Uber is planning to issue exchangeable senior notes worth $1 billion, maturing in 2028, through a private sale to qualified institutional investors. Each note will initially convert into a share of class A common stock of Aurora Innovation (AUR, Financial). Specifics regarding the interest rate, conversion rate, and other terms will be set when the notes are priced. The company aims to utilize the net proceeds for general corporate purposes, which might include strategic investments, though no specific plans have been outlined yet.

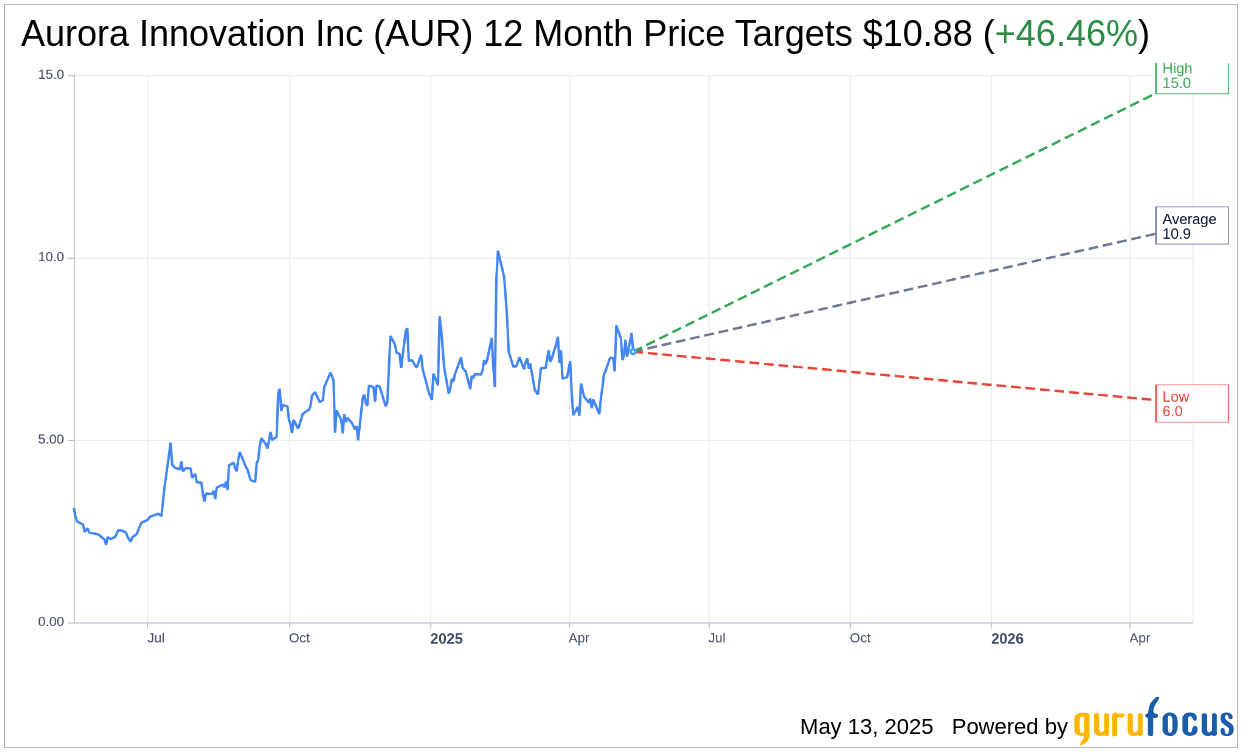

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Aurora Innovation Inc (AUR, Financial) is $10.88 with a high estimate of $15.00 and a low estimate of $6.00. The average target implies an upside of 48.57% from the current price of $7.32. More detailed estimate data can be found on the Aurora Innovation Inc (AUR) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Aurora Innovation Inc's (AUR, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

AUR Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Aurora Innovation Inc (AUR, Financial) has successfully launched driverless trucks operating commercially, marking a significant milestone in autonomous freight technology.

- The company has developed a rigorous safety case framework, which has been widely adopted in the industry, ensuring the safety of their autonomous vehicles.

- Aurora Innovation Inc (AUR) has strong partnerships with major OEMs and Tier One suppliers, positioning it well for large-scale deployment of autonomous trucking.

- The Aurora driver has demonstrated strong on-road performance, with 95% of loads achieving a 100% API metric, exceeding the commercial launch target.

- The company has a robust financial position with nearly $1.2 billion in cash and short-term investments, providing a strong cash runway into the fourth quarter of 2026.

Negative Points

- Aurora Innovation Inc (AUR) anticipates needing to raise $650 to $850 million before achieving positive free cash flow, indicating a significant capital requirement.

- The company experienced a delay in its commercial launch, which shifted its timeline and increased its financial needs.

- There is a high level of execution risk associated with transitioning to new hardware generations, which could impact the company's scaling plans.

- Aurora Innovation Inc (AUR) faces competition from other companies in the autonomous vehicle space, which may accelerate their own advancements.

- The departure of co-founder and Chief Product Officer Sterling Anderson could impact the company's strategic direction and execution.