Allurion Technologies (ALUR, Financial) experienced a remarkable increase of 58%, pushing its stock price to $3.78. This significant rise occurred after the company presented new abstract data, which seemingly impressed investors. The market reacted positively to the findings, resulting in substantial gains for the stock.

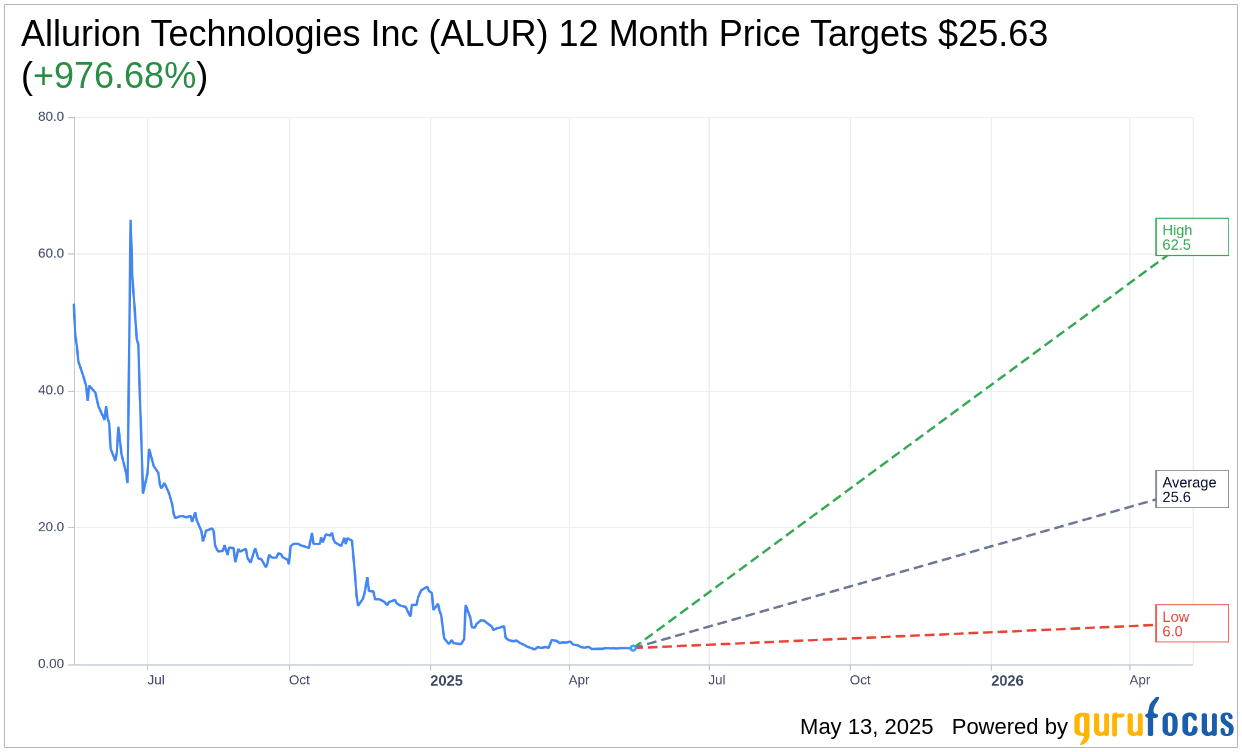

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Allurion Technologies Inc (ALUR, Financial) is $25.63 with a high estimate of $62.50 and a low estimate of $6.00. The average target implies an upside of 985.81% from the current price of $2.36. More detailed estimate data can be found on the Allurion Technologies Inc (ALUR) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Allurion Technologies Inc's (ALUR, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

ALUR Key Business Developments

Release Date: March 26, 2025

- Fourth Quarter Revenue: $5.6 million.

- Full-Year Revenue: $32.1 million.

- Operating Expenses: Decreased by 39% in Q4 compared to the prior year.

- Procedure Volumes: Grew by 4% in 2024.

- Gross Profit (Q4 2024): $2.5 million or 45% of revenue.

- Gross Profit (Full Year 2024): $21.5 million or 67% of revenue.

- Sales and Marketing Expenses (Q4 2024): $7.9 million.

- Research and Development Expenses (Q4 2024): $4.1 million.

- General and Administrative Expenses (Q4 2024): $7.7 million.

- Loss from Operations (Q4 2024): $17.1 million.

- Cash and Cash Equivalents (as of Dec 31, 2024): $15.4 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Allurion Technologies Inc (ALUR, Financial) reported a successful combination of their balloon program with low-dose GLP-1s, showing promising results in weight loss and muscle mass preservation.

- The company has a clear five-pillar plan for 2025, including a new commercial strategy, FDA approval efforts, and profitability goals for their ex-US business.

- Operating expenses decreased by 39% in the fourth quarter of 2024, indicating successful restructuring and reorganization efforts.

- Allurion Technologies Inc (ALUR) resumed sales in France after regulatory clearance, which is expected to contribute to future revenue growth.

- The company raised additional capital, providing a cash runway into 2026 and through expected FDA approval, strengthening their financial position.

Negative Points

- Fourth quarter revenue decreased to $5.6 million from $8.2 million in the same period in 2023, primarily due to the temporary suspension of sales in France and macroeconomic headwinds.

- Gross profit for the fourth quarter was negatively impacted, with a reduction to $2.5 million or 45% of revenue, compared to $6.4 million or 78% of revenue in 2023.

- The company recorded an adjustment for excess and obsolete inventory, affecting gross profit margins.

- Sales and marketing expenses, although reduced, still included $3.1 million of restructuring costs.

- The company anticipates a material contribution from France only in 2026, indicating a delayed impact on revenue from this market.