Kezar Life Sciences (KZR, Financial) reported holding $114.4 million in cash, cash equivalents, and marketable securities as of March 31, 2025. This figure marks a decline from $132.2 million at the end of 2024, primarily due to operational expenses. The company's recent developments include promising results from the PORTOLA trial, which is the first successful randomized study for patients with treatment-resistant autoimmune hepatitis (AIH).

The CEO of Kezar highlighted the trial's encouraging outcomes, particularly the durable remissions and reduced steroid dependence among patients treated with zetomipzomib. This development is noteworthy in a field that has seen little progress in decades, providing a much-needed therapeutic option for both patients and healthcare providers. Additionally, Kezar is in active discussions with the FDA's Division of Hepatology and Nutrition to address a partial clinical hold and aims to establish a trial design that will effectively demonstrate the benefits of zetomipzomib for AIH patients.

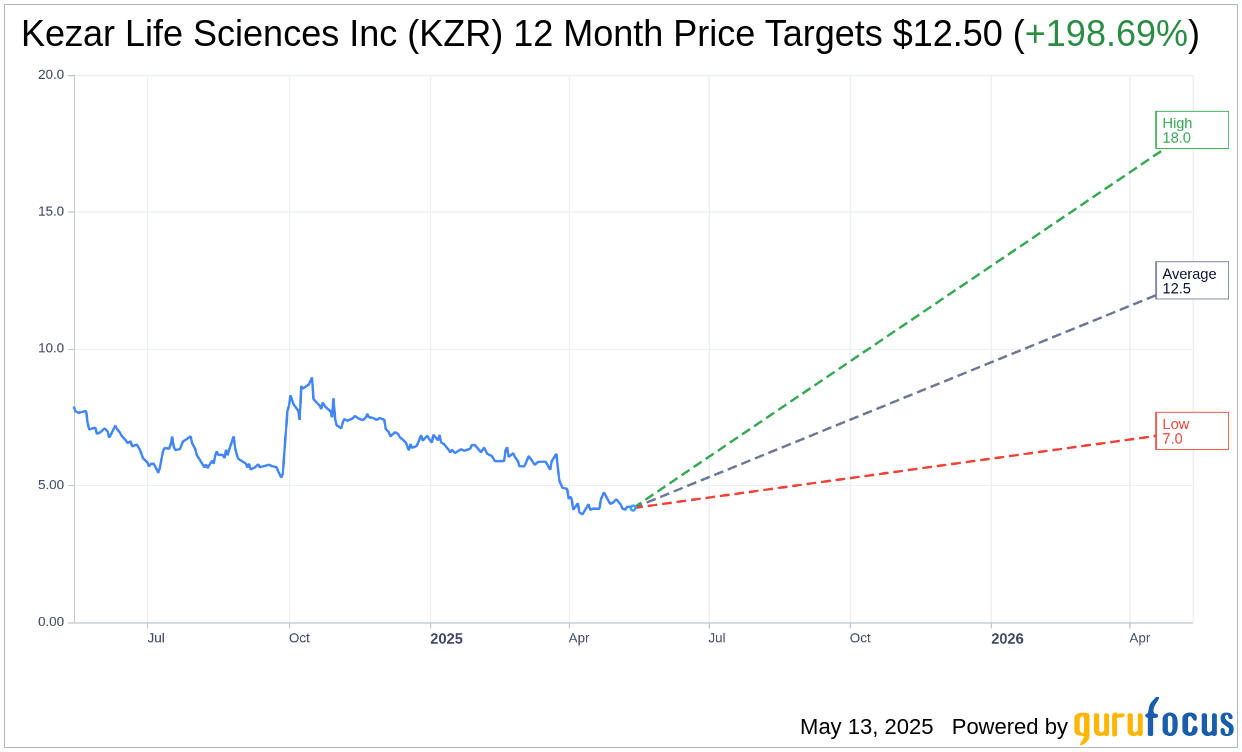

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Kezar Life Sciences Inc (KZR, Financial) is $12.50 with a high estimate of $18.00 and a low estimate of $7.00. The average target implies an upside of 197.62% from the current price of $4.20. More detailed estimate data can be found on the Kezar Life Sciences Inc (KZR) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Kezar Life Sciences Inc's (KZR, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.