- ArcLight Capital Partners increases its stake in the Natural Gas Pipeline Company, heralding potential shifts in energy sector dynamics.

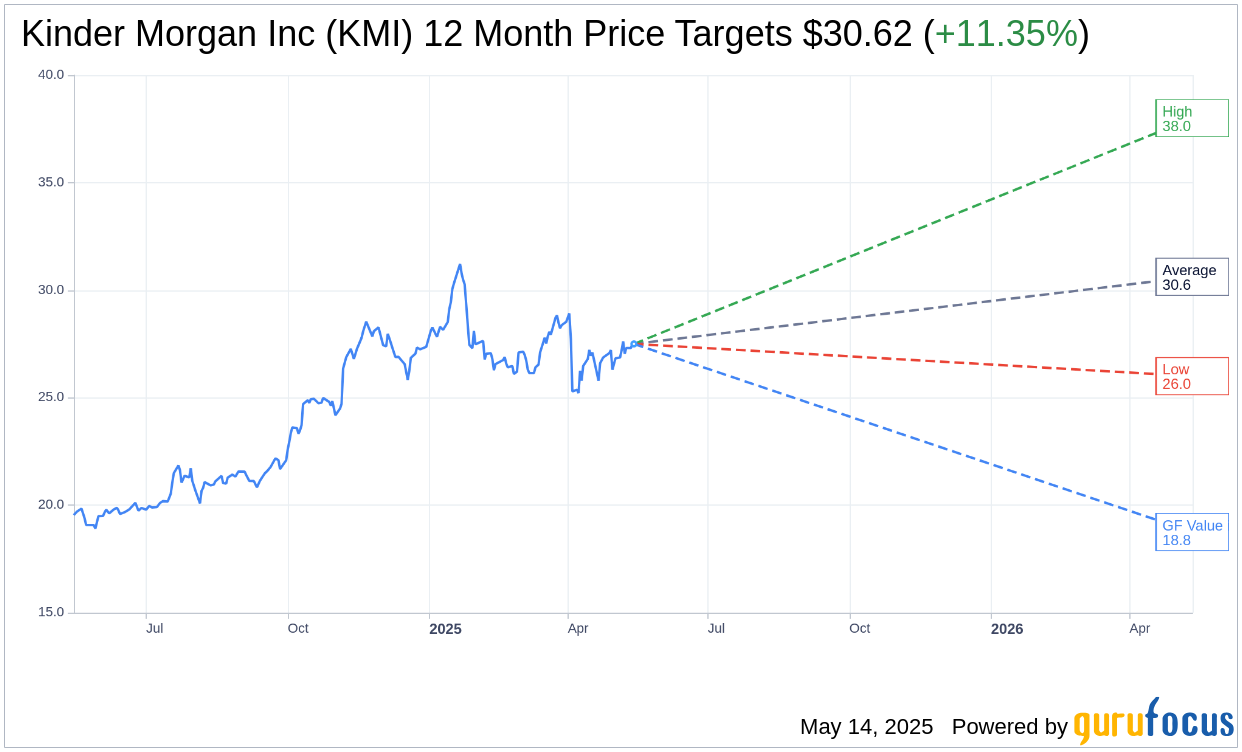

- Kinder Morgan's (KMI, Financial) current Wall Street sentiment suggests an "Outperform" rating, with analysts pinning price targets between $26.00 and $38.00.

- GuruFocus's GF Value indicates a potential downside, highlighting the importance of a nuanced investment approach.

ArcLight Capital Partners has strategically expanded its investment in the Natural Gas Pipeline Company of America, boosting its ownership to 62.5%. Meanwhile, Kinder Morgan (KMI) retains a 37.5% ownership stake and continues to operate this vital pipeline, which traverses nine states and links essential energy markets.

Analyst Price Targets and Market Sentiment

Fifteen analysts have set a range of one-year price targets for Kinder Morgan Inc (KMI, Financial), offering insights into potential stock movements. The average target price is $30.62, with projections stretching from a low of $26.00 to a high of $38.00. This average target suggests an upside of 11.35% compared to the current stock price of $27.50. For more detailed projections and analysis, explore the Kinder Morgan Inc (KMI) Forecast page.

Brokerage Recommendations and Future Outlook

In consensus rankings across 20 brokerage firms, Kinder Morgan Inc's (KMI, Financial) holds an average recommendation of 2.2, signifying an "Outperform" status. The brokerage rating system ranges from 1, indicating a Strong Buy, to 5, indicating Sell. This consensus places KMI in a favorable light among financial analysts.

Evaluating Kinder Morgan's GF Value

GuruFocus provides a distinctive view with its estimated GF Value for Kinder Morgan Inc (KMI, Financial), projecting a value of $18.75 over the next year. This suggests a downside of 31.82% from the current stock price of $27.50. The GF Value represents GuruFocus's assessment of where the stock should trade, based on historical multiples and anticipated business performance. Investors can delve deeper into these valuations on the Kinder Morgan Inc (KMI) Summary page.

Investors are advised to weigh these insights carefully, considering both the potential for stock price growth and the inherent risks highlighted by the GF Value estimate, to make informed investment decisions in the dynamic energy sector.