On May 13, 2025, Alico Inc (ALCO, Financial) released its 8-K filing detailing its financial results for the second quarter ended March 31, 2025. Alico Inc, a Florida-based agribusiness and land management company, is undergoing a strategic transformation to become a diversified land company, moving away from its traditional citrus operations.

Performance and Challenges

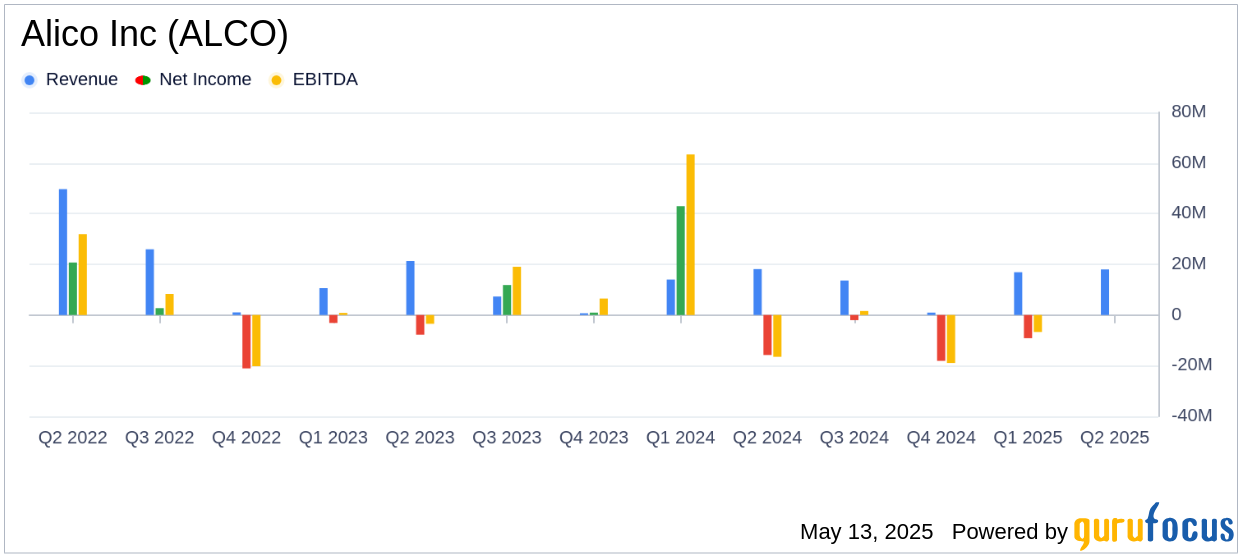

Alico Inc reported a revenue of $17.98 million for the quarter, falling short of the analyst estimate of $22.20 million. The company also posted a net loss of $111.4 million, a significant increase from the $15.8 million loss in the same quarter last year. This substantial loss was primarily due to $119.3 million in accelerated depreciation on citrus trees as part of the company's strategic shift away from citrus operations.

John Kiernan, President and CEO, commented on the challenges faced by the citrus industry, stating,

We are disappointed but not surprised that orange production this current season declined at Alico and across Florida. The continued challenges facing the citrus industry reinforce our recent strategic decision to wind down Alico’s citrus operations as it was not economically viable for us."

Financial Achievements and Industry Impact

Despite the challenges, Alico Inc has made strides in its strategic transformation. The company raised its land sales outlook to potentially exceed $50 million for fiscal year 2025, a significant increase from prior guidance. This shift is crucial for Alico as it transitions from a capital-intensive citrus operation to a diversified land management strategy, which is expected to enhance its financial stability.

Key Financial Metrics

The company's EBITDA for the quarter was reported at $(14.7) million, an improvement from $(16.5) million in the previous year. Adjusted EBITDA, however, showed a positive $12.7 million, reflecting the company's efforts to stabilize its financial performance amidst the strategic shift.

On the balance sheet, Alico reported a robust liquidity position with $14.7 million in cash and cash equivalents and $88.5 million in available credit facilities. The company's net debt stood at $74.9 million, down from $88.0 million at the end of September 2024.

Analysis and Future Outlook

Alico Inc's strategic transformation is a pivotal move aimed at mitigating the risks associated with the volatile citrus market. The company's focus on land sales and diversified land management is expected to provide a more stable revenue stream. However, the transition comes with its challenges, as evidenced by the significant net loss reported this quarter.

The company's ability to execute its land sales strategy and manage its financial resources effectively will be critical in achieving its long-term goals. As Alico continues to navigate this transformation, investors will be keenly watching its progress in land sales and the impact of its strategic initiatives on overall financial performance.

Explore the complete 8-K earnings release (here) from Alico Inc for further details.