulu, Peacock, and others continue to drive scale. Additionally, The Trade Desk posted strong customer retention over 95%, a testament to the platform's staying power. The company also brought in a new COO, Vivek Kundra, a former Salesforce executive and the first CIO of the U.S. government, “will lead global operations and drive operational excellence” as The Trade Desk scales.

Product Reorganization

A key focus for investors this quarter was whether The Trade Desk's “reorganizing for growth” initiative has started to yield tangible results. After Q4's misstep, Jeff Green and his team initiated what they called the largest operational overhaul in company history, aiming to better align go-to-market teams, improve product cycles, and inject AI across the platform. Q1 2025 results suggest those efforts are not just in motion, but they're gaining traction.

The company restructured its engineering function into over 100 scrum teams shipping product weekly and brought product and business teams into tighter alignment. These changes enabled faster platform improvements and a more agile go-to-market approach. Kokai has now been adopted by over two-thirds of its client base, ahead of internal expectations. This early adoption has translated into meaningful campaign improvements. Clients reported a 42% reduction in cost per unique reach and over 20% improvement in cost per acquisition, unlocking new budgets and accelerating spend.

Beyond operational improvements, Jeff Green emphasized that The Trade Desk has been gaining share in an unfair market dominated by anti-competitive behavior from Big Tech. He referenced how the DOJ verdicts against Google for monopolistic practices and Spotify's legal win against Apple mark a shift toward a more level playing field. “If we've been winning in an unfair market, imagine what we can do in a fair one”, Green said. He argued that regulatory pressures are already prompting behavioral changes from walled gardens, creating space for independent players like The Trade Desk to thrive. This commentary aligns with Green's long-held thesis that an independent, objective DSP will win the lion's share of ad spend in a competitive, open internet.

That theme of independence carries into other parts of the strategy. OpenPath, a supply path optimization initiative built on direct publisher integrations that allows advertisers to connect directly with premium publishers and cut out middlemen in the ad supply chain, continues to expand. The goal is to provide more transparency and efficiency. Advertisers get better pricing and assurance of quality, while publishers potentially earn more from each impression. Major names like Warner Bros. Discovery and The Guardian joined the initiative this quarter, and results have been encouraging. The New York Post, for example, saw an eightfold increase in fill rate and nearly doubled its programmatic revenue. OpenPath gives advertisers a clearer line-of-sight into where their dollars go while enabling publishers to capture more value from impressions.

The Sincera acquisition is another step toward increasing transparency. The company plans to reintroduce it as “Open Sincera,” providing detailed visibility into auction mechanics across the ad supply chain. In a space where opacity often benefits incumbents, this transparency, if executed well, could strengthen The Trade Desk's competitive edge further.

Valuation

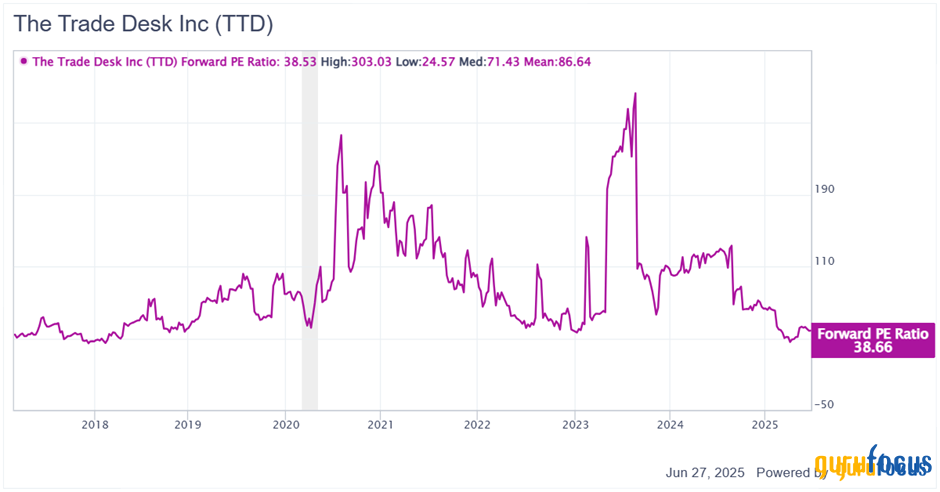

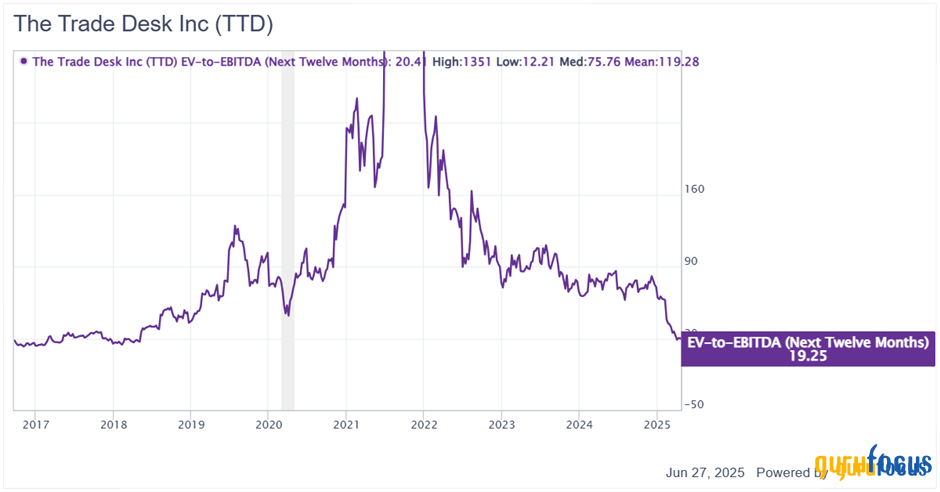

The Q1 rebound and reacceleration in growth have re-inflated The Trade Desk's valuation multiples. The stock currently trades at approximately 11× forward price-to-sales (P/S), around 39× forward price-to-earnings (P/E), and about 19× forward EV/EBITDA. These multiples are rich, but not unreasonable for a company still growing revenue at 25% with strong operating leverage and adjusted EBITDA margins above 30%.

In my view, the multiples might be expensive on an absolute level, however, relative to its historical value. The Trade Desk is trading at cheaper multiples. In my opinion, this discount reflects the market's cautious optimism as the company works to reaccelerate growth.

The forward P/E and EV/EBITDA are toward the lower end of their historical range, levels last seen around 2018. I would argue the company is in a much better position than it was seven years ago, and I believe these multiples could expand back toward their historical average. Ignoring spikes, the historical range is about 40–50× EV/EBITDA and 50–60× P/E.

Source: Author

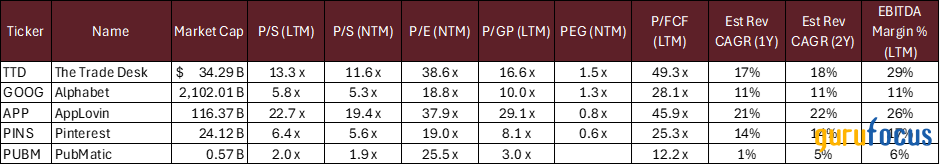

It's useful to compare The Trade Desk to other digital advertising plays to gauge relative valuation.

The Trade Desk's main competition comes from large integrated platforms like Google's (GOOG, Financial) (GOOGL, Financial) DV360, which offers advertisers deep reach into YouTube and search audiences, and Meta's (META, Financial) Advantage+ suite, which automates campaign placement within Meta's massive social ecosystem. While AppLovin (APP, Financial) is one of the fastest-growing names in adtech, I see it more as a gaming ads specialist that is only now expanding into CTV. I recently covered AppLovin's shift into this space, but in my view, it's not yet a direct competitor to The Trade Desk.

Alphabet (GOOG, Financial), which derives a substantial portion of its revenue from advertising, trades at roughly 5x forward P/S and 17x forward P/E. These multiples reflect its maturity and slower growth profile. AppLovin, meanwhile, trades at a lofty 20x forward P/S but lower forward P/E, with a very different margin and product mix. On the other hand, players like Pinterest and PubMatic command more modest multiples, in line with their limited growth and narrower moats.

To me, the key takeaway is that The Trade Desk remains one of the most richly valued names in the advertising sector, but it also offers one of the strongest growth profiles and competitive moats.

The Trade Desk operates within a vast and expanding advertising landscape. The open internet advertising market is estimated at over $935 billion, spanning sectors such as video, audio, display, and digital out-of-home. Despite this enormous market, The Trade Desk's trailing twelve-month revenue stood at $2.6 billion, implying the company currently captures just over 0.25% of its addressable market. In my view, this highlights how early the company still is in its market penetration. If The Trade Desk continues to innovate, expand adoption of initiatives like Kokai, and benefit from the ongoing shift toward programmatic advertising in CTV and retail media, I believe it is well-positioned to gain meaningful market share.

The Q4 miss caused a temporary reset, but Q1's performance helped to stabilize sentiment. As long as the company continues to execute, I believe the current multiples can remain supported.

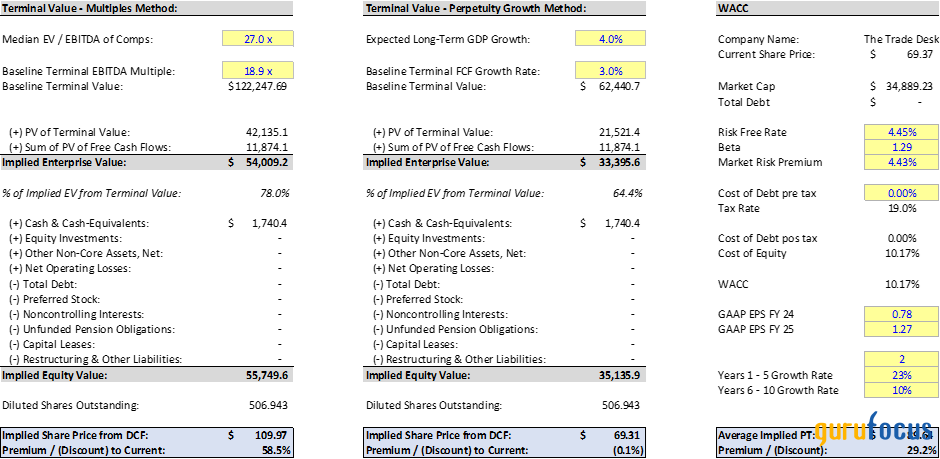

Another way to assess the opportunity is through a discounted cash flow analysis that blends multiple-based and perpetuity growth assumptions. I estimate a fair value of around $90 per share, suggesting a potential 29% upside from current levels, even after the Q1 rally. My estimates assume low 20s growth for the first year, tapering to low 10s, with a discount rate around 10%.

Source: Author

Finally, it's worth noting that institutional investors have recently adjusted their positions in The Trade Desk, reflecting evolving conviction levels following the Q4 stumble and Q1 rebound. While some long-term holders trimmed exposure amid the Q4 volatility, others leaned in, interpreting the pullback as a buying opportunity. For instance, ARK Investment Management has historically been a vocal supporter of The Trade Desk's open internet thesis, and their continued exposure indicates long-term confidence. Meanwhile, Baillie Gifford (Trades, Portfolio), known for backing innovative growth companies, has maintained a meaningful stake (6% of shares outstanding), underscoring a willingness to ride out near-term volatility for secular upside.

But more importantly, The Trade Desk has also taken advantage of its Q4 selloff to buy back stock. The company repurchased $386 million worth of shares in Q1 alone, more than the total spent in all of 2024.

Risks Outlook

While the quarter was encouraging, the key risks haven't disappeared. Execution remains a concern. The Trade Desk must continue delivering consistent performance and prove that its restructuring wasn't a one-quarter fix. The macro environment is still volatile, and as advertising is a cyclical spend category, any downturn could squeeze results. Competitive pressure from Amazon and Google hasn't vanished, even if their attention seems elsewhere. Lastly, the digital advertising ecosystem remains exposed to shifting privacy laws and regulatory scrutiny, even if recent verdicts have tilted the field.

What's changed post-Q1 is that these risks are now more widely acknowledged and better priced into expectations. After Q4's stumble and Q1's beat, the market now has a clearer view of both the downside and the recovery potential. As long as The Trade Desk keeps executing, it can continue regaining investor confidence and outpacing its peers in the rapidly evolving programmatic landscape.

My Final Take

It's still early in 2025, and one quarter doesn't make a trend. But in my opinion, The Trade Desk has done exactly what it needed to regain investor confidence, restore operational discipline, and demonstrate that its “reorganize for growth” plan wasn't just rhetoric. Execution will remain critical over the next few quarters, but based on what I've seen so far, I believe the company is on the right path.

With a unique position in the open internet, strong customer retention, and a balance sheet that offers flexibility, The Trade Desk is well-positioned to navigate macro headwinds while gaining share. The regulatory shift toward a more competitive market could be the tailwind that helps unlock even more value. In my view, the company's independence is becoming more of a strategic asset, not less. As long as execution continues, I remain confident that The Trade Desk can outperform the market over the long term.