On March 31, 2025, Syncona Portfolio Ltd (Trades, Portfolio) executed a significant transaction by acquiring an additional 12,180,333 shares of Autolus Therapeutics PLC. This move marked a 73.20% increase in Syncona's holdings of the stock, bringing the total to 28,821,053 shares. The transaction was completed at a price of $1.55 per share, reflecting Syncona's strategic decision to bolster its investment in the biopharmaceutical sector. This acquisition increased the stock's position in Syncona's portfolio to 62.18%, with Autolus now representing 10.80% of Syncona's total holdings.

Syncona Portfolio Ltd (Trades, Portfolio): A Focused Investment Firm

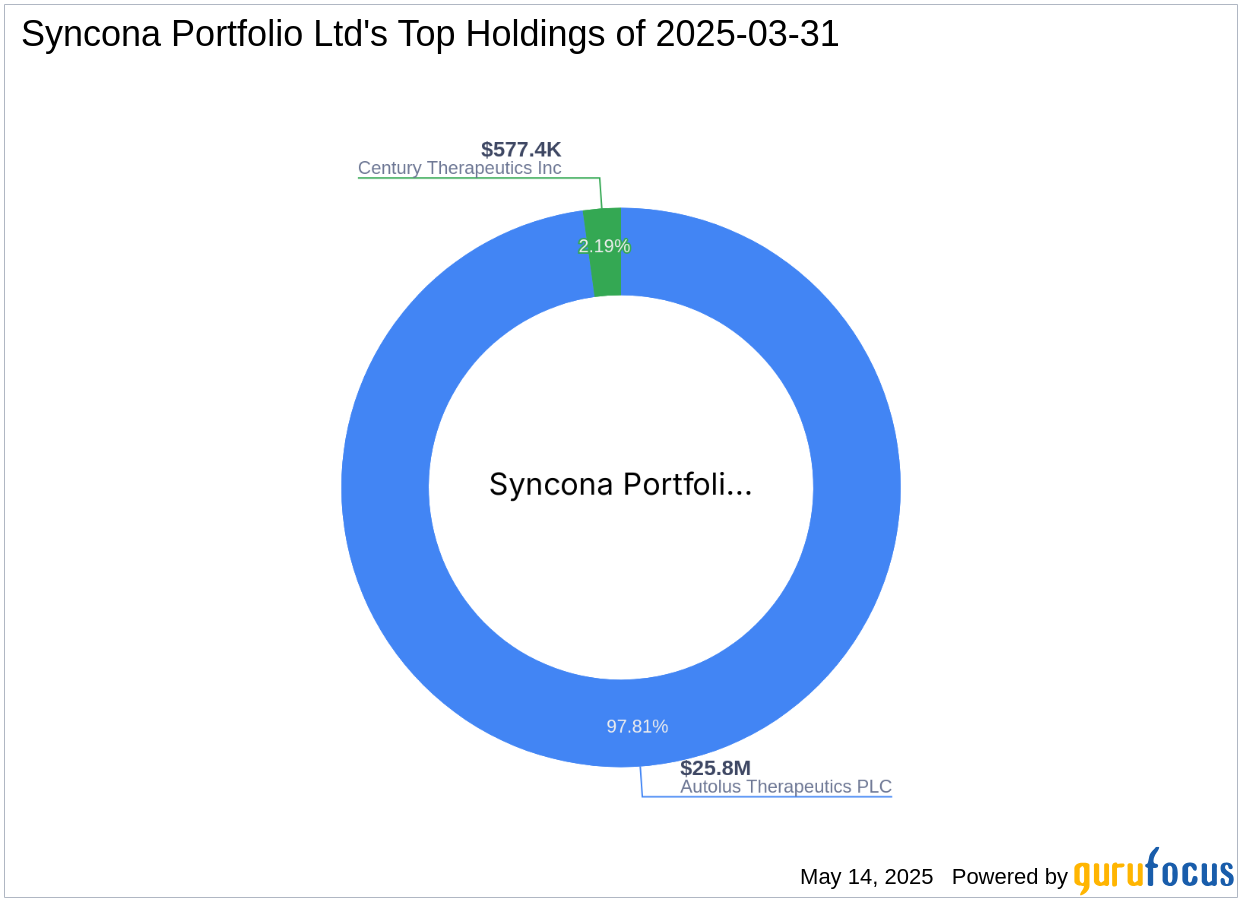

Syncona Portfolio Ltd (Trades, Portfolio), based in London, is a renowned investment firm with a strong focus on biopharmaceutical and healthcare investments. The firm manages a concentrated portfolio, with top holdings in Autolus Therapeutics PLC (AUTL, Financial) and Century Therapeutics Inc (IPSC, Financial), overseeing equity worth $26 million. Syncona's investment philosophy centers on identifying and nurturing high-potential companies in the healthcare sector, aiming to drive long-term value creation.

Autolus Therapeutics PLC: Innovating Cancer Treatment

Autolus Therapeutics PLC is a UK-based biopharmaceutical company specializing in the development of next-generation programmed T-cell therapies for cancer treatment. Since its IPO in June 2018, the company has been at the forefront of developing and commercializing CAR T therapies. With a market capitalization of $338.002 million, Autolus is committed to advancing its clinical-stage pipeline, which includes promising candidates like Obe-cel and AUTO1/22.

Financial Metrics and Valuation of Autolus Therapeutics PLC

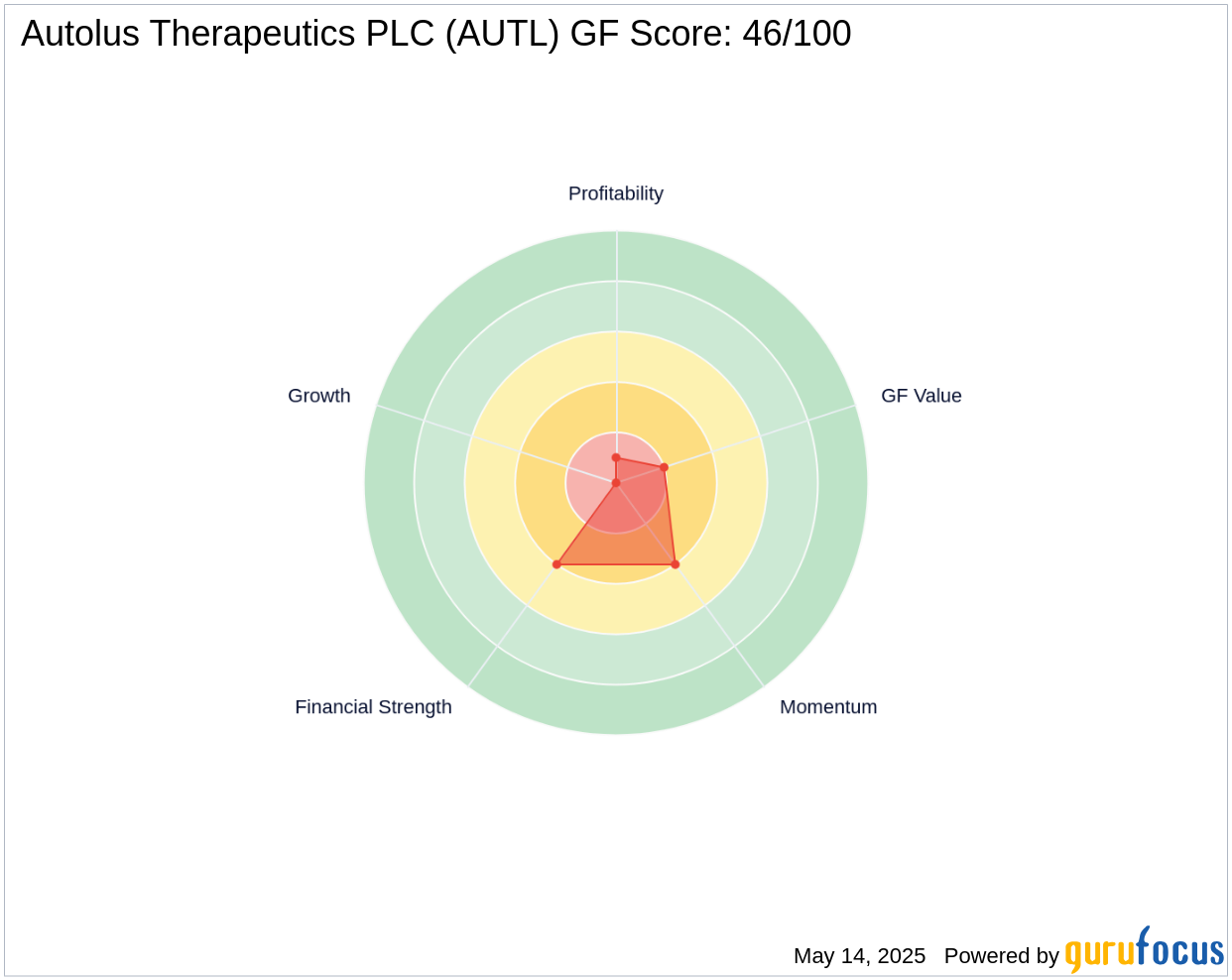

Currently trading at $1.27, Autolus Therapeutics PLC presents a potential value trap with a [GF Value](https://www.gurufocus.com/term/gf-score/AUTL) of $4.03. The stock has experienced a significant decline, with a year-to-date price change of -51.71% and a price change since IPO of -95.46%. The [GF Score](https://www.gurufocus.com/term/gf-score/AUTL) for Autolus is 46/100, indicating poor future performance potential. The company's balance sheet, profitability, and growth ranks are low, with an [Altman Z score](https://www.gurufocus.com/term/zscore/AUTL) of -1.31, suggesting potential financial distress.

Performance and Risk Assessment

Autolus Therapeutics PLC's financial health is under scrutiny, with a [Financial Strength](https://www.gurufocus.com/term/rank-balancesheet/AUTL) rank of 4/10 and a [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/AUTL) of 1/10. The company's [Growth Rank](https://www.gurufocus.com/term/rank-growth/AUTL) is 0/10, and its [GF Value Rank](https://www.gurufocus.com/term/rank-gf-value/AUTL) is 2/10, reflecting challenges in achieving sustainable growth. Despite these hurdles, Syncona's substantial investment underscores confidence in Autolus's long-term potential in the biotechnology sector.

Market Context and Implications

Despite the challenges faced by Autolus, Syncona's significant investment reflects a strategic bet on the company's potential to innovate in the biotechnology sector. Investors should weigh the risks and potential rewards associated with Autolus, considering its current valuation and market conditions. The firm's decision to increase its stake in Autolus suggests a belief in the company's ability to overcome current financial challenges and deliver value in the long run.

Transaction Analysis

This transaction has notably increased Syncona's exposure to Autolus, making it a central component of the firm's portfolio. The acquisition at $1.55 per share, despite the stock's current trading price of $1.27, indicates a long-term investment strategy. Syncona's confidence in Autolus's future prospects, despite its current financial metrics, highlights the firm's commitment to supporting innovative biopharmaceutical companies with the potential to revolutionize cancer treatment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.