In the preliminary results for the first quarter, TransAct Technologies (TACT, Financial) announced a notable revenue of $13.1 million, surpassing the projected $11.04 million. The company set a new quarterly record with the sale of 2,350 BOHA! terminal units, driving a 49% increase in year-over-year revenue for its Food Service Technology (FST) division. Additionally, the casino and gaming segment experienced an 18% revenue boost, amounting to $6.7 million.

The BOHA! platform is making significant inroads in emerging markets like convenience stores and healthcare food services. Key achievements include an upgrade of 1,400 BOHA! units for a leading convenience store chain and securing a national contract with a healthcare food service provider. The company credits its strong net income and adjusted EBITDA to effective operational strategies and successful adjustments in its market approach. With these initiatives, TransAct anticipates sustaining year-over-year improvements throughout 2025.

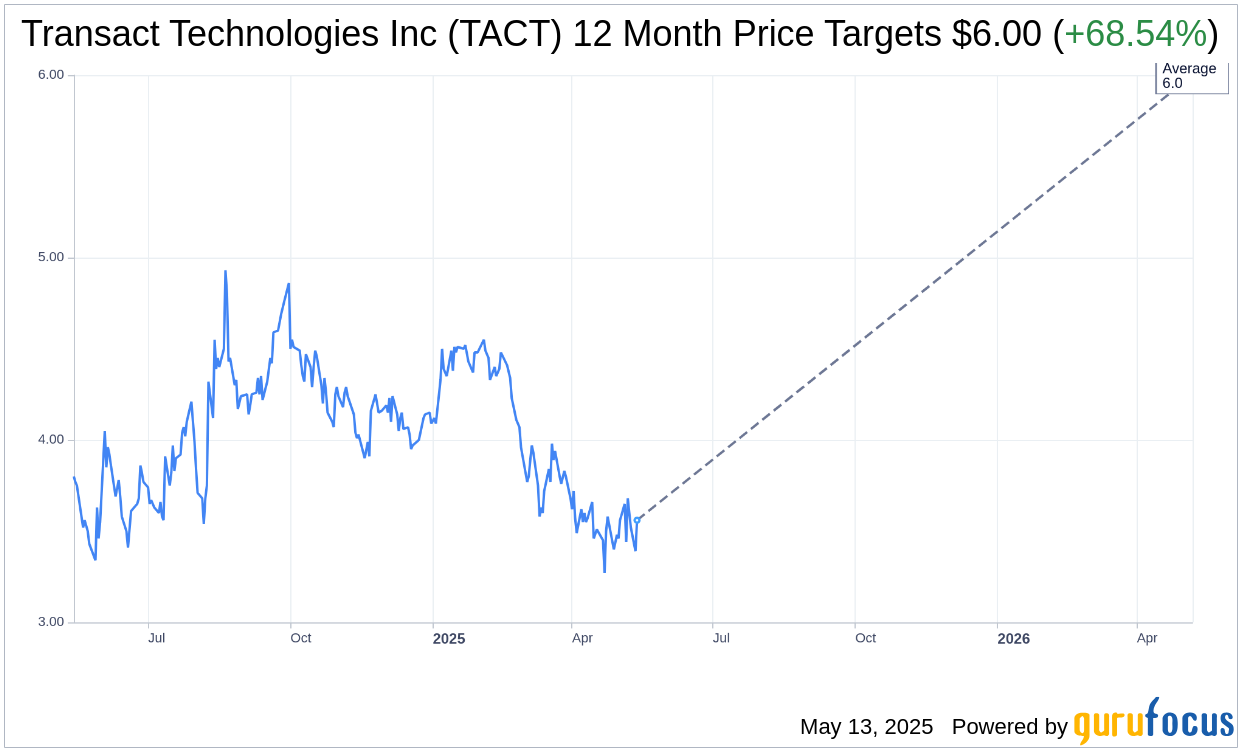

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Transact Technologies Inc (TACT, Financial) is $6.00 with a high estimate of $6.00 and a low estimate of $6.00. The average target implies an upside of 69.73% from the current price of $3.54. More detailed estimate data can be found on the Transact Technologies Inc (TACT) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Transact Technologies Inc's (TACT, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

TACT Key Business Developments

Release Date: March 13, 2025

- Total Revenue (Q4 2024): $10.2 million, down 23% from $13.3 million in Q4 2023.

- Full-Year Revenue (2024): $43.4 million, down 40% from $72.6 million in 2023.

- FST Revenue (Q4 2024): $4.3 million, flat sequentially, down 9% year over year.

- FST Full-Year Revenue (2024): $16.1 million, down 1% from 2023.

- Recurring FST Revenue (Q4 2024): $2.7 million, down 15% year over year.

- Casino & Gaming Revenue (Q4 2024): $4.8 million, up 14% year over year.

- Full-Year Casino & Gaming Revenue (2024): $20.3 million, down 51% from 2023.

- Gross Margin (Q4 2024): 44.2%, down from 48% in Q4 2023.

- Operating Loss (Q4 2024): $1.1 million, compared to a loss of $522,000 in Q4 2023.

- Net Loss (Q4 2024): $8 million or $0.79 per diluted share, compared to a net loss of $62,000 or $0.01 per share in Q4 2023.

- Adjusted EBITDA (Q4 2024): Negative $705,000, compared to positive $587,000 in Q4 2023.

- Cash on Hand (End of 2024): $14.4 million, up from $2.1 million at the end of 2023.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Transact Technologies Inc (TACT, Financial) reported a strong year-end with a 42% compound annual growth rate in BOHA! terminal placements over the last eight quarters.

- The company successfully sold 1,639 BOHA! terminals in Q4 2024, marking the highest quarterly number since 2020.

- Casino & Gaming revenue increased by 13.5% to 14% year over year in Q4 2024, indicating a recovery in this segment.

- TACT completed the rollout of the Epic TR80 thermal roll printer, expected to fuel additional sales in 2025.

- The company has a strong balance sheet with $14.4 million in cash, up from $2.1 million at the end of 2023, providing liquidity for at least the next 12 months.

Negative Points

- Total net sales for Q4 2024 were down 23% compared to Q4 2023, and full-year 2024 net sales were down 40% compared to 2023.

- Recurring FST revenue decreased by 15% sequentially and 5% year over year in Q4 2024.

- The company recorded a net loss of $8 million for Q4 2024, compared to a net loss of $62,000 in the same period the previous year.

- TACT incurred a $7.3 million non-cash charge to record a full valuation allowance on its deferred tax assets.

- POS Automation sales decreased by 74% in Q4 2024 compared to the prior year, due to increased competition and difficult comparisons.