Key Highlights:

- Arteris Inc. (AIP, Financial) reports record-breaking $66.8 million in contract value and royalties for Q1 2025.

- The company achieves a 28% year-over-year revenue increase, reaching $16.5 million.

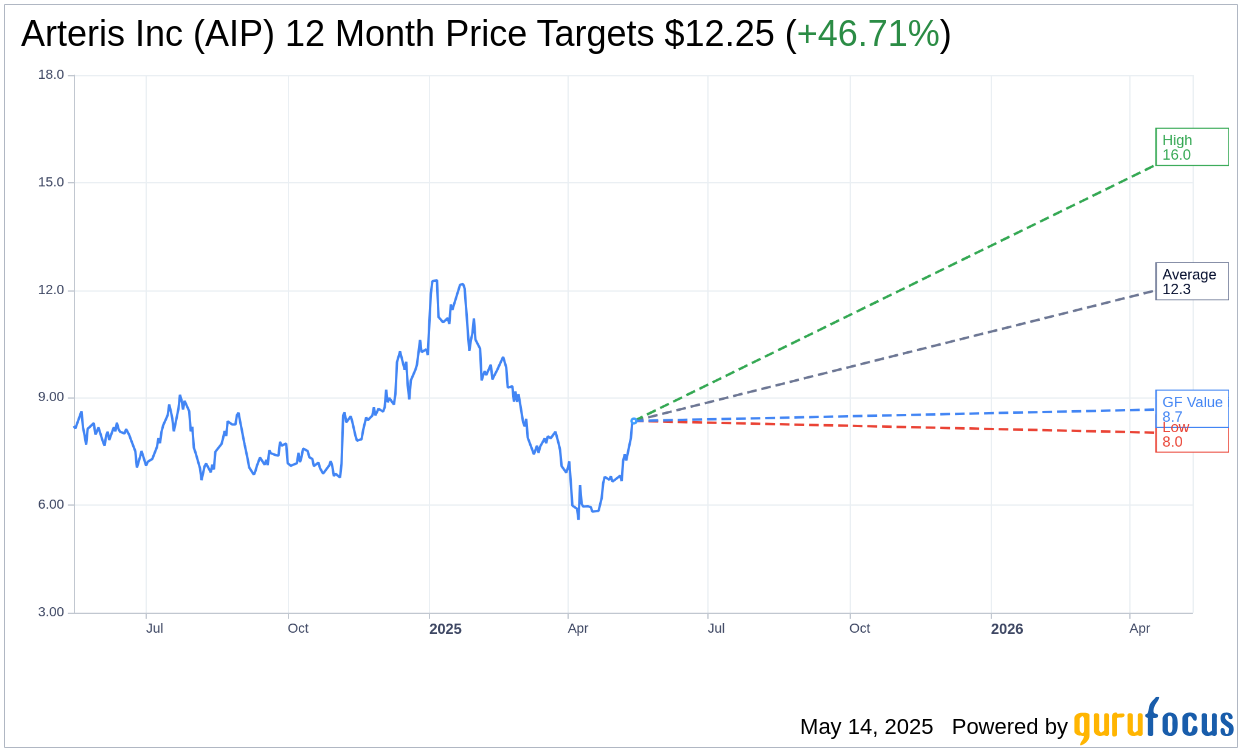

- Analysts forecast a potential upside of 46.71% based on the current stock price.

Arteris Inc.'s Impressive Q1 2025 Performance

Arteris, Inc. (AIP) has reported a notable milestone, achieving a record annual contract value and royalties, totaling an impressive $66.8 million in the first quarter of 2025. Demonstrating robust financial health, the company generated $2.7 million in non-GAAP positive free cash flow, reflecting significant growth across various sectors. Additionally, Arteris's Q1 revenue soared to $16.5 million, marking a substantial 28% increase compared to the previous year.

Wall Street Analysts Forecast

Wall Street analysts have provided their insights based on one-year price targets from four analysts. The average target price for Arteris Inc. (AIP, Financial) is projected at $12.25, with estimates ranging from a high of $16.00 to a low of $8.00. This average target suggests a potential upside of 46.71% from the current stock price of $8.35. For further detailed estimates, investors can visit the Arteris Inc (AIP) Forecast page.

The consensus recommendation from four brokerage firms positions Arteris Inc. (AIP, Financial) with an average rating of 2.3, indicating an "Outperform" status. This rating is derived from a scale where 1 signifies a Strong Buy, and 5 indicates a Sell.

Assessing Arteris Inc.'s GF Value

According to GuruFocus estimates, the GF Value for Arteris Inc. (AIP, Financial) one year from now is projected at $8.69. This estimate suggests a modest upside of 4.07% from the current price of $8.35. The GF Value is GuruFocus's calculation of the fair market value the stock should trade at, based on historical trading multiples, past business growth, and future performance estimates. More comprehensive data is available on the Arteris Inc (AIP) Summary page.